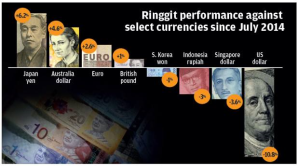

The weakening ringgit appears to have investors scared, with the currency hitting a 9-year low of 3.77 against the US dollar on Monday. But are investor concerns warranted, or simply overdone? Tiger examines the matter in greater detail.

On Monday, the ringgit hit a 9-year low, the lowest level since January 2006, according to aBloomberg report on the same day. Yesterday, the ringgit closed at 3.7525 against the US dollar, with some analysts reportedly saying this was merely a technical correction. Additionally, data from Bloomberg showed that the ringgit had fallen to as low as 3.76 to the US dollar.

READ THIS:

Market talk says that the ringgit would break the 3.8 level today. At the time of writing, this hasn’t happened yet and Tiger doesn’t think it will last even if it does. Even if it does, it is not a disaster unless there are fundamental reasons for the ringgit weakness. In the long-term, the currency performance is tied to economic fundamentals, and the fundamentals are still strong.

In fact soon after the Bloomberg report, there was another one from the same agency which said that the ringgit was the best performing currency in the immediately preceding two weeks! That simply indicates how volatile conditions are in the currency market now.

An economist Tiger spoke to said that increased volatility and downward pressure on the ringgit is expected preceding the meeting by the US Federal Reserve next week. Other economists have noted in previous media reports that investors have been selling the ringgit in anticipation of an increase in interest rates by the Fed, which could very well be true as interest rates do tend to influence currency movements.

It is also worth remembering that the ringgit is a managed float currency, which means that its exchange rate is allowed to appreciate and conversely, depreciate against other currencies according to market conditions. With a managed float currency, the central bank intervenes when necessary to stabilise the currency. As the economist pointed out to Tiger, it is not unusual for the current weak condition of the ringgit as the greenback has also been strengthening against other currencies of late.

There are also other short-term concerns such as uncertainty over 1Malaysia Development Bhd or 1MDB but this would have already been pretty much discounted and is probably already in the equation unless there are unexpected developments here. Also, the issue has taken a political dimension with pressure on the prime minister to step down which adds to uncertainty.

Meantime, there is the overhang of a possible downgrade on Malaysia’s sovereign rating by international rating agency Fitch which has said that there is even chance of it downgrading Malaysia. Again this has been in the market for a while and is possibly discounted.

But back to economic fundamentals. Economists have pointed out that the country’s 2015 gross domestic product forecast of 5.5% is healthy and that investor reactions towards falling crude oil prices have already been priced in. In fact the subsequent recovery from the earlier huge fall in oil prices was said to be positive for the ringgit as it will reduce pressures on the trade account. They have said that the investor selldown of the ringgit has been sentiment-driven as opposed to motivated by a drastic change in fundamentals.

According to a forex strategist from AmBank, the ringgit is falling due to positive economic data from the US and timing over the hiking of interest rates there following the easing of liquidity injection there. He also said that “increasing political noise over the sensational development in 1MDB, risk of fiscal slippage and threat of a sovereign rating downgrade by Fitch Ratings have caused the sell-off of the ringgit as well.”

To illustrate the strength of the fundamentals, let’s take a look at Bank Negara Malaysia (BNM)’s foreign exchange reserves. When forex reserves decrease, it signifies an outflow of funds. If you look at the graph below, the country’s forex reserves have been on the rise from 1997 to 2013, except for dips during the 1997/1998 Asian financial crisis and the 2007-2009 period, which coincides with the global financial crisis.

In fact, data from the BNM website show that the forex reserves as of May 29th this year are RM394.3 billion, unchanged from the RM393.4 billion in the fourth quarter of 2014. As economists have noted in the past, the amount of forex reserves is sufficient to absorb foreign outflows in the short-term and since the country’s current account remains in surplus, there’s every chance that the experts are right about the ringgit selldown being sentiment-driven.

The current account is the balance of trade between a country and its trading partners, including all payments between countries for goods, services, interest and dividends. A current account surplus is a positive thing for the long-term outlook for the ringgit because it implies that a country is a large exporter and has a positive balance from inflows and outflows of trade and service.

The balance of payment includes the current account plus outflows of capital, both long-term and short-term. What is happening right now is that short-term portfolio outflows have been high in recent weeks. These outflows tend to weaken the ringgit because ringgit funds are converted, into other currencies, mainly the US dollar. But unless the outflows are sustained, the pressure on the ringgit eases off after some time.

BNM data show that the current account balance was RM9.968 billion for the first quarter of this year, versus RM5.666 billion for the immediately preceding quarter – the last quarter of 2014. That indicates that the trade and services account has actually done better during the period, recording a surplus which is substantially higher.

What’s happening with the ringgit now is essentially volatility, due to the factors mentioned above and this too, shall pass. Experts have said that the volatility is short-term due to portfolio outflows, hence once sentiment improves and outflows normalise, the fundamentals shall prevail.

But until the interest rate position in the US becomes clearer, one should expect volatility of not only the ringgit but all other currencies as well in the coming months. That does not necessarily indicate a fundamental change in the economic position.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.