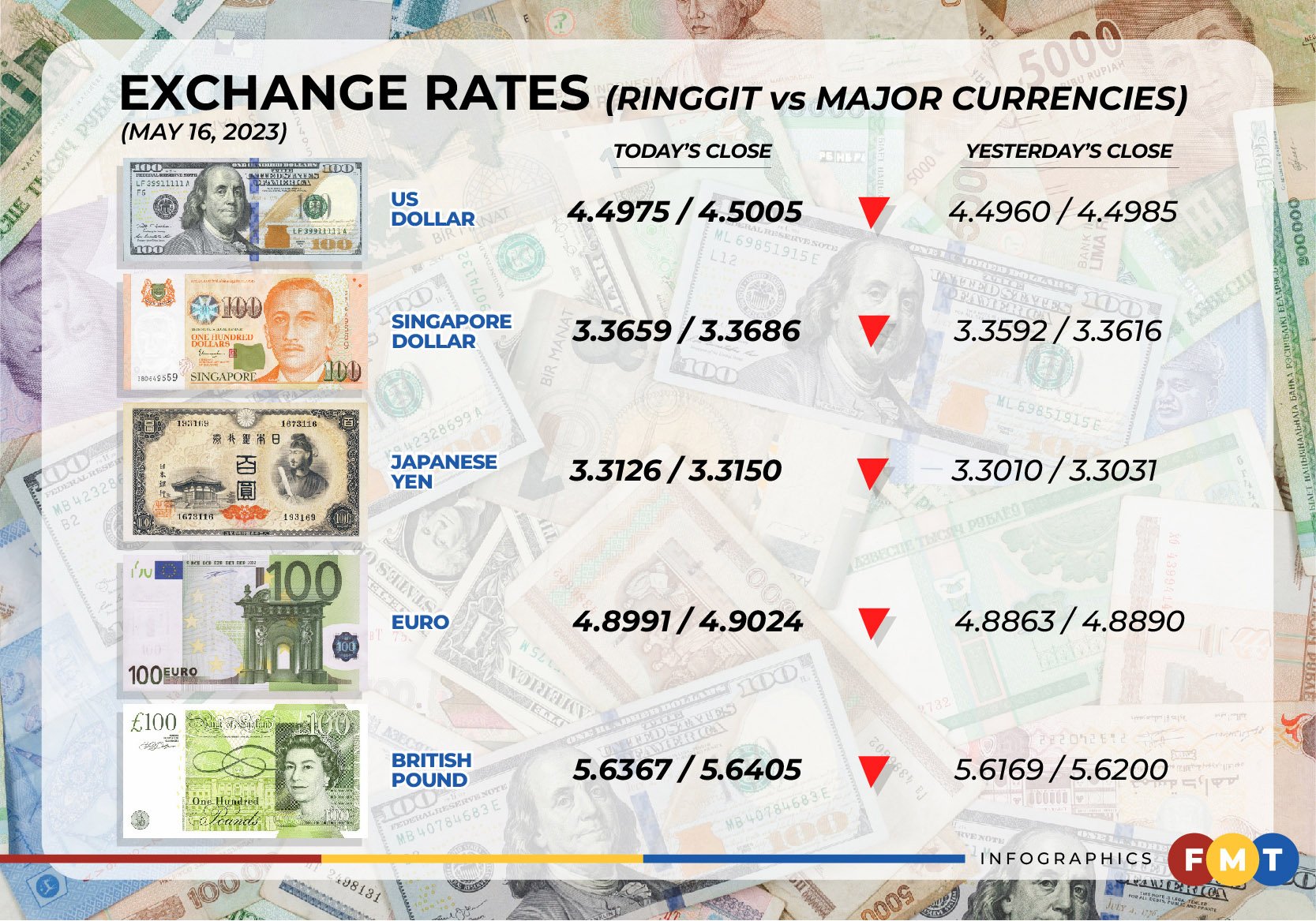

At 6pm, the local currency fell to 4.4975/4.5005 versus the greenback from Monday’s closing rate of 4.4960/4.4985.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Rashid said the ringgit trended weaker after most of China’s economic data released today registered below-than-expected numbers against the market forecast.

According to China’s National Bureau of Statistics, fixed assets investment grew by 4.7% against market consensus estimates of 5.5%, while retail sales and industrial production were at 18.4% and 5.6%, respectively, below the market consensus of 21% and 10.9%, respectively.

“This shows that the global growth outlook is still challenging but the hope for China to be the key catalyst for global expansion following the reopening of the economy is still there.

“However, it may not be straightforward in light of the possible speed bumps along the way,” Afzanizam told Bernama.

At the close, the ringgit traded lower against a basket of major currencies.

It depreciated against the euro to 4.8991/4.9024 from 4.8863/4.8890 at the close on Monday, fell vis-a-vis the British pound to 5.6367/5.6405 versus 5.6169/5.6200 and eased against the Japanese yen to 3.3126/3.3150 from 3.3010/3.3031 previously.

The local currency traded mixed against Asean currencies.

It rose versus the Indonesian rupiah to 303.4/303.8 from 303.6/304.0 and strengthened vis-a-vis the Thai baht to 13.2400/13.2547 from 13.3045/13.3174 at Monday’s close.

The ringgit slid to 3.3659/3.3686 against the Singapore dollar compared with 3.3592/3.3616 and was unchanged against the Philippine peso at 8.02/8.03. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.