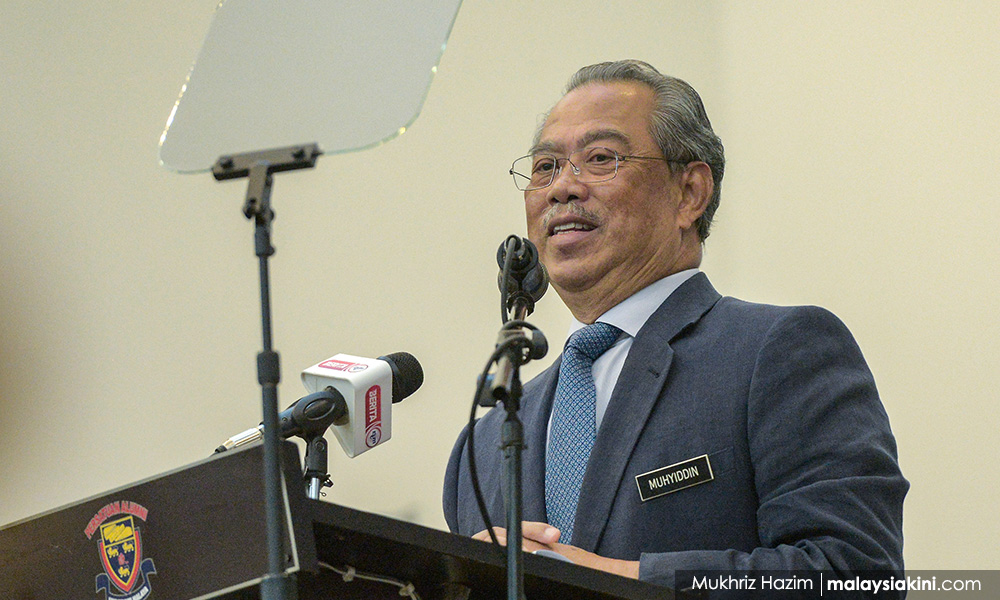

As Perikatan Nasional government has yet to make any decision whether to extend the six-month loan moratorium that ends this month, the DAP is calling for Sabah voters to pressure Prime Minister Muhyiddin Yassin by choosing Warisan Plus.

In a statement released by party secretary-general Lim Guan Eng, the DAP claimed that refusal by Muhyiddin administration to extend the loan moratorium would take its toll on eight million individuals and companies in the country.

"DAP regrets the stubborn refusal by the Prime Minister Muhyiddin Yassin to heed the calls of ordinary Malaysians and the business community to extend the moratorium of bank loans by another six months, when it expires on Sept 30.

"Master Builders Association Malaysia (MBAM) is the latest to plead for an extension, following losses for the construction industry of RM11.6 billion every month since the nationwide movement control order (MCO) began on March 18. Of these, 29 percent of the losses were due to the unemployment of industry workers as construction projects had to be halted.

"What is significant is that MBAM’s plea for the extension of the moratorium for another half a year is defensive and a cry for help, to help protect not promote one of the most important economic sectors in the country," said the Bagan MP.

According to Lim, who is also a former Finance Minister, the amount of loan repayment moratorium by financial institutions since April 1 was estimated to be at RM85.8 billion.

Of this, some RM55.8 billion was said to have benefited individual borrowers, while RM30 billion benefited the business sector.

"This is significant in protecting the livelihood, jobs and businesses of eight million individuals and companies," Lim stressed.

He claimed that the banking industry is able to shoulder another six-month extension of the moratorium, which would incur losses of RM6.4 billion to them against RM32 billion profit they made last year.

The government could also take up the responsibility by injecting the RM6.4 billion for the moratorium, Lim said.

"This is money well-spent, with a high impact value to eight million Malaysian individuals and companies of RM86 billion.

"The Human Resources Ministry has also revealed that there will be one million unemployed Malaysians by the end of September, of which more than 500,000 are youths. Failure to extend the loan moratorium will only increase the hardship of one million unemployed Malaysian workers.

"Since the federal government refuses to listen, then outside pressure is needed. Perhaps only a Warisan Plus victory in the upcoming Sabah state general election can compel Muhyiddin to change his mind and extend the moratorium on bank loans by another six months.

Malaysia's economy was badly affected as the government had to introduce the MCO in March to curb the spread of Covid-19 pandemic.

The MCO saw most of the country's economic activities came to a halt for nearly two months and was reopened in stages when the government allowed the economic sector to reopen in stages starting May 4 as the pandemic was put under control.

As part of government's efforts to mitigate the impact on individuals and businesses, Bank Negara in March ordered banks to grant an automatic six months moratorium on all loan and financing payments, except for credit card balances.

The moratorium started on April 1 and to end this Sept 30. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.