Putrajaya can now breathe a sigh of relief after it received a US$126 million (RM514 million) offer for the superyacht Equanimity, a figure only US$4 million shy of the minimum price it was seeking.

The Pakatan Harapan led government had embarked last year on an attempt to recover and dispose of assets allegedly acquired using stolen 1MDB funds.

However, it risked embarrassment with the superyacht commissioned by businessperson Low Taek Jho, purportedly using money diverted from the state fund.

Having received Indonesia's help in seizing the vessel, Putrajaya found itself with a problem. It cost around RM2 million a month to maintain the superyacht, which had been docked at Port Klang, before being moved to off the coast of Langkawi for viewing by a niche group of buyers.

After arriving in Malaysia in August, the superyacht attracted interest from the super-rich across the globe, whom perhaps expected a firesale due to Putrajaya's urgent need to dispose of the vessel.

The Genting Group's US$126 million offer put those concerns to rest. The current value of the vessel is unclear, considering depreciation and repair cost, but Low was believed to have spent around US$250 million when he commissioned the building of Equanimity in 2014.

Genting's emergence at the tail-end of the 1MDB scandal is not the first time it has crossed paths with the state fund. The conglomerate was also involved with 1MDB in its early days, when the alleged misappropriation at the state-owned company was not yet apparent.

1MDB’s purchase of Genting power assets

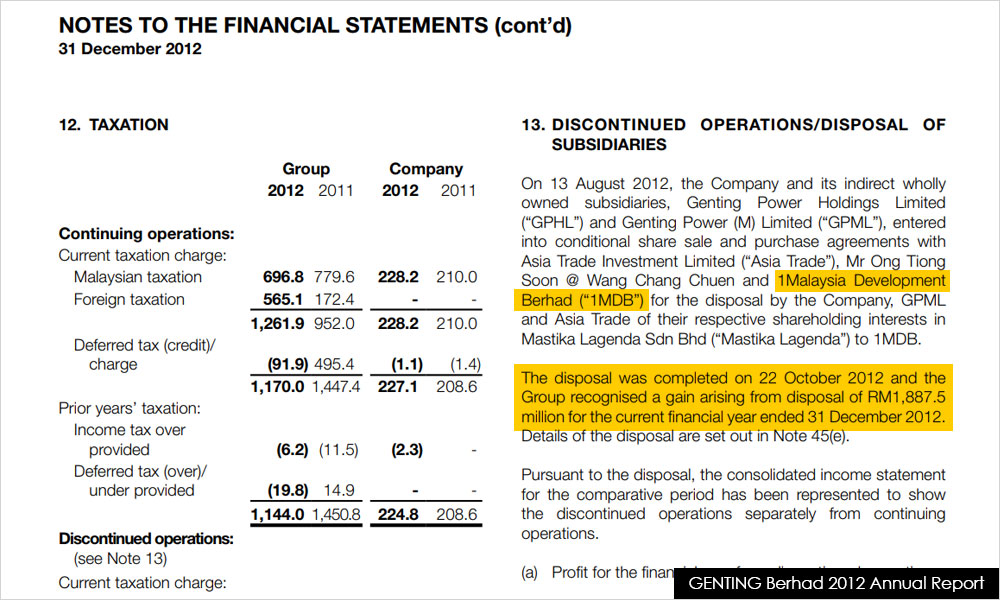

In March 2012, news began to emerge that 1MDB was buying Genting's power assets in Kuala Langat, Selangor, for RM2.34 billion, despite its concession nearing expiry.

One analyst was quoted by business daily The Malaysian Reserve as saying that 1MDB's purchase was "overpriced by a mile", pointing out that the sum was enough to build a brand-new power plant.

Genting, in its 2012 annual report, recognised a gain of RM1.89 billion from the sale, meaning that it had previously only valued the power assets at RM400 million.

The opposition at the time raised questions about the peculiar deal, but it fell on deaf ears.

