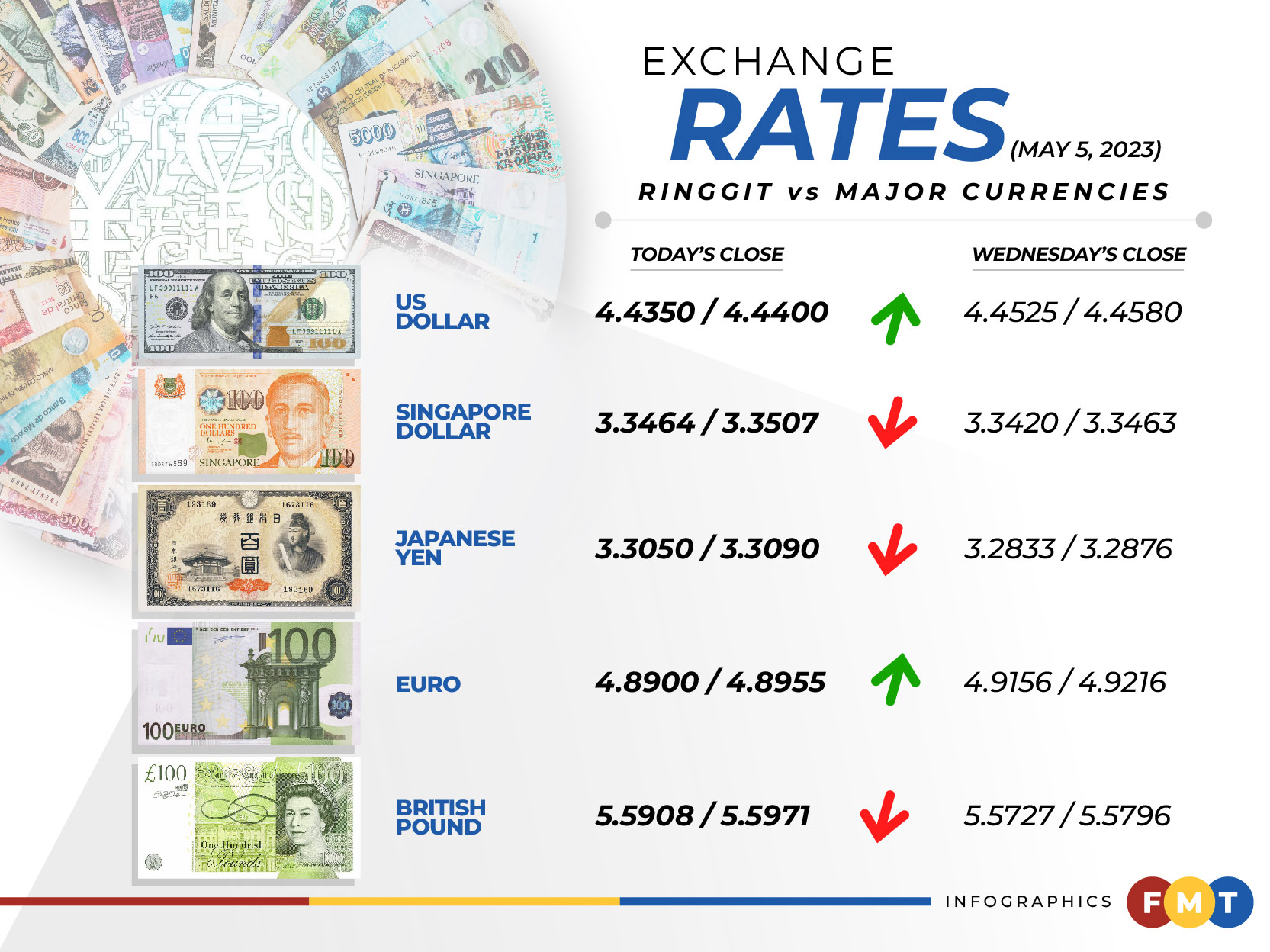

At 6pm, the local note rose to its two-week high of 4.4350/4.4400 versus the US dollar from Wednesday’s closing rate of 4.4525/4.4580.

Bank Muamalat Malaysia Bhd chief economist and social finance head Afzanizam Abdul Rashid said Bank Negara Malaysia’s positiveness on the domestic economic outlook, along with the spillover effects from China’s reopening, has also helped to bolster the ringgit’s value.

“The US dollar/ringgit pair is currently nearing its support level of 4.4254 while other technical indicators suggest that the ringgit is hovering at the oversold position, a condition that might lead to an appreciation in the ringgit in the near term.

“The next support level is located at 4.3488. Should tonight’s US Non-farm Payroll (NFP) for April turnout be at 179,000 based on consensus estimates, the case for a further weaker US dollar is quite likely,” he told Bernama.

The US economy added 236,000 new NFP jobs last month, while unemployment eased to 3.5% in March from 3.6% in February.

Meanwhile, the ringgit traded mostly lower against a basket of major currencies.

It depreciated against the Japanese yen to 3.3050/3.3090 from 3.2833/3.2876 on Wednesday, was easier vis-a-vis the British pound at 5.5908/5.5971 versus 5.5727/5.5796 previously, but rose against the euro to 4.8900/4.8955 from 4.9156/4.9216 at the previous close.

The local note traded mixed against Asean currencies.

It improved further against the Philippine peso to 8.02/8.03 from 8.04/8.05 at Wednesday’s close, appreciated versus the Indonesian rupiah to 302.1/302.6 from 303.3/303.5 previously, but was lower against the Singapore dollar at 3.3464/3.3507 compared with 3.3420/3.3463, as well as vis-a-vis the Thai baht at 13.1446/13.1661 from 13.0817/13.1037. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.