PETALING JAYA: Beleaguered minority shareholders of Malaysian glove makers finally have something to be happy about. In the last month, Top Glove Corporation Bhd is up 55.71% or 39 sen to RM1.09, with the counter near the top of the Bursa Malaysia active stocks list most days of the week.

The rest of the glove counters are also on the move with Hartalega Holdings Bhd (up 35.48%), Kossan Rubber Industries Bhd (25.69%), Supermax Corporation Bhd (26.58%), Hextar Healthcare Bhd (18.52%), and the rest of the glove industry players also riding the upward momentum.

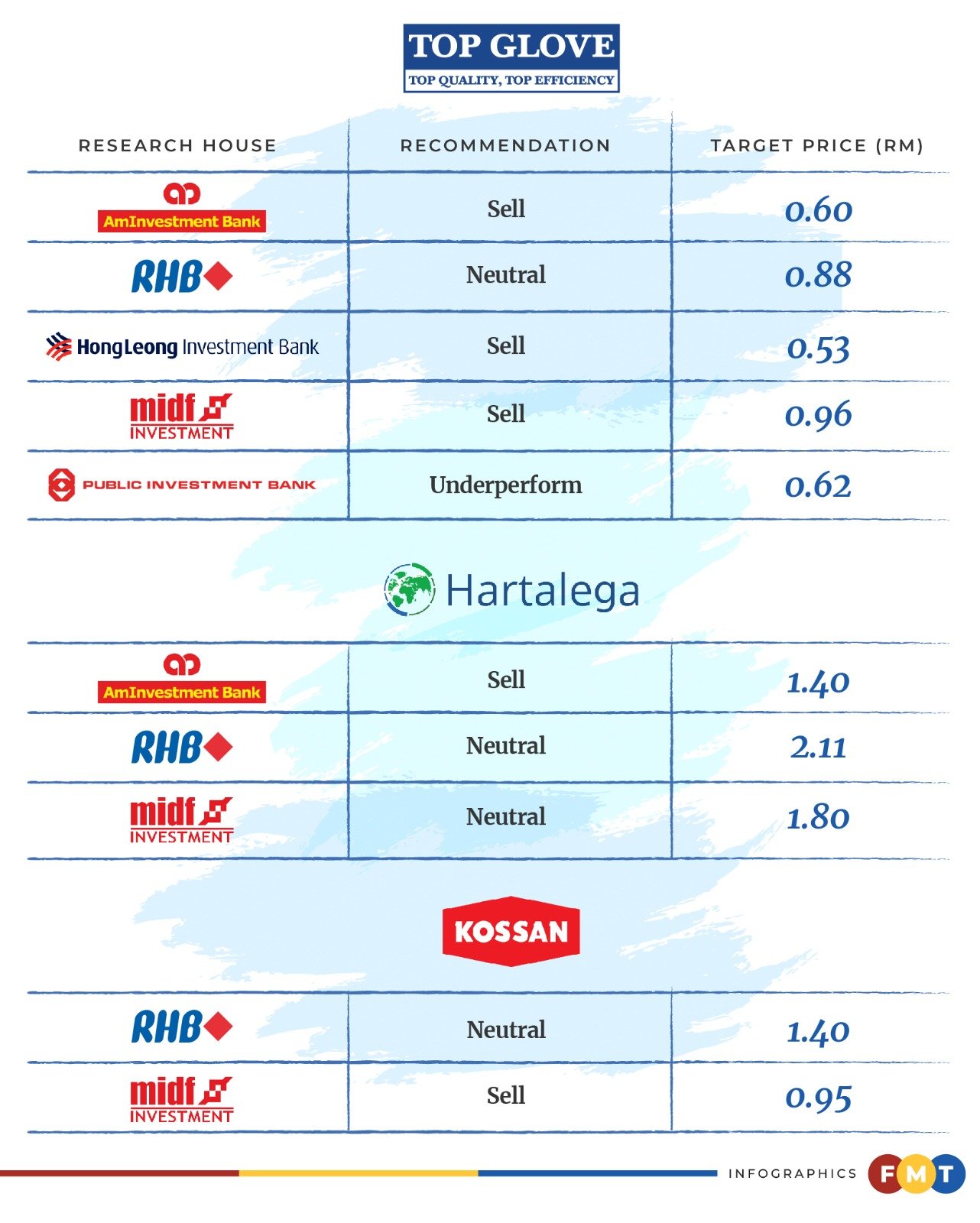

The steady rise in their share prices have, however, puzzled some industry observers. Glove stocks have seemingly become the flavour of the month despite most research houses giving the thumbs down to the sector in their recent reports.

In the last week alone, MIDF Research released a research note maintaining its “negative” call for the glove sector, while Kenanga Investment Bank and CGS-CIMB Securities have reiterated their “underweight” rating on the sector.

The reports did not mention any new major developments in the industry. The only change in the past month were companies announcing financial results – and most have not been encouraging.

Industry leader Top Glove scored an unwanted hattrick of quarterly losses, with the rest of the field either in the red or marginally in the black.

So, what has prompted the upward pressure on glove shares? FMT Business posed this question to some research houses.

Bargain-hunting investors

Asked whether bargain-hunting investors should invest in glove stocks now, Rakuten Trade Sdn Bhd vice-president of equity research Thong Pak Leng said he does not foresee shares improving for the next three years.

“The rise in share prices is due to speculation, and not fundamentals,” he said.

MIDF analyst Ng Pei Fan echoed this view. “It is possible that some investors will view glove stocks as being undervalued at the current juncture.

“However, this could only be for the short-term as we believe that the fundamentals of glove stocks remain weak due to the ongoing oversupply of gloves,” she said.

In a previous research note, MIDF said that while all the glovemakers under its coverage were trading at a 33% to 52% discount, it was due to continuous downside risk to their companies’ profitability.

