KUALA LUMPUR: The ringgit closed lower against the US dollar today on the back of an upbeat US consumer sentiment, which raised the prospects of more interest rate hikes by the US Federal Reserve.

The local note’s decline was in line with most Asian currencies, which also slipped today following lacklustre Chinese economic growth data, said an analyst.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid said the ringgit was weaker today against the US dollar after experiencing a steep appreciation last week following the moderation in the US consumer price index.

On another note, he said China’s second quarter gross domestic product growth came in lower than expected at 6.3% versus the market expectation of 7.3%.

China’s fixed asset investment and retail sales also saw lower growth in June at 3.8% (May: 4%) and 3.1% (May: 12.7%), respectively, suggesting that China’s domestic demand is softening, Afzanizam said.

“Consequently, the Chinese yuan was weaker by 0.03% at 7.1370 against the US dollar. Given that the yuan and the ringgit are closely correlated, the ringgit also depreciated today,” he told Bernama.

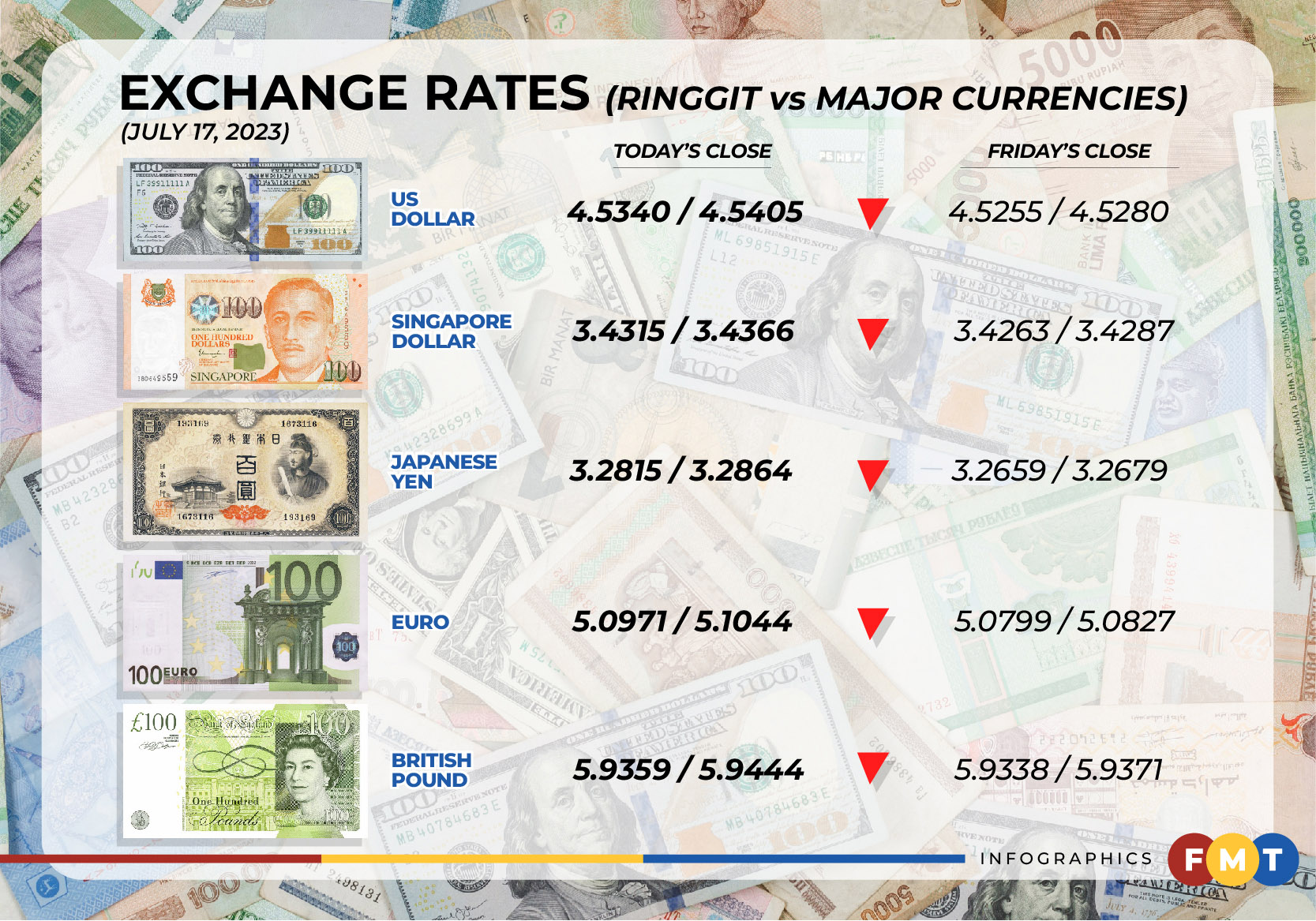

At 6pm, the local note stood at 4.5340/4.5405 against the greenback compared with 4.5255/4.5280 at last Friday’s close.

At today’s close, the ringgit traded lower against a basket of major currencies.

It fell vis-a-vis the euro to 5.0971/5.1044 from 5.0799/5.0827 at last Friday’s close, slipped against the British pound to 5.9359/5.9444 from 5.9338/5.9371 at the end of last week, and eased versus the Japanese yen to 3.2815/3.2864 from 3.2659/3.2679.

The local note also traded mostly lower against other Asean currencies.

The ringgit fell against the Thai baht to 13.0984/13.1225 from 13.0689/13.0814 last Friday, declined versus the Singapore dollar to 3.4315/3.4366 from 3.4263/3.4287 previously and slid vis-a-vis the Philippine peso to 8.33/8.35 from 8.31/8.33.

However, the ringgit gained against the Indonesian rupiah to 301.9/302.5 from 302.5/302.8 previously. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.