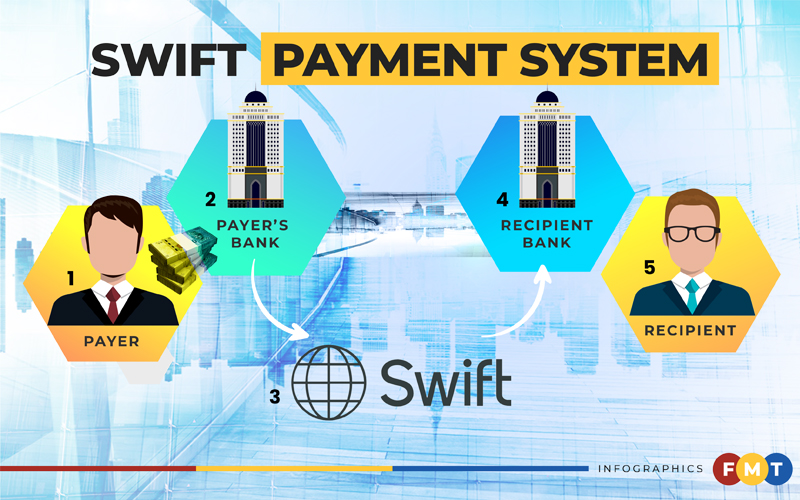

PETALING JAYA: Malaysia has been cautioned against making hasty decisions when considering a move away from the SWIFT cross-border payment system in financial settlements in international trade.

Analysts and economists pointed out that much is at stake, politically and economically, in any move to favour one system over another.

The push for a switch from the US-controlled SWIFT system to an emerging Asian alternative is in line with another proposal to ease dependence on the US dollar for financial settlements in trade.

The proposal has gained momentum especially after sanctions were imposed on Russia by the West over its invasion of Ukraine.

At an official meeting of Asean finance ministers and central bank governors in Bali on March 28, Indonesia President Joko ‘Jokowi’ Widodo said the region should ease its dependence on the US dollar, euro, yen and British pound in financial transactions and move to make settlements in local currencies.

He also urged regional administrations in Indonesia to start using credit cards issued by local banks and gradually ease their dependence on foreign payment systems to shield the country’s economy from geopolitical disruptions.

Monash University Malaysia economics professor Niaz Asadullah said that while some Asean leaders had sought Asian alternatives to SWIFT, Malaysia should first participate in regional discussions on the matter of reducing dependence on Western financial systems.

“While China is Malaysia’s biggest trading partner and a dominant source of foreign direct investment, Malaysia’s economic ties with the US is also too significant to overlook,” he told FMT Business.

The US is Malaysia’s third largest trading partner while Malaysia is the US’s second largest trading partner in Asean.

But with China intensifying its economic and diplomatic relationship with Asian nations, more Asean countries may switch to the China International Payment System (CIPS) as an alternative.

However, Niaz said, a sudden switch away from SWIFT would be costly for all major trading partners of the US.

“It will also require a significant coordinated effort from the global financial infrastructure given that SWIFT has been, for decades, the unquestioned international payment system,” he added.

Pacific Research Center of Malaysia principal advisor Oh Ei Sun said that ultimately, it is a decision for businesses to make.

“Now, they value the US dollar’s global free flow and fluidity and the security and assurances of a payment system controlled by the US, so the answer will be a resounding ‘no’,” he told FMT Business.

“Forcing a business to adopt a monetary system only works when you are a commanding economy. Otherwise, businesses will vote with their feet,” he said.

Center for Market Education CEO Carmelo Ferlito does not see any economic benefit in adopting a different system apart from a shield against geopolitical tensions.

He said Jokowi’s concern that an escalating situation was fast becoming a confrontation rather than a conciliation was already beyond the issue of a multipolar world. “It is more of a power test,” he told FMT Business.

S Rajaratnam School of International Studies adjunct senior fellow James Dorsey has described the notion that local banks could quickly set up a new payment system network as “a pie in the sky”.

“Countries can notionally have regional networks but a willingness for greater economic integration is required, which Asean does not have,” he told FMT Business.

Dorsey said that as the world moved towards greater multilateralism, certain commodities could then be traded in local currencies but an overall switch would be unlikely.

Universiti Malaya economics professor Nazari Ismail said the way to ease dependence on the US and other Western systems was to be less dependent on them for borrowings.

“Many Asian leaders look to the US and European financial institutions for sources of funds to underwrite their local political agendas,” he told FMT Business.

Malaysia University of Science and Technology economics professor Geoffrey Williams said a viable and reliable alternative for interbank transfers and e-payments must be in place before SWIFT is replaced.

He said while many local institutions could offer the same service, only a stable, reliable and secure system would survive.

He added that cybersecurity was essential while questions on geopolitical stability had also surfaced but these problems could not be resolved by breaking up an international system into smaller regional ones. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.