Hence, MIDF held off on bottom fishing until it was certain about customer reaction to average selling price (ASP) hikes.

Old issues persist

The market yesterday gave a timely reminder that the positive sentiment for glove stocks may be fleeting. Most glove counters were in the red with nine of the 10 biggest listed glove companies’ share prices down between 2% and 8%.

Top Glove was down 5.22% or 6 sen, being the third most active counter on the bourse with 81.3 million shares traded.

Despite a more optimistic outlook from investors in the last month, the sector still faces the same old problems from a year ago – higher costs, lower selling prices, and overcapacity leading to suppressed industry utilisation rate.

The industry utilisation rate fell from 35%-40% in Q4 2022 to 32%-35% in Q1 2023, after excluding temporarily shut down of inefficient plants.

The Malaysian Rubber Glove Manufacturers Association (Margma) says the industry will turn the corner in 2023, projecting a 12%-15% growth in the global demand for rubber gloves this year.

Kenanga’s dissenting view

Kenanga begs to differ, saying its demand-supply forecasts show it will take at least another two years of consistent demand growth to fully fill the current excess capacity in the industry.

In a research note this week, Kenaga projected the demand for gloves to rise by 15% in 2023, which is consistent with Margma’s forecast.

However, it says this will not fix the overcapacity situation as the global capacity is set to grow another 16% to 595 billion pieces during the year.

“This comes following new capacity planned by incumbent and new players during the pandemic years – enticed by super-fat margins that had evaporated – finally coming online,” it said.

Kenanga says this will result in the excess capacity rising by 22% to 137 billion pieces from 112 billion pieces in 2022. The expanded overcapacity means low prices and depressed plant utilisation will likely persist in 2023.

Not helping the already dire situation is the reluctance of customers to commit to sizable orders and hold substantial stocks, on expectations of further decline in prices.

Prices, on the other hand, remain uncertain as raw materials which account for 34%-37% of total operation costs continue to fluctuate.

Investors, nevertheless, are hoping that the good times will firmly return for Malaysia’s battered glove makers. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.