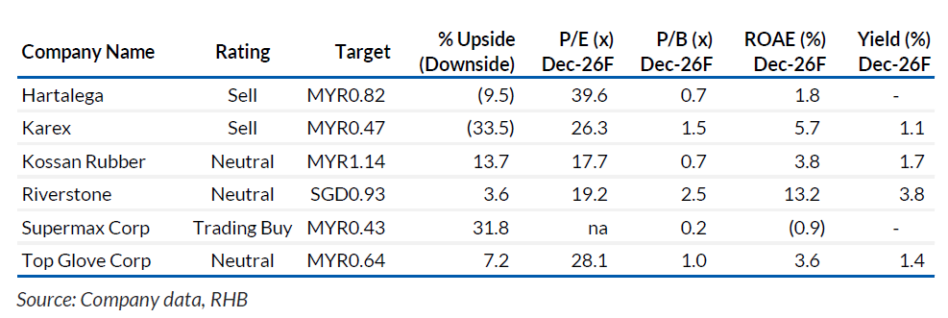

RHB maintains their Underweight stance, as they view the rubber sector’s current valuation appeal as secondary to the looming risk of earnings misses.

The sector’s narrative remains dominated by a pricing power deficit, with glove producers caught between a strengthening MYR and intensifying global competition.

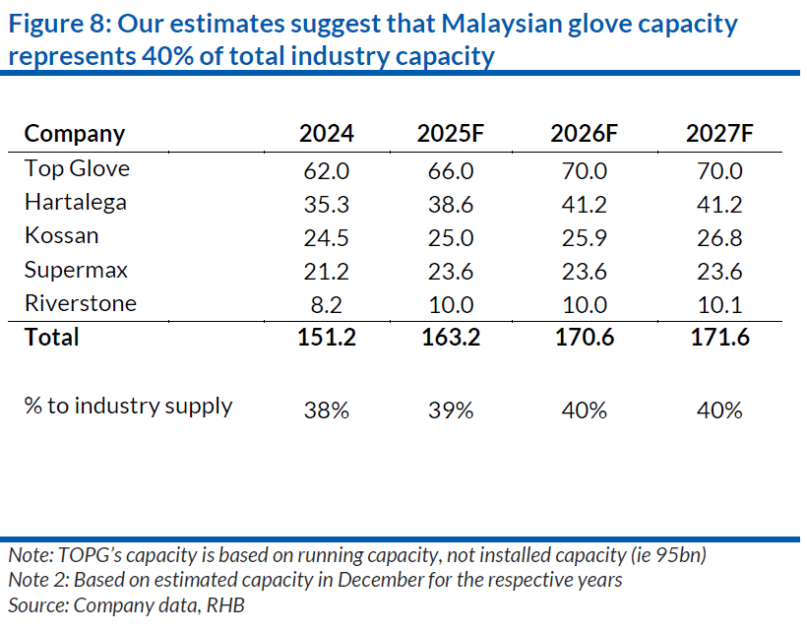

“We expect demand for gloves to grow by 8% in 2026 to 400 bil pieces, followed by a more moderate 6% to 424 bil pieces in 2027, driven by structural improvements in global hygiene awareness and occupational safety standards,” said RHB.

Under these assumptions, a more balanced demand-supply dynamic could emerge by 2027. However, this outcome is highly contingent on the absence of further capacity expansion announcements, particularly from China-linked producers (which could go up to 80 bil pieces pa).

Management commentaries across briefings suggest continued average selling price (ASP) pressure going into 2026, potentially exacerbated by incremental supply from China glove producers with offshore facilities.

Compounding this pressure is the rise in raw material costs. While a weakening USD provides some relief on MYR-denominated input costs, it simultaneously erodes manufacturers’ pricing power.

In a price-taker environment, buyers are likely to leverage the stronger MYR to resist price pass-throughs, thereby increasing margin compression risks.

“We prefer players with diversified end markets and strong execution capabilities. Top Glove fits the bill due to its focus on latex, which provides it with a strategic buffer against aggressive pricing from China competitors, who primarily dominate the nitrile market,” said RHB.

This niche allows TOPG to defend its market share through selective pricing, a strategy that is already yielding results, weekly orders have surged to 1.4 bil pieces, exceeding capacity and extending lead times beyond 60 days.

“However, we maintain our NEUTRAL rating on the stock as rising latex costs could eventually erode this competitive advantage and compress margins,” said RHB.

Risks to the sector are such as a stronger USD/MYR rate, an increase in glove ASPs, slower-than-expected capacity expansion, lower-than-expected raw material prices, and a favourable tariff environment vs competitors. — Focus Malaysia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.