PARLIAMENT | BN lawmaker Tajuddin Abdul Rahman is one of the fiercest government critics on the opposition bench. But he offered no defence when Economic Affairs Minister Azmin Ali sank his talons into former premier Najib Abdul Razak today for putting US$505.4 million (RM2.07 billion) of Felda funds at risk in the Eagle High deal.

On the contrary, the Pasir Salak MP claimed that he, too, was suspicious when the deal was inked.

"With regard to Eagle High, I had raised that we must be cautious at the time.

"Personally, I smelled (a) rat. I smelled (a) rat. I was against it,” he told the Dewan Rakyat much to the surprise of those on the government bench.

Tajuddin said he was suspicious of Indonesia's Eagle High Plantations' books and called for an investigation.

"Many of its lands are actually empty and has no plantations," he added.

Tajuddin said although he had expressed concern over the matter, the Umno man, however, indicated that he was unable to fight the prime minister at the time.

"Don't accuse us of being silent. We did speak up but...," he trailed off and shrugged.

"It is the same, like Langkawi (Prime Minister Dr Mahathir Mohamad). You can talk, but in the end, the decision is made by Langkawi.

"You should get what I mean," he added.

Azmin: Dr M and Najib like 'heaven and earth'

However, Azmin ticked off Tajuddin, stating he should not compare Najib to Mahathir, describing the difference between the two as "heaven and earth".

"I'm not comparing, what I mean is the system... In a group, the leader decides," Tajuddin replied.

Najib was absent from the Dewan Rakyat due to a court case he had to attend at the Kuala Lumpur High Court.

Azmin was delivering his winding-up speech after the tabling of a White Paper on Felda in the Dewan Rakyat.

Felda paid US$505.4 million to Rajawali Capital International to buy a 37 percent stake in Eagle High Plantations, even though it was only worth US$115.2 million) (RM473 million) in the open market when the decision was made in December 2015.

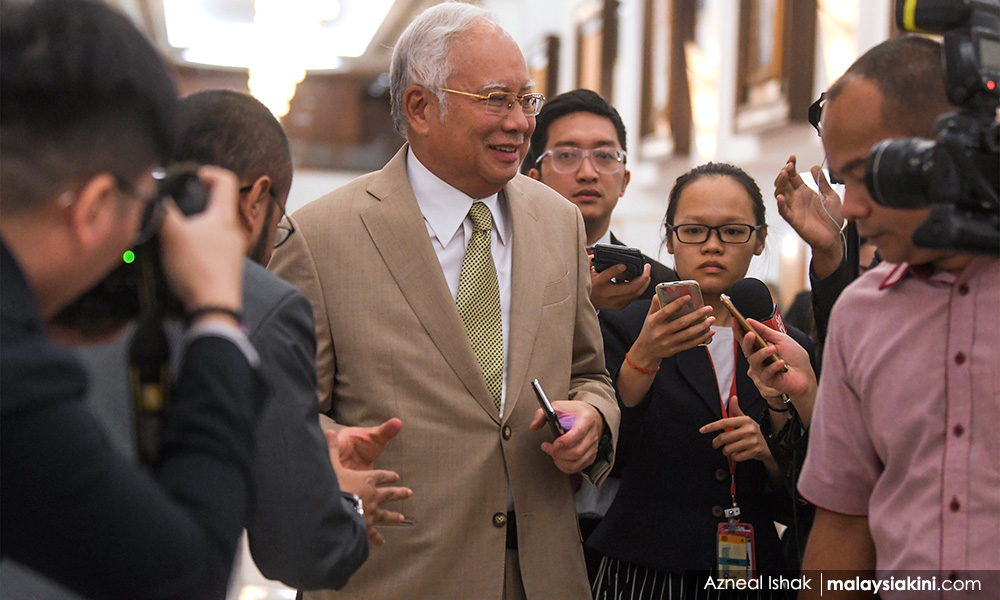

Najib (photo) had defended the deal, stating that the “put option” meant that Felda can regain the full investment on top of a return of six percent per annum, regardless of the share price.

However, Azmin pointed out that Felda had exercised the “put option,” but was facing a hard time regaining the US$505.4 million as Rajawali is now fighting the move.

Furthermore, the minister said Rajawali might not have the capability to repay the sum since it only had a nett tangible asset of US$7.2 million (RM29.6 million) in 2014.

"If the nett tangible asset of Rajawali in 2014 is only US$7.2 million, how is it going to repurchase Eagle High from Felda for US$505.4 million?" he asked.

Rajawali is linked to Indonesian tycoon Peter Sondakh, who is said to be a close associate of Najib.

No credit risk evaluation

According to the Felda White Paper tabled in the Dewan Rakyat today, the “put option” allows Felda to redeem the full investment plus return of six percent per annum in the fifth year.

The deal was signed on Dec 26, 2016, meaning that it has been less than three years.

However, the White Paper said Felda can still trigger an early “put option” if Eagle High fails to comply with its obligations in the Roundtable on Sustainable Oil Palm (RSPO) requirements, fails to get its RSPO within two years, commits a material breach or is involved in judicial proceedings relating to liquidation, insolvency, composition or reorganisation.

To date, Eagle High has yet to secure its RSPO certification.

The White Paper also criticised Felda for not conducting a credit risk evaluation on Rajawali, which it referred to as "Company A1" to ensure that it is able to repay Felda if the “put option” is exercised.

"There is no evidence to show the management and Felda board conducted due diligence or credit evaluation for 2016 on Company A1 to ensure that Company A1 is capable of returning the value of the investment through the 'put option'," it said.

Yesterday, Najib shared parts of the Felda White Paper before it was tabled in the Dewan Rakyat, highlighting its acknowledgement of the “put option”.

"With the 'put option', if we do not wish to proceed with the investment, we can reclaim all our money including interest of six percent per annum.

"It does not matter how much the share price is worth because our profit is guaranteed.

"Therefore, the rakyat's money is safeguarded and we will not suffer losses - this also proves that Harapan's claim that Felda suffered loses from buying into Eagle High is slander," he said. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.