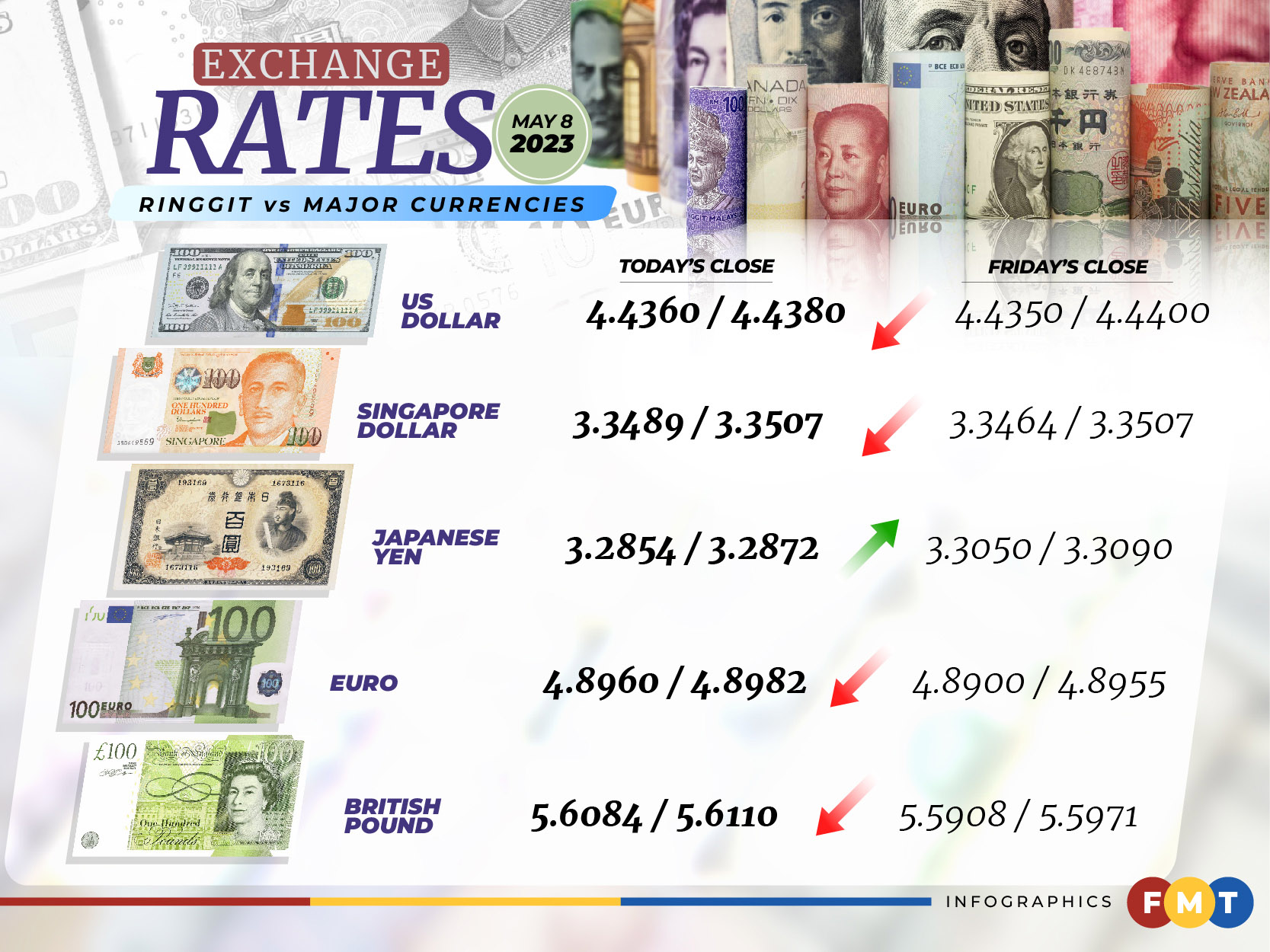

At 6pm, the local note stood at 4.4360/4.4380 versus the US dollar compared with last Friday’s closing rate of 4.4350/4.4400.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid said investors were awaiting the gross domestic product (GDP) data for the first quarter of 2023 (Q1 2023) due at the end of this week for forward guidance.

“The Q1 2023 GDP, to be announced on Friday, would give us more clues as to how the Malaysian economy would fare in the near term.

“We also believe the market has already priced in that the Federal Reserve (Fed) would be gentler in respect of its grip on monetary policy,” he told Bernama.

As such, he said, market participants would be observing whether the economy would continue to slow down and whether the Fed would alter its stance despite knowing that inflation would take a while to normalise towards the 2% target.

Meanwhile, the ringgit traded mostly lower against a basket of major currencies.

It was easier vis-a-vis the British pound at 5.6084/5.6110 versus 5.5908/5.5971 last Friday and fell against the euro to 4.8960/4.8982 from 4.8900/4.8955, but appreciated against the Japanese yen to 3.2854/3.2872 from 3.3050/3.3090.

The local note traded mostly higher against Asean currencies.

It rose vis-a-vis the Thai baht to 13.1184/13.1302 from 13.1446/13.1661 at last Friday’s close and improved versus the Indonesian rupiah to 301.5/301.8 from 302.1/302.6.

The local unit was, however, lower against the Singapore dollar at 3.3489/3.3507 compared with 3.3464/3.3507 at the end of last week and unchanged against the Philippine peso at 8.02/8.03. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.