The local note last traded at the current level on Nov 11 last year.

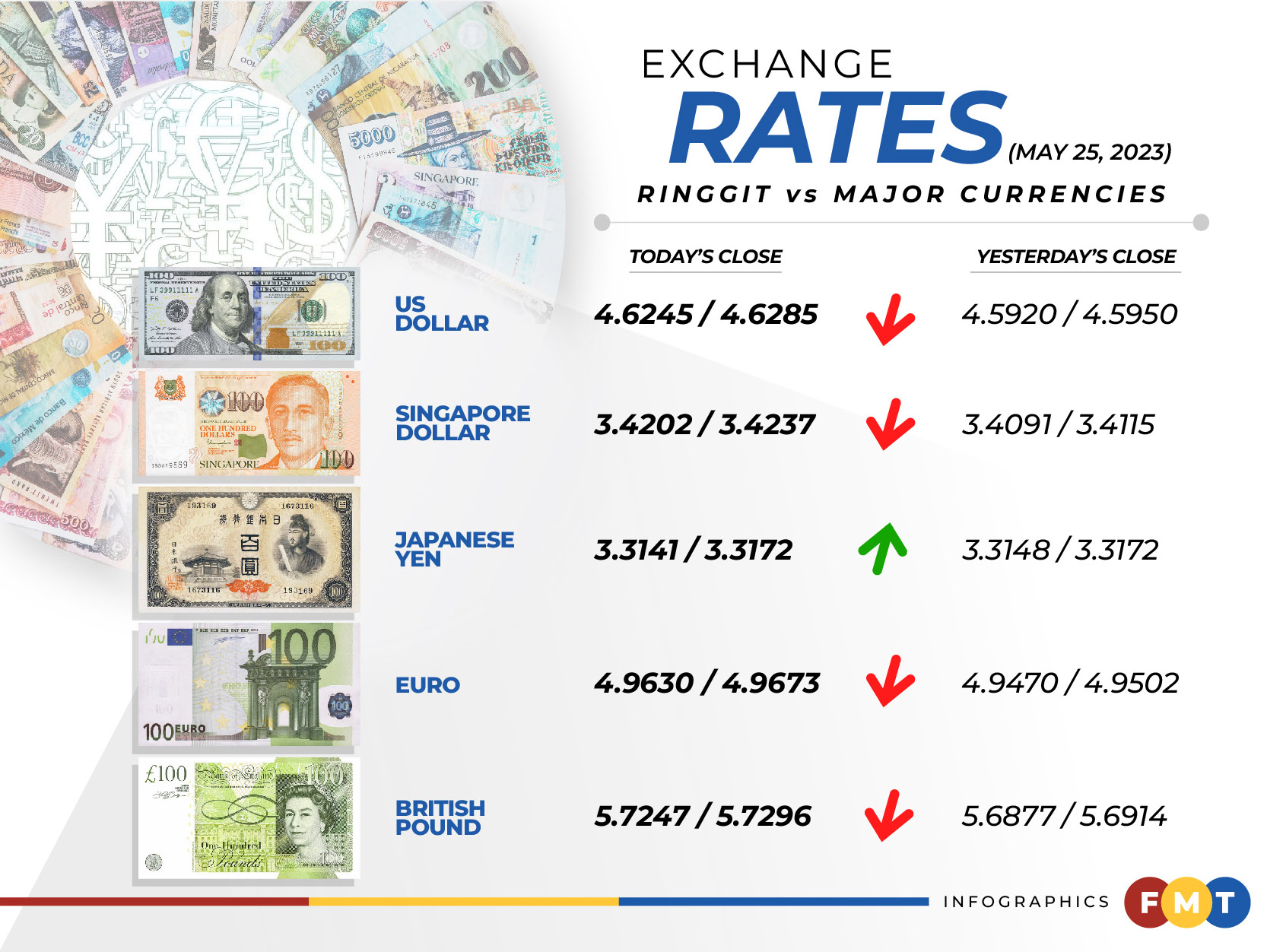

At 6pm, the local note stood at 4.6245/4.6285 against the greenback compared with Wednesday’s closing of 4.5920/4.5950.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid said the US debt ceiling risks remained the main concern and financial markets were expected to remain jittery over the impasse along with concerns on the weakening global economy.

“The immediate impact will be on the ringgit which we expect will continue to remain soft.

“As for Malaysia’s overnight policy rate, we believe it will stay at 3% throughout the year as the external uncertainties become elevated which might have a direct impact on the country’s external demand,” he told Bernama.

In a nutshell, there is a greater sense of anxiety over the prospects of the global economy.

Meanwhile, RHB Investment Bank Bhd group chief economist and market research head Sailesh K Jha said the bank indicated its short-term target for US dollar-ringgit is 4.60, which has been breached, and the near-term target for US dollar-ringgit has been raised to 4.70, with the balance of risks tilted towards a print of around 4.75.

“The balance of risks to our end-second quarter 2023 US dollar-ringgit forecast of between 4.55 and 4.65 is tilted towards a print of 4.65 and 4.75.

“We expect the next strong US dollar-ringgit resistance levels of 4.6385 and 4.6470 to be broken quickly, which then brings 4.70 into play,” he said in a note today.

He added that in the medium term, the bank would not rule out US dollar-ringgit hitting the 5.0-level.

“The near-term Singapore dollar-ringgit target of 3.40 has also been breached and we are raising our target to between 3.45 and 3.50,” he added.

At today’s closing, the ringgit depreciated against a basket of major currencies, except against the yen.

It eased further vis-a-vis the British pound to 5.7247/5.7296 from 5.6877/5.6914 at the close on Wednesday, weakened against the euro to 4.9630/4.9673 from 4.9470/4.9502, but rose marginally against the Japanese yen to 3.3141/3.3172 from 3.3148/3.3172 yesterday.

The local note also traded lower against other Asean currencies.

The ringgit hit 3.4202/3.4237 from 3.4091/3.4115 against the Singapore dollar, depreciated further versus the Indonesian rupiah to 309.2/309.6 from 308.1/308.5 at Wednesday’s close, slipped against the Philippine peso to 8.25/8.26 from 8.23/8.24, and fell vis-a-vis the Thai baht to 13.3602/13.3776 from 13.2924/13.3073 previously. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.