KUALA LUMPUR: External pressures continue to weigh on the ringgit, causing it to close lower against the US dollar on the last trading day of the week.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Rashid said the ringgit was severely affected by external events, in particular, the Bank of England’s unexpected 50 basis points (bps) rate hike and the US Federal Reserve’s apparent hawkish stand.

“Malaysia’s CPI (consumer price index) came in lower than expected at 2.8% in May while the inflation rate has been improving.

“In a lot of sense, the 125bps overnight policy rate (OPR) hike since March last year has started to have an impact on inflation,” he told Bernama.

Afzanizam said at the current juncture, Malaysia’s real interest rate has turned positive at 0.2%, and hence, there is no urgency for Bank Negara Malaysia to raise the OPR again in the near term.

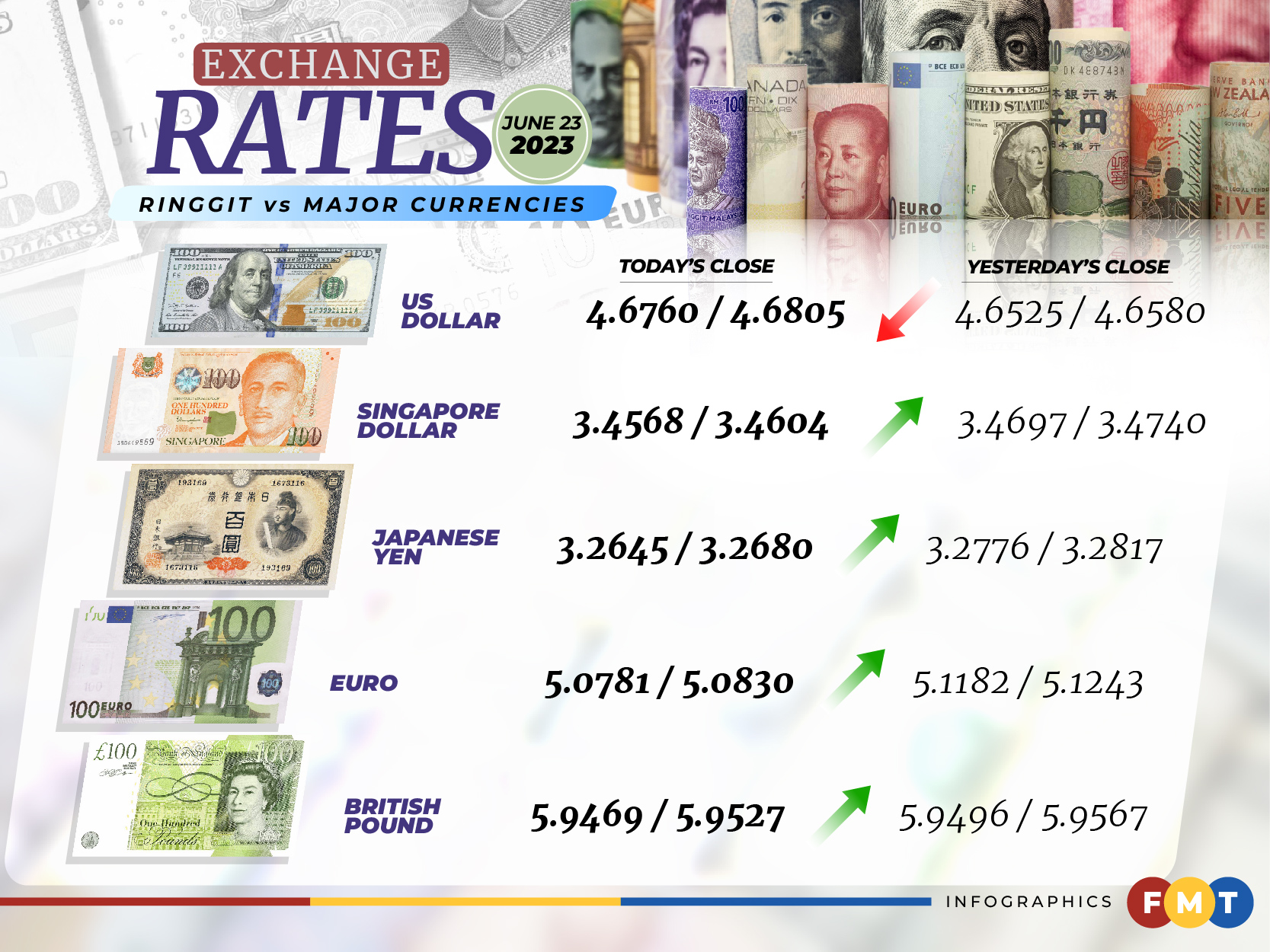

At 6pm, the local currency ended at 4.6760/4.6805 against the greenback compared with 4.6525/4.6580 yesterday.

Meanwhile, the ringgit strengthened against a basket of major currencies.

At the close, the local currency was marginally higher versus the British pound to 5.9469/5.9527 from yesterday’s closing of 5.9496/5.9567, strengthened against the Japanese yen to 3.2645/3.2680 from 3.2776/3.2817 and appreciated vis-a-vis the euro to 5.0781/5.0830 from 5.1182/5.1243 on Thursday.

However, the local currency weakened against other Asean currencies except the Singapore dollar.

The ringgit went up against the Singapore dollar to 3.4568/3.4604 from 3.4697/3.4740 previously, it was marginally lower versus the Thai baht at 13.2765/13.2950 from 13.2720/13.2934 yesterday, fell further vis-a-vis the Indonesian rupiah to 311.7/312.2 from 311.3/311.9, and depreciated against the Philippine peso to 8.38/8.40 from 8.36/8.38 yesterday. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.