Allowing Employees Provident Fund (EPF) savings to be used as collateral for emergency loans does not actually resolve the rakyat’s financial problems, said economists.

This is because it does not address the rakyat’s needs for emergency access to funds and will not benefit those who need financial aid the most due to the scheme’s constraints, among others.

Malaysia University of Science and Technology economics professor Geoffrey Williams said the limited pool of eligibility is due to the RM3,000 loan threshold and the limit of not being able to borrow more than what one has in their EPF Account 2.

“Most of the poorest people have nothing in their accounts. Around 75 percent of EPF members will not benefit and mostly, (income groups) M40 and T20 will benefit,” Williams told Malaysiakini.

Another downside is that lenders would still end up getting the money and deplete the savings of those who utilised the EPF loan scheme, unless they repay before the end of the loan, he said.

However, Williams noted that this conservative design of the support facility will protect people and is better than a direct withdrawal scheme.

Similarly, Malaysian Institute of Economic Research senior fellow Shankaran Nambiar said it is good that participating banks will offer a lower interest rate than otherwise available under the EPF loan scheme.

This will lower the burden on potential borrowers, he added.

“However, it doesn’t solve the problem of access to funds under emergency situations,” he said.

Meanwhile, Center for Market Education CEO Carmelo Ferlito said he was “not a big fan” of the EPF loan scheme proposal, stressing that the fund should be kept for contributors’ future.

He pointed out that Malaysia has one of the highest household debt to gross domestic product ratios in the world, which makes people particularly vulnerable to economic cycles.

“Plus, it further undermines future financial stability by introducing the idea that EPF is something that can be useful, while it should clearly be a tool to face the future.

“Loans should be backed by present resources, not by future ones,” he said.

While Carmelo acknowledged that there are some limits and conditions on the EPF loan scheme, he insisted the principle of using EPF for emergency funds in itself is wrong.

Better policies needed

Williams and Nambiar both also said the government should be exploring other ways to address the rakyat’s financial woes.

For starters, Nambiar said the government should look into a universal basic income for those not on a pension scheme, and public intervention in the provision of housing and healthcare financing.

“If the above policies are put in place, there will be less dependence on EPF as a source of credit,” he added.

Williams said other alternatives would be a complete reform of the pension and social protection system as well as wage and income reform.

“These problems arise because people get into serious trouble and they have neither the income nor the savings to respond. There is also no social safety net to help them.

“This is a structural issue which must be reformed. But the government is too scared to take it on.

“It is time to leave EPF alone and allow it to recover from the big withdrawals and get on with its job as a national pension provider rather than treating it as a national ATM,” he added.

Account 2 Support Facility

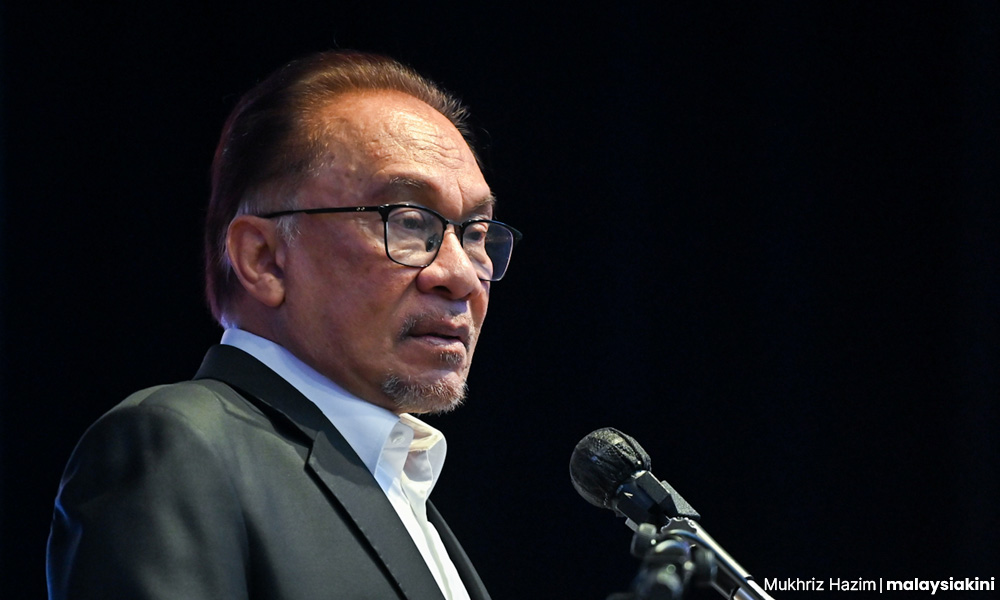

Prime Minister Anwar Ibrahim had announced previously that the government would introduce a method that would allow contributors who are in dire straits to take up loans from a bank with collateral from their EPF.

This method will not involve direct withdrawals from the contributors’ savings.

EPF has since announced on April 3 that they have finalised the mechanism as well as the terms and conditions for the Account 2 Support Facility (FSA2), which will be implemented in two phases, with Phase 1 beginning on April 7.

Participating banks include MBSB Bank and Bank Simpanan Nasional (BSN), and more banks may be added in the future.

Under the facility, EPF members under the age of 55 can submit an advance notice of age 50 or 55 withdrawal, provided they have a minimum amount of RM3,000 in their EPF Account 2.

The maximum financing amount has been fixed at RM50,000, subject to EPF Account 2 balance, with a repayment tenure of up to 10 years. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.