This question is particularly pertinent in the case of government-linked company (GLC) Sapura Energy with news reports saying that an imminent bailout of the company is being contemplated by the Finance Ministry with an assistance package and a possible grant.

The answer to that question is rarely, if ever. If the failure of a company does not cause a systemic failure - that is, a considerable knock-on effect which will cause other collapses throughout the system - then it is best to leave it entirely to commercial considerations.

For instance, in a large bank failure, without a concerted intervention to enable it to meet business obligations, cross defaults can happen which can cause far more damage to the financial system than the rescue of the bank in question.

Typically, the shareholders are not saved but the business is via a new injection of funds. Turnaround occurs fairly rapidly with a change in management because the basic business is very viable, after provision for losses from unfortunate encounters.

The other instance is when a business is allowed to continue to operate despite losses because it is in the national interest for the business to do so. Such reasons are often specious because it is usually not possible to assess accurately the impact of such a business on the broader economy.

Part of the reason for repeatedly bailing out Malaysia Airlines (MAS), where probably over RM20 billion of public money has been spent, is this national interest factor. But in this case, the latest rescue plan itself was flawed through too drastic a cut in operations and coverage which benefited neither the airline nor the national interest. This set the airline back many years.

In the case of Sapura Energy (now 40 percent owned by Permodalan Nasional Bhd or PNB which is in the driver’s seat), reported to be the largest integrated oil and gas field services provider in Malaysia and the second largest in the world, one has to tread with considerable caution.

Despite loss of jobs, it won’t cause a systemic failure and the national interest is not served - there are many others who can provide the same services, including bumiputera companies.

But first what constitutes a bailout? Investment website Investopedia has a good definition: A bailout is an injection of money from a business, individual, or government into a failing company to prevent its demise and the ensuing consequences.

Note the words “failing company”. To that, I would add another condition - saving the original shareholder without being rewarded sufficiently for the risk.

Helping companies during Covid-19 via a grant is a bailout, although a desirable one. So are loans on favourable terms. Saving the shareholder is a bailout, saving the business is not if there are commercial reasons for that.

Two things to consider: First, does the company’s business have a good chance of being turned around? And second, are the providers of funds being adequately rewarded for risk? A grant is a bailout, a soft loan is a bailout, but a commercially-priced loan which can be converted into equity at a reasonable price may give some reward for risks taken and therefore be acceptable.

So if the report is true that the Finance Ministry is considering an assistance package/grant, it is a bailout - no doubt about that. Should it be bailed out? No, because Sapura Energy’s failure poses no major systemic risk and there is no national interest to protect.

But former PM Najib Razak seems to think it should be bailed out because it is a bumiputera company. That’s a bad reason to do so. The only reason it should be saved is for commercial reasons, that is, there is a good chance for a turnaround. Otherwise, it will continue to bleed and cause even more losses. It will need to be shut down anyway. What’s the point?

Najib is clearly playing politics and throwing the bumiputera trump card to try and bolster his own standing within the community after being badly battered by his association with the 1MDB scandal, the worst financial and kleptocratic scandal the world has ever known.

Rescue attempt?

Now, does Sapura Energy have a case for a rescue attempt, not a bailout? Perhaps.

