Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid said the ringgit continued to perform favourably versus the US dollar today, taking a cue from the sharp decline in US bond yields.

It was reported that the 10-year US Treasury yield dropped a further 50 basis points (bps) in December 2023 after falling 53 bps in November 2023.

“It was at 5% in mid-October 2023 and fell to 3.8% in December 2023.

“The ringgit against the US dollar was hovering at 4.58 today, nearing its immediate support level of 4.5778,” he told Bernama.

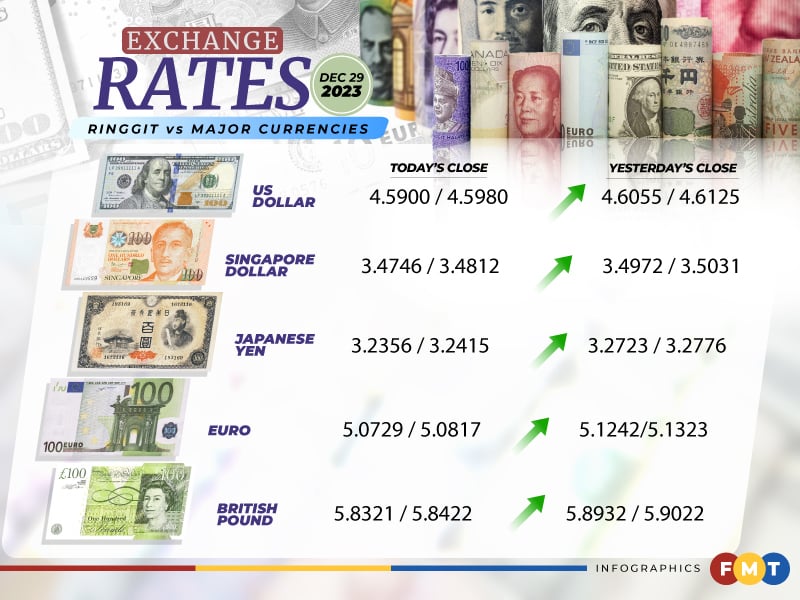

At 6pm, the ringgit rose to 4.5900/4.5980 versus the greenback from yesterday’s close of 4.6055/4.6125.

The local note also traded higher against a basket of major currencies.

It appreciated against the Japanese yen to 3.2356/3.2415 from 3.2723/3.2776 yesterday, rose versus the euro to 5.0729/5.0817 from 5.1242/5.1323, and strengthened vis-a-vis the British pound to 5.8321/5.8422 from 5.8932/5.9022 at yesterday’s close.

The ringgit was also traded higher against Asean currencies.

It firmed against the Singapore dollar to 3.4746/3.4812 from 3.4972/3.5031 at yesterday’s close and improved vis-à-vis the Philippine peso to 8.28/8.31 from 8.30/8.31 previously.

The local currency also edged up versus the Indonesian rupiah to 298.1/298.6 from 298.6/299.3 yesterday and strengthened against the Thai baht to 13.3422/13.3760 from 13.4979/13.5260. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.