KUALA LUMPUR: The ringgit eased further against the US dollar at the close today, in tandem with regional currencies on lingering concerns over China’s economic growth, despite the softer greenback.

The US dollar languished near its lowest level since April 2022 touched last Friday after the soft US Consumer Price Index (CPI) and Producer Price Index (PPI) reports, said an analyst.

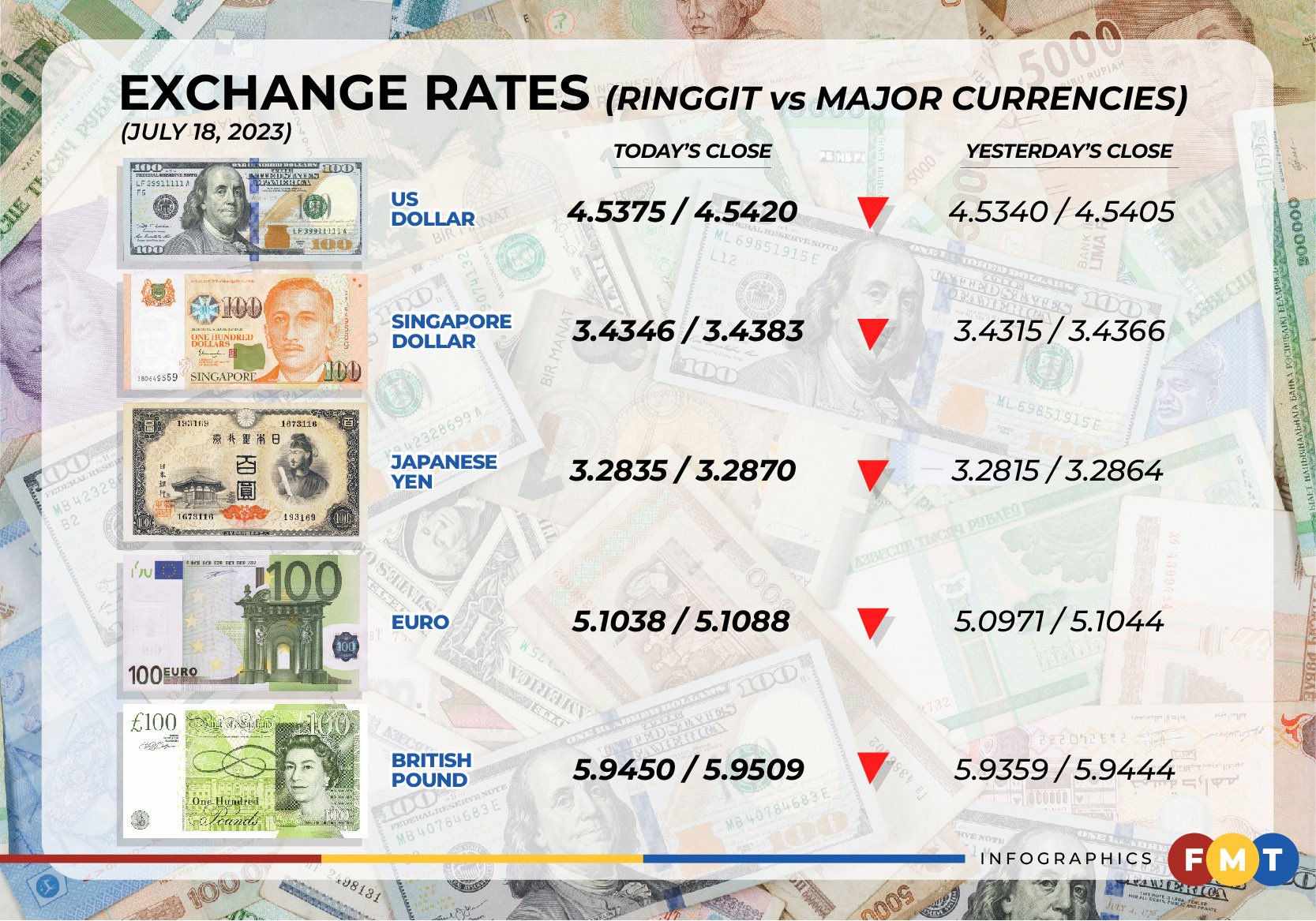

At 6pm, the local note stood at 4.5375/4.5420 against the greenback compared with 4.5340/4.5405 at Monday’s close.

Bank Muamalat Malaysia Bhd chief economist and social finance head Afzanizam Abdul Rashid said the ringgit continued its rangebound trade against the greenback today as concerns over China’s weakening economic prospects appeared to be taking root in the currency market.

China’s central bank is likely to cut its policy rate again as the country’s inflation has turned to 0% year-on-year in June.

On another note, he said the US Federal Reserve (Fed) is expected to change its tact and will soften its hawkish stance as the US disinflationary trend has become prevalent recently.

The US CPI had moderated to 3% in June 2023 after reaching a 40-year high of 9.1% in June 2022, Afzanizam said.

“Clearly, the Fed is on track to achieve the 2% inflation target.

“For now, we think the ringgit should linger around RM4.53 to RM4.54 against the US dollar which is slightly lower than the immediate resistant level of RM4.5491. The immediate support level is currently located at RM4.4872,” he told Bernama.

The ringgit traded lower against a basket of major currencies at today’s close.

It fell vis-a-vis the euro to 5.1038/5.1088 from 5.0971/5.1044 at Monday’s close, slipped against the British pound to 5.9450/5.9509 from 5.9359/5.9444 and eased versus the Japanese yen to 3.2835/3.2870 from 3.2815/3.2864 yesterday.

The local note also traded lower against other Asean currencies.

The ringgit fell against the Thai baht to 13.2586/13.2768 from 13.0984/13.1225 on Monday, declined versus the Singapore dollar to 3.4346/3.4383 from 3.4315/3.4366 previously.

It inched down vis-a-vis the Philippine peso to 8.34/8.35 from 8.33/8.35 and slid against the Indonesian rupiah to 302.5/302.9 from 301.9/302.5 yesterday.

The market will be closed on Wednesday in conjunction with Awal Muharram. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.