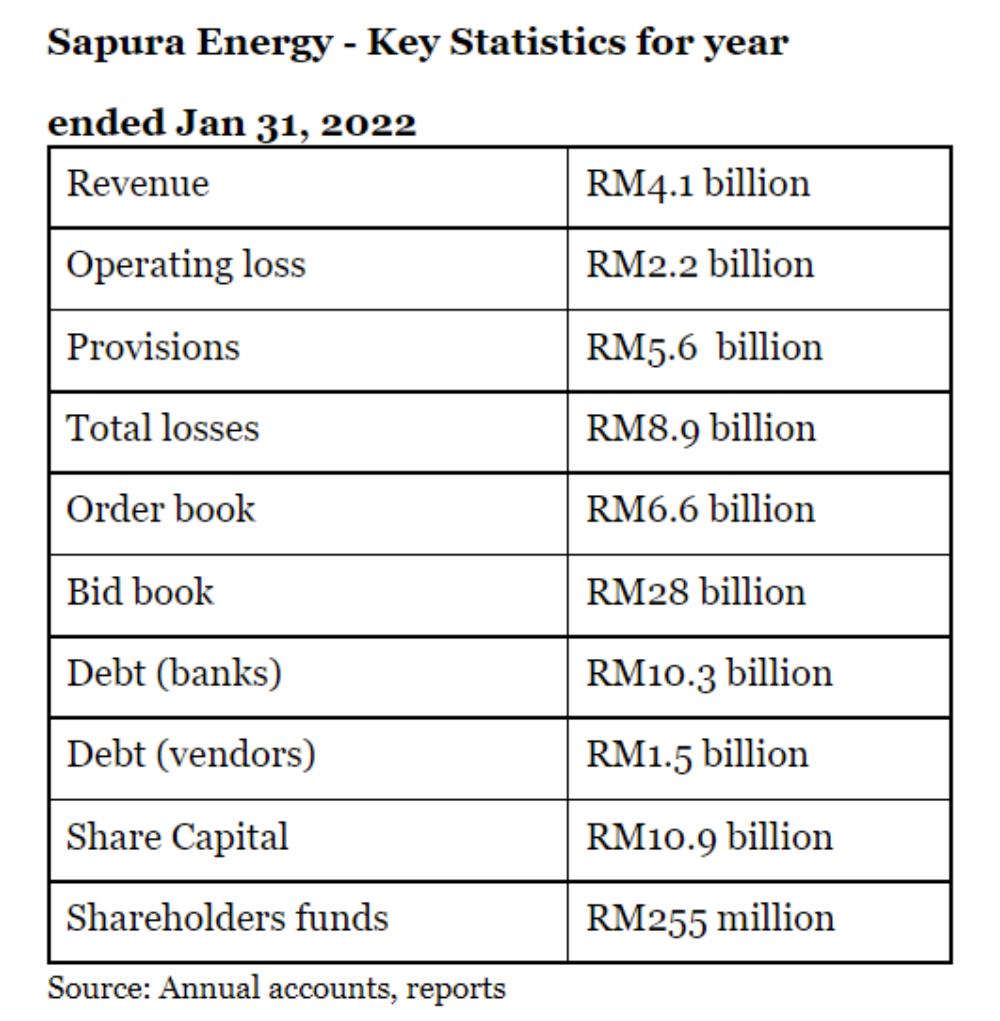

Reportedly, it is the second-largest integrated oil and gas services company in the world. So it has some heft. Employees number some 3,500. For the year to Jan 31, 2022, it made an operating loss of RM2.2 billion on revenue of RM4.1 billion. It has an order book of RM6.6 billion and a bid book of RM28 billion. Bank loans totalled RM10.3 billion.

But neither the Finance Ministry nor national oil corporation Petronas should bail them out. The Finance Ministry has no idea of the business. Petronas, if it buys Sapura Energy, might not be able to pick the best oil field and gas services company as it will be compelled to use a company in which it has interests - conflicts.

Sapura must be saved only if there is a commercial reason and a strong belief and evidence it can return to sustained profitability.

Neither Sapura shareholders nor management has asked for a bailout. The Sapura CEO said in an interview they are trying to sort matters out with the banks and have a plan to return the group to profitability. Leave them alone to work it out. Oil prices have improved, it may be possible to salvage the business and return it to profitability.

When there is a clear view of how a GLC can be returned to profitability and when extenuating circumstances which will not last have resulted in the problems, then a rescue, which is not a bailout, is justified.

The idea is to save the business, not its shareholders. No matter who the shareholders are - you must not throw good money after bad. But that’s a judgement call that competent people must make.

GLCs have two roles - contributing to increased business and economic opportunities and helping to redress income and ownership inequalities. This is as it should be but there are just too many of them.

They should be restricted to strategic and important industries but they are not always and have too much political interference and political leadership. The appointment of politicians to head GLCs must be outlawed and proper standards set for recruitment of top people.

The GLCs currently play a very large role in terms of contributing to economic growth in areas such as banking, plantations, oil and gas, motors, property and so on. In fact, most of the top 10 companies on the stock market and the largest companies in Malaysia are GLCs.

But they really need to be better regulated and need a lot more expertise, especially the thousands of relatively unmonitored state-owned GLCs. That's a potential minefield taken together as a whole.

When government gets into business, they have to be very careful. Most of the Petronas, Khazanah Nasional Bhd and PNB GLCs are doing well but not so the others, especially the state-owned ones where the extent of the total losses is not even known. For the three groups, the government has put in many initiatives to improve governance, competence and accountability.

But 1MDB was one which was unfiltered and which had its own set of rules, was unregulated and reported to just one man - former PM Najib Razak. We all know what happened as a result.

Ultimately good governance, good people and accountability in GLCs which are in viable businesses will ensure the success of a GLC. Really, that’s not rocket science. - Mkini

P GUNASEGARAM, a former editor at online and print news publications, and head of equity research, is an independent writer and analyst.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.