After the deal, Genting and its subsidiaries made an unprecedented "corporate social responsibility" donation of RM190 million in 2013, which had an impact on the group's profits.

Donations used for GE13

It was unclear to whom Genting had donated the funds to, but at least RM35 million went to a company named Yayasan Gemilang 1Malaysia, according to RHB Research Institute in a note on May 30, 2013.

Little was known about the entity at the time, which was set up in January 2013, four months before the 13th general election.

Yayasan Gemilang 1Malaysia described itself as an entity to "receive donations and provide assistance in the areas of education, sports, culture and others". One of its directors was then prime minister Najib Abdul Razak.

There were speculations that the donations were related to the general election, but the link was never clearly established at the time because Yayasan Gemilang 1Malaysia changed its name to Yayasan Rakyat 1Malaysia after receiving the donation.

So while Yayasan Rakyat 1Malaysia was mentioned publicly during the 13th general election, including Najib’s announcement that it would donate RM2 million to schools in Penang, the name Yayasan Gemilang 1Malaysia never appeared in the public sphere.

Yayasan Rakyat 1Malaysia was believed to have also received money from Ananda Krishnan's Tanjong Energy Holdings Sdn Bhd after the latter sold its power assets in a similar fashion to 1MDB for RM8.5 billion in March 2012.

It is unclear if Yayasan Rakyat 1Malaysia also received "donations" from other sources. However, the company, described as 1MDB's charity arm, is now the subject of scrutiny in Najib’s money laundering trial involving former 1MDB subsidiary SRC International.

The prosecution, during the first day of Najib's trial yesterday, had requested for more information on the company from the Companies Commission of Malaysia.

The allegedly overpriced purchase of Genting's power plant, followed by a handsome donation to a political slush fund, may have raised alarm bells. Nevertheless, the story does not end there.

‘Diverted’ funds

Behind the scenes, Genting was unwittingly being drawn into something more sinister.

1MDB had used the Genting and Tanjong deals as a premise to raise two bonds totalling US$3.5 billion. The bonds were arranged by Goldman Sachs in order to fund the deals. Incidentally, Goldman is the same company 1MDB said produced the "independent valuation" for Genting's power assets.

The Auditor-General's Report on 1MDB, which was declassified following the collapse of Najib's government in the 14th general election last year, had questioned Goldman's valuation method.

The Auditor-General's Department noted that Goldman's enterprise value for the Genting power assets of RM2.56 billion to RM2.64 billion had included a terminal value of RM1.16 billion.

"The terminal value for the power plant should not have been considered in the calculation of enterprise value, as the asset no longer has value at the expiry of the concession period," it said.

After 1MDB raised the two bonds totalling US$3.5 billion, only a portion of it went towards paying Genting and Tanjong for the allegedly overpriced power assets.

The remaining sum of US$1.367 billion was purportedly diverted and misappropriated. It came to be known as the Aabar-BVI phase, one of four phases in which at least US$4.5 billion was allegedly stolen from 1MDB, according to the US Department of Justice.

Coming full circle

In 2012, 1MDB's purchase of Genting's power assets was paid through 1MDB Energy (Langat) Limited, whose parent company is 1MDB Energy Holdings Limited.

Ironically, with the Equanimity purchase seven years later, Genting will deal with 1MDB Energy once again. This time, however, the conglomerate will be the one forking the money.

1MDB Energy, together with its sister company 1MDB Global Investment Limited and parent 1MDB were the entities that applied to the courts to sell the seized superyacht.

Yachts are not alien to Genting as its Resorts World Bimini in the Bahamas hosts the largest yacht and marina complex in that country.

Genting, in an announcement to Bursa Malaysia yesterday, confirmed it made the offer to purchase The Equanimity on March 28. The sale is expected to be finalised at the end of April.

It said the superyacht will allow Genting to "differentiate itself from its competitors and provide Genting with a unique and competitive edge for its premium customers business". - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.