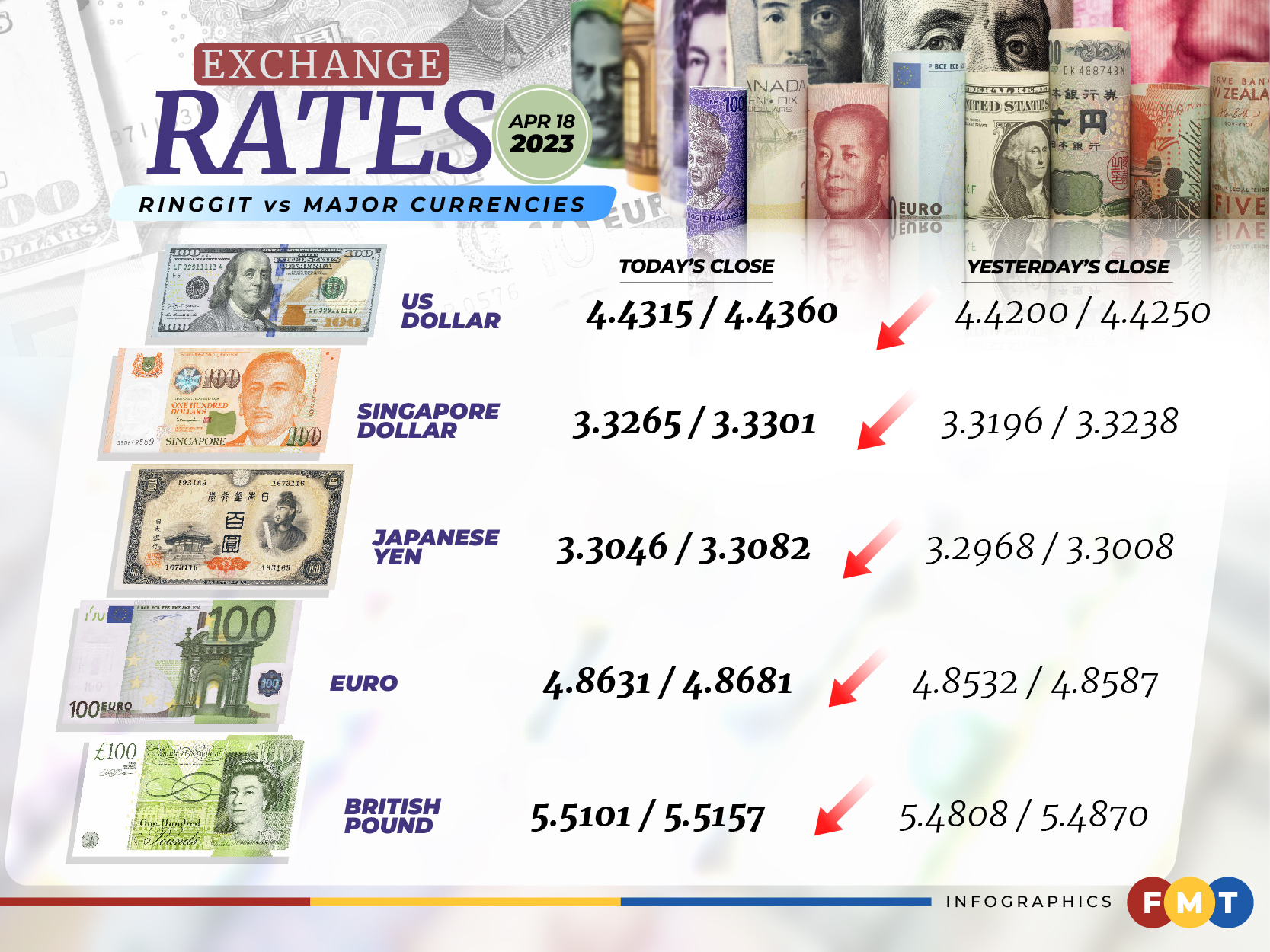

At 6pm, the local currency depreciated to 4.4315/4.4360 versus the greenback from Monday’s closing rate of 4.4200/4.4250.

“The ringgit’s next resistance level is RM4.4858 against the greenback. So far, the ringgit versus the greenback is at an overbought position from a technical standpoint,” Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid told Bernama.

He said despite the weaker ringgit against the US dollar, the local currency would receive some support as China released its gross domestic product (GDP) results for the first quarter of this year (Q1 2023), which grew more than expected at 4.5% (Q1 2022: 2.9%) against consensus estimates of 4%.

“This would mean that the Malaysian economy would benefit from the strengthening of China’s growth via trade and investment. We shall expect further support from China’s growth via trade and investment,” he added.

Meanwhile, the ringgit reversed its gains against a basket of major currencies.

It weakened vis-a-vis the euro to 4.8631/4.8681 from 4.8532/4.8587 yesterday; it was easier versus the British pound to 5.5101/5.5157 from Monday’s close of 5.4808/5.4870 and eased against the Japanese yen to 3.3046/3.3082 from 3.2968/3.3008 yesterday.

The local currency also traded mixed against Asean currencies.

It was marginally higher against the Indonesian rupiah at 298.5/299.0 from 298.7/299.2 on Monday and also traded marginally higher against the Philippine peso at 7.89/7.90 from 7.91/7.93 yesterday.

The ringgit also depreciated versus the Thai baht to 12.9228/12.9416 from 12.8604/12.8813 and weakened further against the Singapore dollar at 3.3265/3.3301 from 3.3196/3.3238 yesterday. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.