PETALING JAYA: A former MP has questioned why Muhyiddin Yassin’s administration rushed into a 2020 settlement with Goldman Sachs at a time when the bank and two senior executives were in legal jeopardy due to their roles in the 1MDB fiasco.

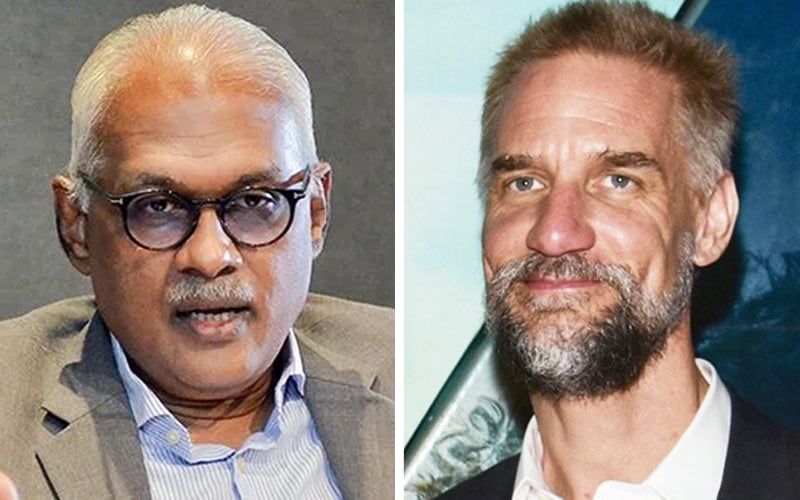

“Tim Leissner, the bank’s then managing director (and chairman of its South East Asia division), had already pleaded guilty in 2018 to conspiring to launder money and for corrupt practices.

“At the time, his accomplice, Roger Ng, was in the process of being extradited from Malaysia to face similar charges,” Charles Santiago told FMT.

It was also public knowledge that the Department of Justice was investigating Goldman Sachs itself for criminal offences, he added.

“We were in a strong bargaining position as the cards were clearly stacked against the bank by that time. We could have secured a much better deal.

“Something does not add up,” said Santiago.

On Oct 22, 2020, both the Goldman Sachs Group in New York and its Malaysian subsidiary pleaded guilty to conspiring to violate the US’ Foreign Corrupt Practices Act when underwriting 1MDB bonds worth US$6.5 billion between 2012 and 2013.

“The bank’s admission of guilt was inevitable after Leissner pleaded guilty,” said Santiago.

“For the same reason, a civil suit brought in the US against Goldman Sachs was bound to favour the government,” he added.

Santiago also said that there was no “immediate need” for the government to secure the settlement funds in 2020.

“The first two bonds which were due in 2022 and worth US$3.5 billion, were jointly guaranteed by International Petroleum Investment Co (IPIC) and 1MDB, not by the government.

“Upon their maturity, IPIC would have been obliged to honour demands for payment from investors of these bonds even if 1MDB defaulted,” said Santiago.

“The government could have worked out a resolution to reimburse IPIC at a later time,” he added.

Both prime minister Anwar Ibrahim and 1MDB task force chief Johari Ghani have questioned the apparent speed at which Muhyiddin’s government negotiated and agreed to the settlement with Goldman Sachs.

Johari said that on June 30, 2020, he met Muhyiddin, finance minister Tengku Zafrul Aziz and Attorney-General Idrus Harun to discuss bringing a lawsuit against Goldman Sachs in the United States.

On July 3, 2020, Johari put his proposal in writing to Muhyiddin, who sent it on to Idrus on July 15, 2020.

By July 24, 2020, however, the government had already signed the “Points of Agreement” with Goldman Sachs. A full settlement agreement was executed on Aug 18, 2020.

1MDB is reported to have suffered substantial losses of between US$7 billion and US$9.6 billion in connection with the three bond issues.

The settlement agreement executed on Aug 18, 2020 saw the government and 1MDB recover US$2.5 billion from the bank, inclusive of the US$606 million fee it had paid.

Goldman Sachs was also obliged to recover foreign assets traceable to 1MDB funds worth US$1.4bil within five years.

Under the terms of the agreement, the government would be entitled to an interim payment of US$250 million if assets worth US$500 million were not recovered by August last year. However, to date, Putrajaya has not received the promised payment.

Many believe the settlement quantum to be low.

On Feb 27, Johari told the Dewan Rakyat that the country had been shortchanged in the settlement, a statement Anwar agreed with in a speech in Parliament on March 9.

Johari also called on the government to identify and investigate the negotiators who acted for Putrajaya in the matter. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.