(Malaysia Now) – The Kuala Lumpur High Court was told today that the 1MDB board of directors was misled when its management gave the illusion that 1MDB investment money was coming back into the state fund in 2014.

Former 1MDB non-executive director Ismee Ismail, 58, said this when he was asked by lead counsel Muhammad Shafee Abdullah to comment on a briefing by former 1MDB chief financial officer Azmi Tahir during a board meeting on Oct 20, 2014.

Shafee was referring the 13th prosecution witness to a specific briefing by Azmi during the board meeting where he told the directors that a total of US$870 million had been redeemed as of October 2014 and another US$300 million would be redeemed within the next few days.

Ismee said at the time, the board had no idea that the money, which Azmi said went into Brazen Sky Ltd, was in fact borrowed by 1MDB from Deutsche Bank.

The court earlier heard that Brazen Sky Ltd was a special purpose vehicle set up by fugitive businessman Low Taek Jho or Jho Low and his associates to repatriate investment money by 1MDB.

Shafee: You see how Azmi lied to the board. What he did was, all this money purportedly went into Brazen Sky but he omitted the part where the money went back into a shell company named Aabar Investments PJS Ltd. The 1MDB directors would not know this aspect because you have to be dependent on your management’s honesty. Now that you know the truth, what is your comment?

Ismee: I guess the same thing that I said earlier. It is inappropriate to talk about it during the fasting month.

Shafee: Tan Sri, we are doing a judicial inquiry. You still have to tell the truth during the fasting month.

Ismee: I said this in November last year and I will say the same thing again. The board of directors was misled.

The court previously heard testimonies that Aabar Investments PJS Ltd (Aabar BVI) was not the same as Aabar Investment PJS, which was the actual subsidiary of International Petroleum Investment Company (IPIC).

Earlier, Ismee agreed to a suggestion by Shafee that in order to carry out an initial public offering, the management of 1MDB convinced the board of directors to borrow US$250 million and US$975 million from Deutsche Bank Singapore in May and August 2014 respectively.

Previously, former 1MDB CEO Mohd Hazem Abd Rahman confirmed that a total of RM49 million originating from the said bank loans taken by 1MDB wound up in Najib Razak’s bank account in AmIslamic Bank.

On the first day of the 1MDB trial in August 2019, lead prosecutor Gopal Sri Ram had said in the prosecution’s opening statement that the prosecution would show that some money originating from a US$250 million loan and a US$975 million loan taken by 1MDB subsidiary 1MDB Energy Holdings Ltd from Deutsche Bank Singapore allegedly ended up in Najib’s bank account.

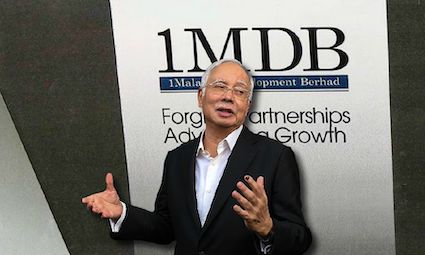

Najib, 68, faces four charges of using his position to obtain bribes totalling RM2.3 billion from 1MDB funds and 21 charges of money laundering involving the same amount.

The trial before judge Collin Lawrence Sequerah continues tomorrow.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.