This backdoor government’s shameful sham to reward members of the Employees Provident Fund (EPF) with their own money to get votes is showing some alarming results which will have extremely deleterious effects on members’ retirement savings in the future.

In just two weeks since the latest EPF withdrawal scheme was opened inauspiciously on April Fool’s Day, April 1, many took the bait and succumbed to the government’s temptation, pulled in hook, line and sinker like a fish desperate for food into a situation they should have resisted with all their might.

According to EPF figures, as of April 14, the total amount of withdrawals applied for is an astounding RM40.1 billion, representing 44 percent or 5.3 million out of the 11.95 million members who were eligible to withdraw their savings under the facility.

This is in addition to the RM101 billion which has already been withdrawn since 2020 under earlier Covid 19-related schemes, making total withdrawals at RM141 billion.

If the withdrawal rate continues at this pace, the withdrawals under the latest scheme could come up to RM80 billion by the end of the month, until which time applications can be made, making the total withdrawn under the various facilities a stupendous RM180 billion.

That represents 18 percent of EPF’s investment funds of just over RM1 trillion as of the end of last year, and a huge investment opportunity foregone for EPF members, especially for those in the lower- and middle-income group who can least afford these withdrawals.

Breaking down by wage groups, the withdrawal represented 55 percent of eligible B40 members (the bottom 40 percent of income earners, those earning less than RM1,700 per month), 59 percent of M40 members (the middle income 40 percent, earning RM1,701 - RM4,900 per month), and 39 percent of T20 members (the top 20 percent earning above RM4,900 per month). A further 29 percent of informal and inactive members also applied.

By race, Malays made up the bulk of applicants at 63 percent, followed by the Chinese at 12 percent, and Indians at 7 percent. The remaining 17 percent were bumiputeras from Sabah and Sarawak, and non-Malaysians. Bumiputera withdrawals were about 80 percent, making them the largest group among those who wanted to withdraw money.

I explained in this article fully why most people should not be allowed to withdraw from their accounts simply because very few of them actually lost their jobs while the withdrawal is a blanket one, allowing all to withdraw whether their jobs were affected or not.

Govt’s poisoned bait

The EPF actually offers excellent rates of return for its very low risk. The government under Section 28 of the EPF Act effectively guarantees payment of members’ dues which means the principal is guaranteed. On top of that Section 27 of the Act guarantees a minimum dividend payment of 2.5 percent, higher than most bank’s fixed deposit payments.

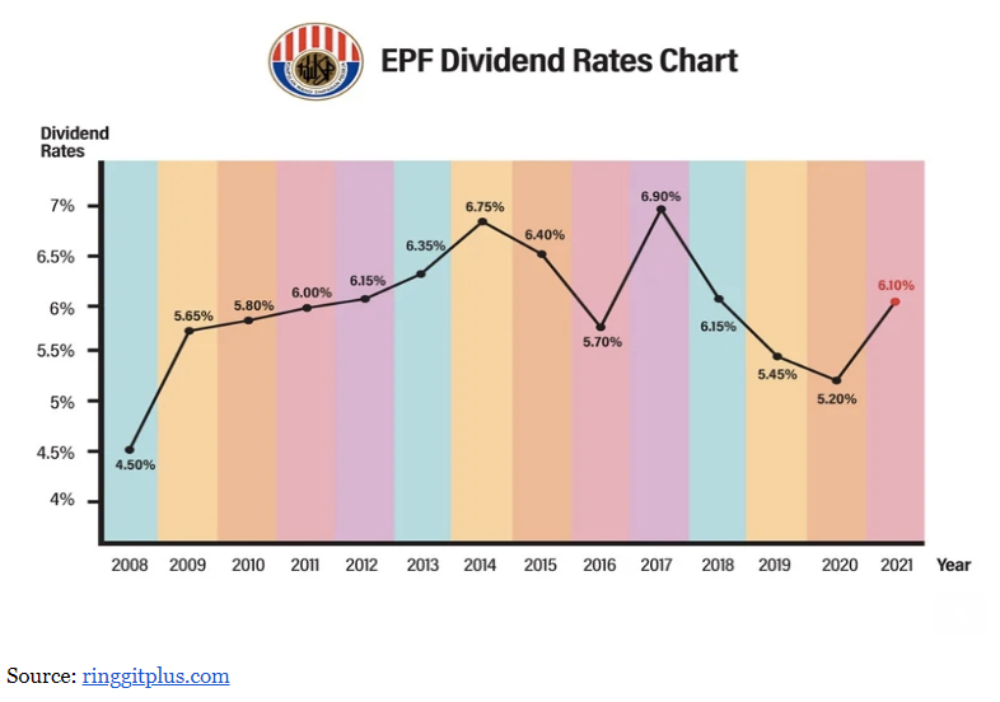

In practice, EPF dividend payments have been much higher (see chart). It declared a fabulous 6.1 percent for 2021. If you think this is a one-off, you are wrong as the same chart shows. In the last 10 years, the average dividend rate has been 6.12 percent.

Just how much do EPF members lose when they withdraw their money? Let’s assume total withdrawals of RM180 billion as explained earlier. Using 25 years and a 6.12 percent average dividend rate, gives a huge RM795 billion at the end of 25 years, using a future value calculator from the Net.

That 25 years is not a high figure. If you are 35 now, you have 25 years before retirement. What you get is 4.4 times, yes that is right, your original withdrawal amount, thanks to the power of compounding interest, which you will be able to collect 25 years from now. But now it’s gone forever because you have withdrawn and spent it.

Let’s assume 30 years to retirement, that is the average age now is 30. Then the total sum withdrawn of RM180 billion would have amounted to RM1 trillion or 5.6 times the amount withdrawn! That is a huge investment opportunity lost because this backdoor, short-term government is more interested in giving you short-term spending money. It’s not the government’s money - it's your own hard-earned money from your retirement fund.

If you saved RM10,000 by not withdrawing it now, after 25 years you will likely have RM44,000, or RM56,000 if you have 30 years towards retirement. Just imagine the amount of savings you will have foregone if you withdraw your EPF money!

Don’t take the poisoned bait this backdoor government is throwing you. If you can do anything possible and legal to keep your money in EPF, do it.

Take it from me: There is no better risk-adjusted investment anywhere out there which gives you those returns with no risk as your principal is guaranteed by the government which also assures a minimum dividend rate of 2.5 percent on top of that.

P GUNASEGARAM, a former editor at online and print news publications, and head of equity research, is an independent writer and analyst.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.