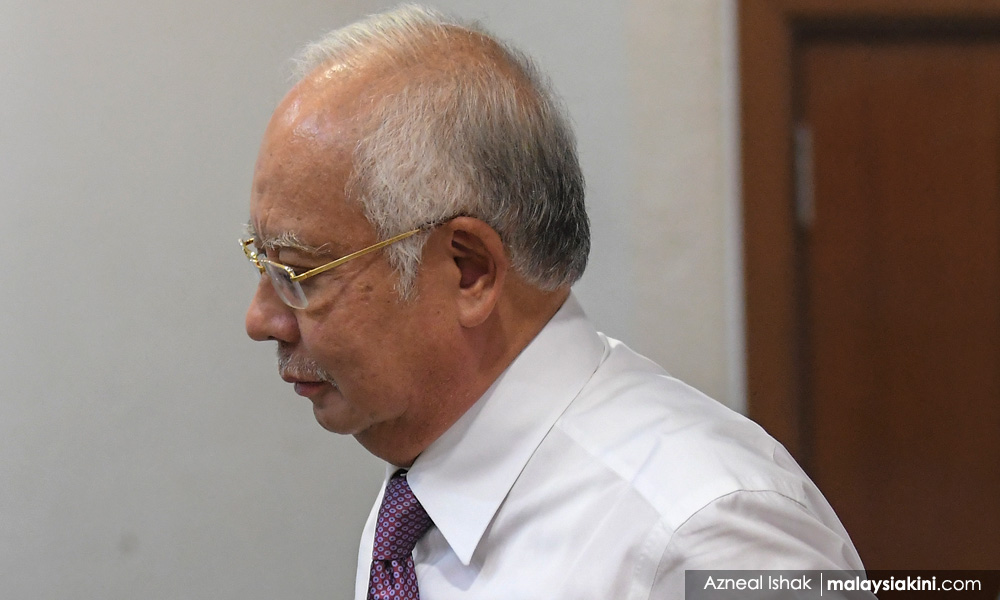

NAJIB TRIAL | Najib Abdul Razak has claimed he will secure a favourable outcome in his appeal to re-assess the over RM1.69 billion in tax he owes because it the sum is largely computed from donations from the Middle East.

This was among the reasons cited by the former prime minister in his affidavit-in- support of his application to stay the RM1.69 billion tax suit against him.

The stay application and the affidavit-in-support were filed at the Kuala Lumpur High Court Registry yesterday.

According to the affidavit sighted by Malaysiakini, the former finance minister claimed that this error in tax-computation by the government would favour his appeal against the assessment by the Inland Revenue Board (IRB).

"I am advised by my solicitors and verily believe that my appeals to the (IRB's) Dispute Resolution Department and/or Special Commissioner of Income Tax would yield a positive result due to the fact that the plaintiff (the government) has erred in their tax computation in arriving at such a colossal amount of RM1,692,872,924.83 tax payable as for the said funds the computation is derived from a donation and not within the meaning of 'income' as defined in Section 3 and 4 of the Income Tax Act 1967," Najib said in the affidavit.

“It is important to note that I have categorically declared that to the best of my knowledge the funds that were deposited in my AmBank accounts were donation monies and not income,” he said.

“I also wish to state that a significant amount of the assessments raised on me that were deposited into my account, can be directly traced as donations from the Middle East,” he said.

The former BN chairperson claimed that the government had also grossly miscalculated his total undeclared income for the years of assessment 2011 to 2017 as RM3,889,427,867, due to the following reasons:

a. There is a refund of a donation received amounting to 2,034,350,000 that was unaccounted for;

b. The inter-bank account fund transfer of RM251,333,116 was treated as duplicate income;

c. That the net total donations received and fully disbursed out was only RM1,344,602,070; and

d. That the dividend received from AmBank as hibah amounting to RM25,045,793 was fully utilised for political and corporate social responsibility purposes.

He claimed that as a result of these special circumstances, the assessments against him was unsustainable and ought to be realised in the assessment appeal to the IRB.

The former Umno president said the stay of the tax suit should be granted as any successful appeal with the IRB would be rendered nugatory by a refusal to stay the proceedings.

“This is especially when the total amount claimed by the plaintiff will indeed cause colossal financial damage and the risk of the defendant (Najib) of losing his qualification as a member of Parliament (of Pekan) by virtue of bankruptcy (enforcement) proceedings likely to be imminent,” Najib said.

He alleged that he would not be able to pay the astronomical sum of over RM1.69 billion with his only source of income, which is his current allowance of RM25,700 as the Pekan MP.

He also said his savings he gathered from the income he used to receive as the then prime minister would also not be enough to cover the sum.

“It should also be noted that the majority of the sums that have been taxed against me are a donation made to me for political and corporate social responsibility purposes. Furthermore, the entire sums were utilised for political and corporate social responsibility purposes

“Subsequently, the remainder of the said funds were returned to its sender. Therefore, I do not retain any of that from the donation received subject matter of a majority of the taxable sums,” Najib said in backing his claim that the tax suit could cause irreparable damage to him.

Najib said that any stay allowed on the tax suit would not prejudice the government as he is currently barred from leaving the country, therefore there was no risk of him absconding from making payment.

It is understood that a certificate of urgency was also filed with the stay application yesterday to seek an early hearing date for the application.

When met at the Kuala Lumpur Courts Complex today, Najib’s lawyer Muhammad Farhan Muhammad Shafee confirmed the stay application had been filed.

On July 25, Farhan was reported saying that his client would be filing a stay of the tax suit pending an appeal on the tax assessment with the IRB. He also said the government would seek to file an application to dispose of the tax suit via summary judgment.

Under civil law, summary judgment is a mode of disposing of legal action without going for a full trial, in very clear cases where the defendant has no defence against the claim.

On June 25, the government through IRB filed the suit against Najib seeking him to pay a total of RM1,692,872,924.83, with interest at five percent a year from the date of judgment, as well as cost and other relief deemed fit by the court.

In its statement of claim, the government said, additional tax assessments on Najib’s income for the assessment years of 2011, 2012, 2013, 2014, 2015, 2016 and 2017 were RM116,173,374.12; RM320,929,932.31; RM891,573,465.46; RM119,144,655.51; RM16,879,500.03; RM643,445.21 and RM346,471.41 respectively.

It said that since Najib failed to pay the taxes within the stipulated 30-day period as required under Section 103 of the Income Tax Act 1967, the amount was increased by 10 percent, amounting to RM11,617,337.41; RM32,092,993.23; RM89,157,346.54; RM11,914,465.55; RM1,687,950.00; RM64,344.52 and RM34,647.14 for the assessment years from 2011 to 2017, respectively.

It also said that Najib was given 60 days to pay the taxes, together with the 10 percent increase, but still failed to do so.

Following which, Najib was slapped with another five percent increase on the 10 percent hike, amounting to RM6,389,535.57; RM17,651,146.27; RM49,036,540.60; RM6,552,956.05; RM928,372.50; RM35,389.48 and RM19,055.92 for the stipulated assessment years, bringing the total amount of income tax due to RM1,692,872,924.83.

The tax suit will come up for further case management at the High Court on Aug 30. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.