The proposed third account of the Employees Provident Fund (EPF) is an epic flaw because it does not focus on increasing retirement benefits or future investments but provides an avenue to withdraw at any time up to 10 percent of contributions from May.

The government wants to palm this off as a superior savings plan which is better than that of the banks as the EPF dividend rates are typically much higher.

The trouble is that the principal is carved out of funds intended for retirement, reducing them.

It will result in extra EPF withdrawals from members, leading to a poorer quality of life later in retirement. This instant gratification helps boost the economy through an increase in disposable income but is at the expense of employees’ future - an intensely shortsighted move.

The proposal was first mooted in the last budget announced in October by Finance Minister and Prime Minister Anwar Ibrahim. Last week, stories quoting sources in some media said that a third account - the flexible account - would be introduced in May, accounting for 10 percent of contributions.

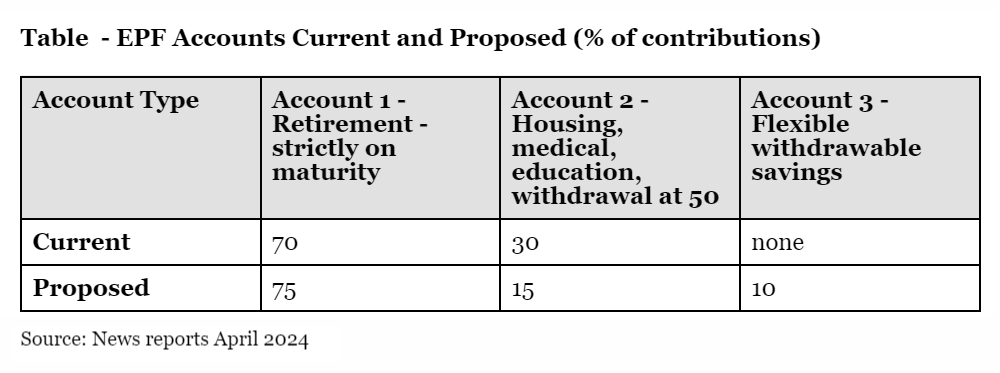

There are two accounts, Account 1 (70 percent) only for retirement and Account 2 (30 percent) for housing, healthcare, education and withdrawal at age 50. The new Account 3 will take 10 percent of contributions but only new contributions, while Account 1 will take 75 percent of contributions and Account 2, 15 percent.

The existing situation is already inadequate - while housing can be a long-term investment as an asset that increases in value, healthcare and education, and withdrawal at age 50 are not. The contributions are a percentage of wages monthly - 13 percent from employers and 11 percent from employees.

If the government had structured this such that the increased contributions came from higher monthly EPF payments proportionately from both employee and employer, then it would have been more acceptable as total savings would still increase.

Even so, it would have been preferable to use that opportunity to increase the retirement savings pool instead of offering an opportunity for contributors to remove one-tenth of their future contributions at any time.

Retirement amounts are already woefully inadequate. Anwar himself warned in February 2023 in Parliament, barely three months after assuming the top position, that over two-thirds of EPF active contributors aged 55 and below do not have enough funds to raise them above the poverty level.

Irresponsible act

An article titled “Anwar: Majority of EPF contributors do not have enough funds for retirement”, reported him attributing this to four special withdrawals approved during the Covid-19 pandemic.

He added that the number of active members who had reached the basic savings target of RM240,000 by the age of 55 had gone down from 36 percent in 2020 to 29 percent at the end of 2022 as a result of the withdrawals, a reduction of more than a third.

“The EPF estimated that members are required to work between four and six extra years to rebuild the savings that were withdrawn during the pandemic,” he said. Those are telling numbers.

That Covid-19 withdrawal was a scam which I wrote about in this article titled “The RM60 billion scam at EPF”. It was an irresponsible act which allowed Muhyiddin Yassin’s backdoor government and the succeeding Umno government of Ismail Sabri Yaakob to reflate the economy using EPF savings.

Worse, it was also a move to garner support ahead of the election by letting all EPF members, whether they lost their jobs or not, withdraw substantial amounts of money. Retirement funds were used not only as economic stimulus but unforgivably as a reward for voters who were paid with their own money.

Eventually, this figure of RM60 billion was far exceeded. The Finance Ministry estimated in August 2022 that the impact on EPF savings as a result of Covid-related withdrawals was a massive RM155 billion or over 15 percent of total funds then. Just imagine the negative impact on retirement savings.

EPF is a provident fund and the word “provident” means carefully providing for the future, not for the present needs and so-called emergency withdrawals. The previous unelected governments obviously did not know the meaning of “provident” or just ignored it.

Inexplicably, in the budget for 2024 announced in October last year, Anwar went down the same route as his two predecessors and announced that a third withdrawable account would be set up. Now, workers will have to slog even longer to recoup the amounts lost.

Instant gratification, but…

Politically, it will improve economic growth and give people a sense of well-being because they have a bit more money to spend - short-term effects. But all this will bite them back at retirement. The last two governments did these but still lost at the polls.

In 2023, the EPF collected nearly RM100 billion in members’ contributions, an increase of 15 percent from the previous year, according to this press release on the EPF website.

If 10 percent of contributions go into Account 3, then some RM10 billion of members’ savings will be available for full withdrawal a year in future. This grows because of returns and continuing increases in members and their incomes.

If we assume just a 10 percent yearly increase in contributions, and a five percent return on investments, my calculations show that over 20 years, that figure would balloon to RM1 trillion plus, representing the loss in savings of current and future investors in EPF, an epic blunder.

The simple solution is to bite the bullet and go forward - eschew short-term gain for long-term benefits by pushing savings up for workers through increased contributions for retirement.

Simultaneously push for better wages, accompanied by adjustments in the workforce such as decreasing reliance on foreign workers, and increasing productivity through better training and improved work procedures.

Sadly the Madani government is adopting short-term palliative, symptomatic measures at the EPF - an expensive mistake - instead of a cure for the basic problem of paltry wages and too little contributions.

The prudent thing for members to do is not to withdraw from Account 3. But they won’t follow the advice. That’s why we have the EPF - to protect them from themselves so that they have enough at retirement.

Our leaders have shown shortsightedness and selfishness by forcing the EPF to do the opposite and derelicting its duty to increase and protect our long-term savings so that they will look better in the short term. - Mkini

P GUNASEGARAM says there is no shortcut to improving quality of life - the road will be rough but the rewards will be worth it.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.