KUALA LUMPUR: The ringgit’s rally against the US dollar extended for the fourth consecutive day today, a development that was long overdue given the local currency’s prolonged oversold condition, said an analyst.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid said the ringgit is likely to appreciate as it appears to be undervalued based on the nominal effective exchange rate (NEER).

NEER measures the value of a country’s currency relative to a basket of foreign currencies, taking into account the importance of each trading partner in the country’s total trade.

“The prevailing US dollar/ringgit rate has surpassed the support level of RM4.5491, and currently, the next support level is located at RM4.4872,” he told Bernama.

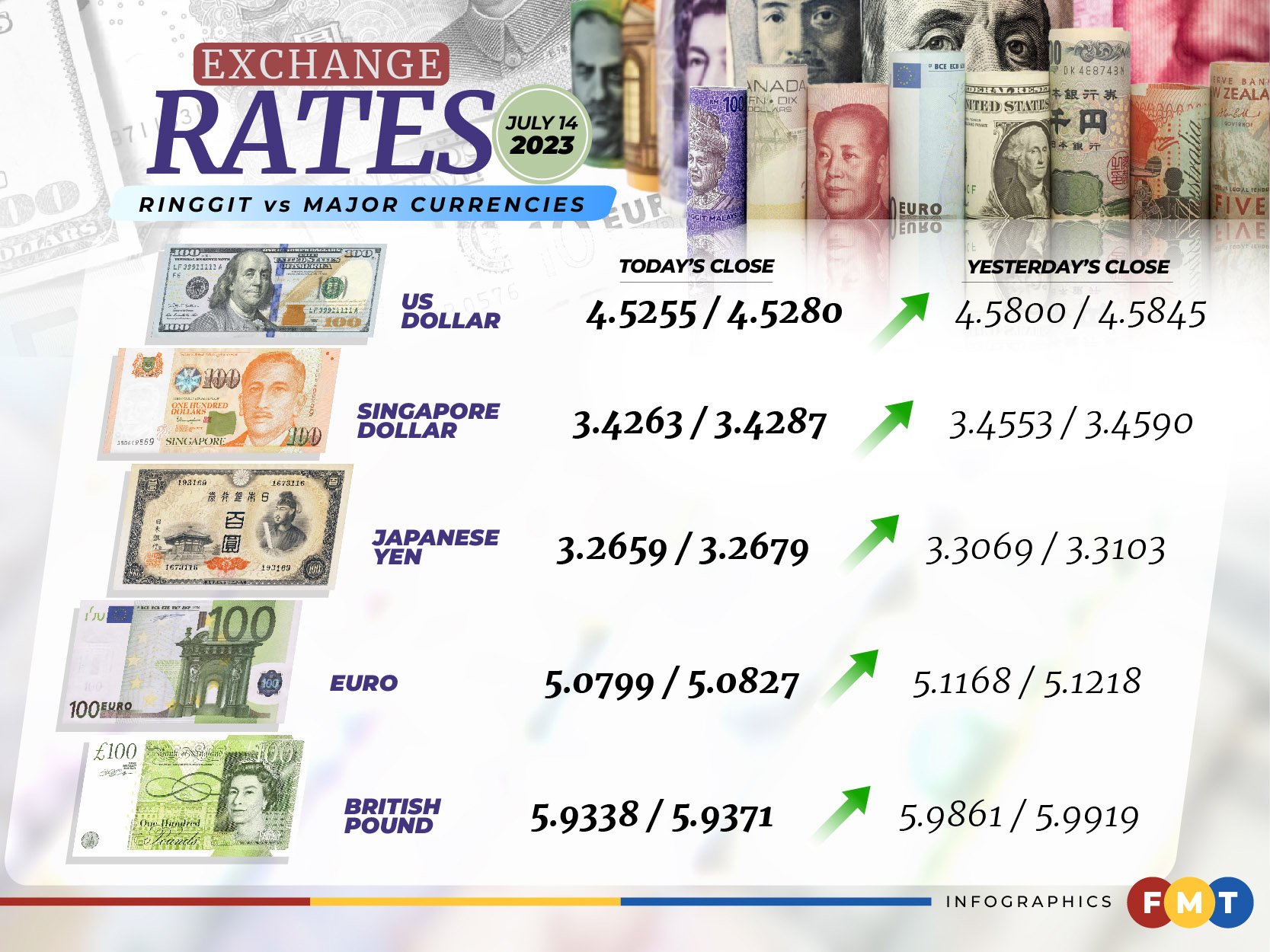

At 6pm, the local note surged 545 pips (percentage in points) to 4.5255/4.5280 against the greenback compared with 4.5800/4.5845 at yesterday’s close.

At home, the ringgit traded higher against a basket of major currencies at today’s close.

It strengthened vis-a-vis the euro to 5.0799/5.0827 from 5.1168/5.1218 at yesterday’s close, rose against the British pound to 5.9338/5.9371 from 5.9861/5.9919 and was up versus the Japanese yen to 3.2659/3.2679 from 3.3069/3.3103.

The local note also traded higher against other Asean currencies.

The ringgit rose against the Thai baht to 13.0689/13.0814 from yesterday’s close of 13.2481/13.2673 and inched up against the Singapore dollar at 3.4263/3.4287 from 3.4553/3.4590 previously.

The ringgit climbed against the Indonesian rupiah to 302.5/302.8 from 305.9/306.4 and gained against the Philippine peso at 8.31/8.33 from 8.40/8.41. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.