When it comes to national debt, discussing it intelligently and accurately is like walking through a minefield - take the wrong steps and you blast wrong information off to a multitude of unsuspecting people, most of whom know little about the subject.

When Prime Minister Anwar Ibrahim said unequivocally that debt has been reduced, as he did in a Bernama report quoting him in an X video, he was undoubtedly wrong.

What has been achieved during his tenure as prime minister is a small reduction in the rate of debt increase.

Instead of increasing by so many billions, it increased by a smaller amount. But the total debt is still increasing albeit at a smaller rate. The situation is better but it is not the same as reducing debt - debt is still inexorably increasing.

What is clear is that the fiscal deficit, the government budget deficit, as a percentage of gross domestic product or GDP (the sum of goods and services produced in the economy), has reduced.

The fiscal deficit is a rough measure among finance people of whether the government may be spending beyond its means. A sustained deficit means the government is spending beyond its means too much, an indication of future problems.

Lower increase

Let’s take debt first. In this case, we are talking about debt the federal government is directly responsible for, the figure which is reported to international bodies such as the International Monetary Fund or IMF.

It excludes contingent liabilities which are things like implicit and explicit guarantees that the federal government has given to others, such as guarantees it made for 1MDB for borrowings and other government corporations such as Petronas, and Khazanah Nasional, among others.

For most reporting purposes national debt is stated excluding contingent liabilities, some of which may however still crystallise in the event of default, such as the 1MDB debt, while others may not, such as Petronas and Khazanah debts.

Anwar mentioned that Malaysia’s debt is between RM1 trillion and RM1.5 trillion. What he probably meant was that the higher figure was if you included contingent liabilities. But unfortunately, that was not made clear.

He was quoted as having said in 2021 and 2022 the nation’s debt reached RM100 billion in each year - that can’t be true. What he must have meant was that the debt increased by RM100 billion a year.

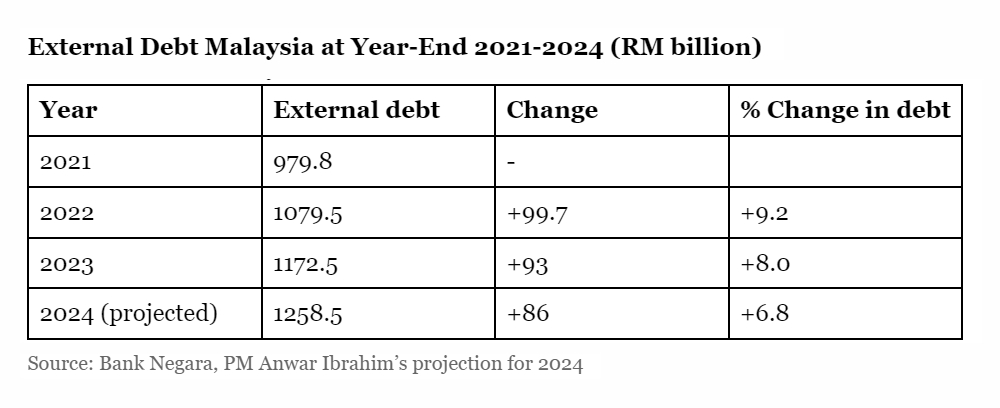

The increase was reduced to RM93 billion in 2023, and it will decline to an increase of RM86 billion this year, according to Anwar.

Rising debt

The point to note is that debt still increased - only the rate of increase decreased. So between 2022 and 2024, over two years, the rate of increase of the debt was reduced from RM100 billion to RM86 billion a year, a reduction of the increase of RM14 billion.

The overall debt is not decreasing but increasing at a reduced rate of RM86 billion a year.

This is clearly borne out by the central bank, Bank Negara Malaysia, in its report for the first quarter of 2024. Anwar came to power in November 2022. The table shows the national debt and its changes from 2021 to 2024. The historical figures match those that Anwar has given.

Of note is the last column which measures the change in the debt level. That is still increasing at a rate of between 6.8 percent and 9.2 percent, which means the debt is still going up, as shown in the first column.

Anwar also stated: “The debt level is high and now stands at 64 percent of GDP. Our target is to reduce it in stages to at least 60 percent.”

He added the national fiscal deficit has been lowered to five percent of GDP in 2023 from 5.6 percent in 2022, and this year it is projected to be reduced to 4.3 percent.

“I present these figures, which are truthful. The Finance Ministry, along with the Statistics Department, release such data from time to time,” he added.

That’s all fine and good. But to take credit for a debt reduction when there was none, and in a situation where debt is increasing, is not acceptable. He should take care to state the situation clearly and without possible misinterpretation.

Leave it to the experts

This task of releasing as well as explaining these figures should be left to the experts who understand them and can interpret them properly for the public without confusion and misinformation.

There are such experts in the Finance Ministry and the Statistics Department. Politicians often have no grasp of these matters.

Also, Anwar was remiss when he did not explain that debt increased rapidly after 2020 because of the onset of Covid-19 and the subsequent serious contraction of the economy - a worldwide impact.

Like the rest of the world, Malaysia had to borrow to spend money to ameliorate the pandemic’s effects and stimulate the economy.

Now that Covid-19 is well behind us, surely Anwar and his Madani government can’t take credit for a slowing in the growth of debt.

In fact, one can ask if the rate of growth of debt could have been checked even more than it was. - Mkini

P GUNASEGARAM agrees that too little knowledge is a dangerous thing which is why all governments rely on experts in specialised areas.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.