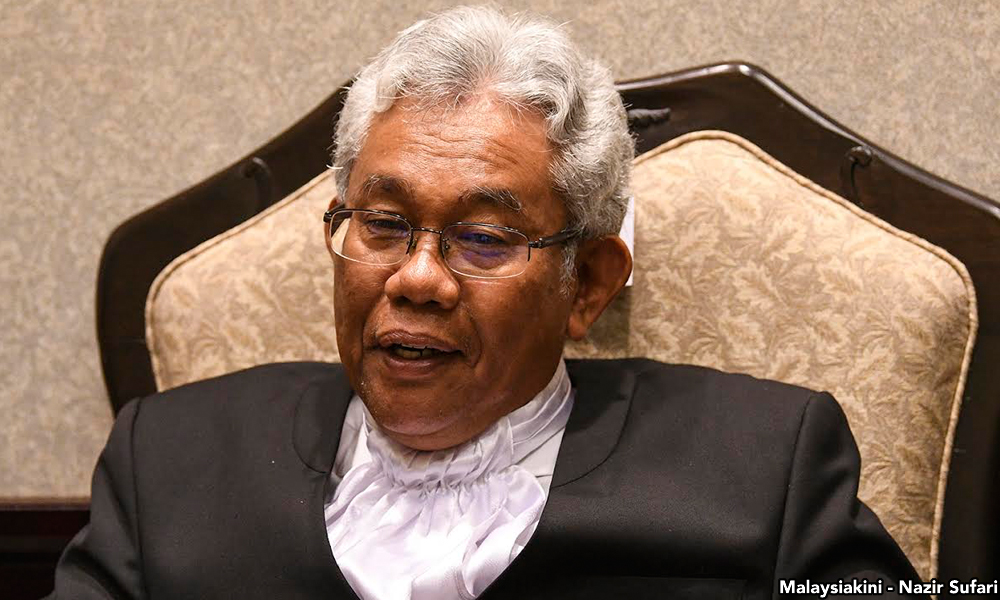

Menyifatkan pembentangan laporan di hari terakhir Dewan Rakyat sebagai 'memalukan', Mohamed Haniff Khatri Abdullah berkata bahan yang dirujuk dalam prosiding RCI tidak memenuhi aras kepercayaan di sisi undang-undang.

fPETALING JAYA: Peguam Tun Dr Mahathir Mohamad menyifatkan pembentangan laporan Suruhanjaya Siasatan Diraja tentang kerugian urus niaga mata wang asing di hari terakhir sidang Dewan Rakyat sebagai “memalukan”.

fPETALING JAYA: Peguam Tun Dr Mahathir Mohamad menyifatkan pembentangan laporan Suruhanjaya Siasatan Diraja tentang kerugian urus niaga mata wang asing di hari terakhir sidang Dewan Rakyat sebagai “memalukan”.

Mohamed Haniff Khatri Abdulla menyifatkan kerajaan melakukan “serangan hendap” kerana tiada notis diberikan kepada orang awam, tidak seperti keriuhan apabila penubuhan RCI diumumkan pada Julai.

Beliau berkata salinan laporan itu tidak diserahkan kepada anak guamnya, walaupun Dr Mahathir dikenalpasti sebagai pihak berkepentingan oleh RCI itu.

“Sama sekali tiada perasaan hormat atau budi bahasa, seperti yang boleh dijangka daripada kerajaan (Perdana Menteri) Najib Razak,” katanya dalam kenyataan.

Haniff hairan laporan itu ada membuat rujukan kepada dakwaan pecah amanah, sedangkan hakikatnya sifat bahan yang dirujuk oleh RCI itu tidak memenuhi dan tidak mencukupi untuk membuat kesimpulan itu.

Beliau berkata pasukan undang-undangnya akan mengulas penemuan itu secara menyeluruh selepas ia dikaji dengan teliti dan dibincangkan dengan Dr Mahathir.

Haniff berkata sifat bahan yang dirujuk dalam prosiding RCI itu berdasarkan khabar angin, dugaan, andaian dan anggapan yang tidak memenuhi aras kepercayaan yang boleh diterima di sisi undang-undang.

“Apa lagi apabila prosiding RCI dijalankan dengan menggunakan ‘undang-undang hutan’ dan ‘peraturan sarkas’, tidak akan mengejutkan jika penemuan itu tidak memenuhi tahap ‘produk pra-tadika’,” katanya.

RCI bersidang selama 8 hari dari 21 Ogos dan selesai pada 19 September selepas memanggil 25 saksi.

Empat puluh dua dokumen diserahkan di prosiding itu.

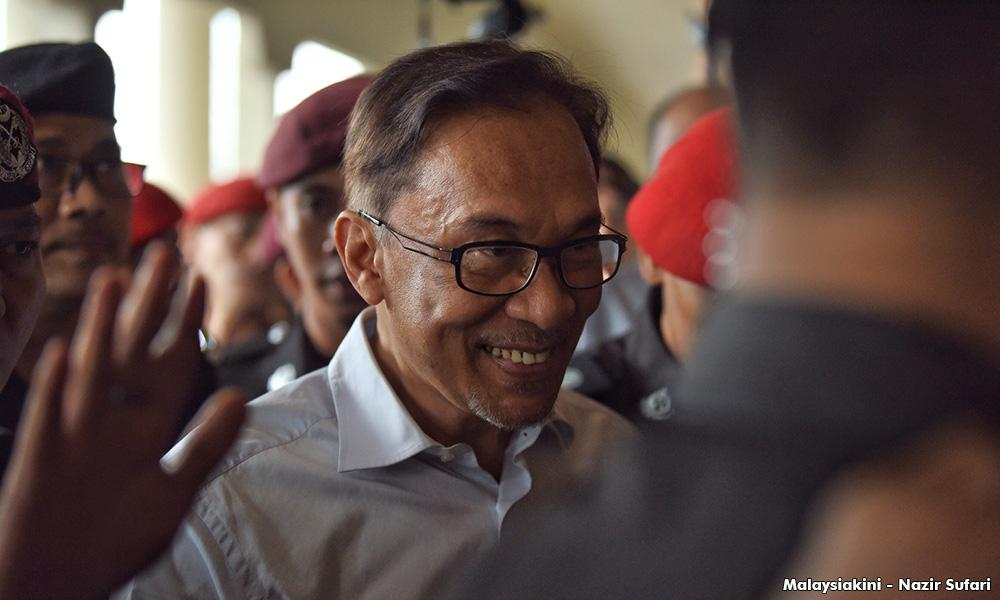

Antara saksi yang dipanggil adalah Dr Mahathir, bekas timbalan perdana menteri Datuk Seri Anwar Ibrahim, bekas gabenor Bank Negara Malaysia Tan Sri Zeti Akhtar Aziz, bekas penasihat BNM Nor Mohamed Yakcop dan bekas menteri kewangan Tun Daim Zainuddin.

Laporan 400 halaman itu diserahkan kepada Yang di-Pertuan Agong pada 13 Oktober. -FMT