So far two federal ministers have made comments on the value of Malaysian Ringgit. The first was by Minister of International Trade and Industry Datuk Seri Mustapa Mohamed who said a weaker ringgit will benefit Malaysia in terms of boosting exports and foreign investments. The second comment was made by Tourism and Culture Minister Datuk Seri Mohamed Nazri Abdul Aziz who said the drop in the value of Malaysian ringgit is a blessing in disguise for the tourism industry as it would see an increase in tourist arrivals to the country and encourage more Malaysians to spend at home.

I wish managing the Malaysian economy, particularly on the value of ringgit and the cost of living, are as easy as what our two ministers have said. Ringgit depreciation is good for us because it helps our export, encourage capital inflows and discourage Malaysians spending abroad. What an eloquent answer to the problems we face. The point is why we didn’t think of this earlier, i.e. depreciate our ringgit earlier to get the perceived benefits.

Deliberate devaluation or not - this is how the market will perceive the issue

I am surprised why mainstream economists have not commented on what the two ministers have said so far. Surely the depreciation of our ringgit is not deliberately done by policy design, i.e. the Malaysian government has done so on purpose.

Under political pressure over the 1MDB financial debacle, Najib has blamed ex-premier Mahathir for 'creating' Malaysia's political crisis

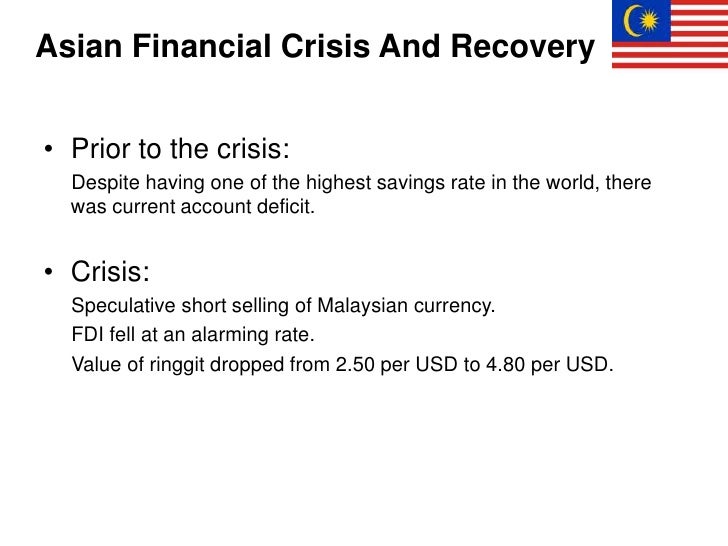

During the 1997 Asian Financial Crisis, Malaysia was forced for peg the ringgit & impose capital controls to stop a massive flight of capital

Whether we like it or not, the value of ringgit and the cost of living are the manifestation of many underlying factors. We surely can’t ignore economic fundamentals and the general confidence the people place on the economy.

Export competitiveness is not based on the value of the currency alone. If that is the case, countries with appreciating currencies like Singapore would find hard to export. On the contrary, countries with depreciating currencies like Malaysia would have to work doubly hard just to get the same amount of foreign exchange. What an irony; are we willing to work more for less?

Depreciating ringgit would also make our imports more expensive which in turn would affect our cost of living, increase input costs and erode our exports competitiveness. As we know, Malaysia is a trading nation with exports and imports accounting for twice the size of our GDP.

We must realise that ringgit depreciation and its subsequent increase in cost of living is a form of “nationalisation” of people’s savings. It diminishes the value of our savings and impoverishes us each time we want to go abroad.

Simpletons for ministers

I think the two ministers must be reminded that things are not as simple as they have made out to be. In fact, their views have inadvertently diverted/evaded the fundamental issues that the country must focus on. To them it is alright, in fact advantageous, to have depreciating currency and high cost of living without going deeper into the real causes.

Some have argued that the forex market has overacted, i.e. the ringgit is now lower than what the fundamentals would suggest. But to me it is harmless to be on the cautious side. Even market behaviour needs “reasons and excuses” to react the way it does.

There are many fundamental factors we must look into.

Datuk Seri Mustapa Mohamed

Nazri Abdul Aziz

Competitive factors other than value of ringgit, such as productivity, efficiency, and niches, should not be ignored.

Sustainability factors such as the fall of oil related revenues and our inability to rein in committed expenditure is another issue.

Confidence factors such as capital inflows and outflows are also important. While foreigners have an important role to play in confidence factors, ultimately, it is how we Malaysians look at our own country. We read in many occasions repeated illicit outflows of funds from Malaysia carried out by Malaysians. We read too the indebtedness of Malaysia and the massive borrowing incurred by GLCs.

I think it is time we look at the fundamentals. Wishing away our problems is not going to help. Worse still, giving our problems the positive spin is going to lull us into complacency. - MAILBAG

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.