KUALA LUMPUR: The ringgit remained bullish against the US dollar for the third consecutive day, with US inflation data being the main catalyst for today’s performance.

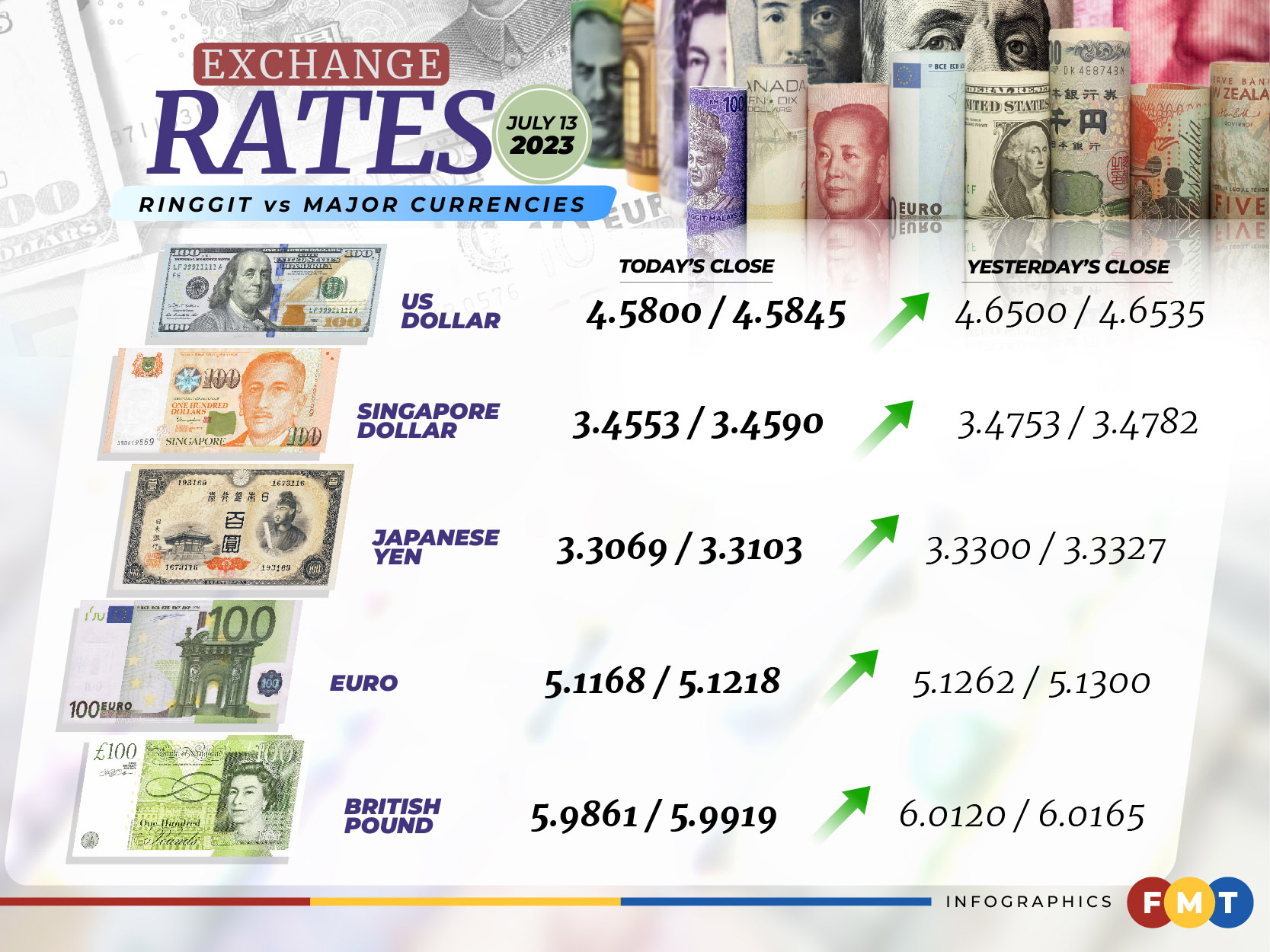

At 6pm, the local currency jumped 700 percentage in points (pips) to 4.5800/4.5845 against the greenback compared with 4.6500/4.6535 at Wednesday’s close.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Rashid said the lower-than-expected inflation, as shown by US Consumer Price Index (CPI) data in June, paved the way for a possible shift in the US Federal Reserve’s monetary policy stance.

According to news reports, the US CPI only increased 3% in June compared to 4% in May 2023, slightly below the market expectation of 3.1%.

“The ringgit posted a turnaround today, with the US dollar/ringgit rate breaching the immediate support level of RM4.6257. The turnaround is timely, as the ringgit has been in an oversold position for quite some time.

“The next immediate support level is located at RM4.5491,” he told Bernama.

Besides, he said the next hurdle would be the US Federal Open Market Committee (FOMC) meeting from July 25-26.

“Their latest assessment in the accompanying FOMC statement would be the key driver for further appreciation of the ringgit going forward,” he added.

At home, the ringgit traded higher against a basket of major currencies at today’s close.

It strengthened vis-a-vis the euro to 5.1168/5.1218 from 5.1262/5.1300 at Wednesday’s close, rose against the British pound to 5.9861/5.9919 from 6.0120/6.0165 and was up versus the Japanese yen to 3.3069/3.3103 from 3.3300/3.3327.

The local currency also traded higher against other Asean currencies.

The ringgit rose against the Thai baht to 13.2481/13.2673 from yesterday’s close of 13.3173/13.3338 and inched up against the Singapore dollar at 3.4553/3.4590 from 3.4753/3.4782 previously.

The ringgit climbed against the Indonesian rupiah to 305.9/306.4 from 308.4/308.8 and gained against the Philippine peso at 8.40/8.41 from 8.46/8.47. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.