The Kuala Lumpur High Court has reserved judgment over the Inland Revenue Board’s (IRB) application for summary judgment in the RM1.69 billion tax suit against former prime minister Najib Abdul Razak.

This following a two-hour submission by parties during the open court proceedings this afternoon.

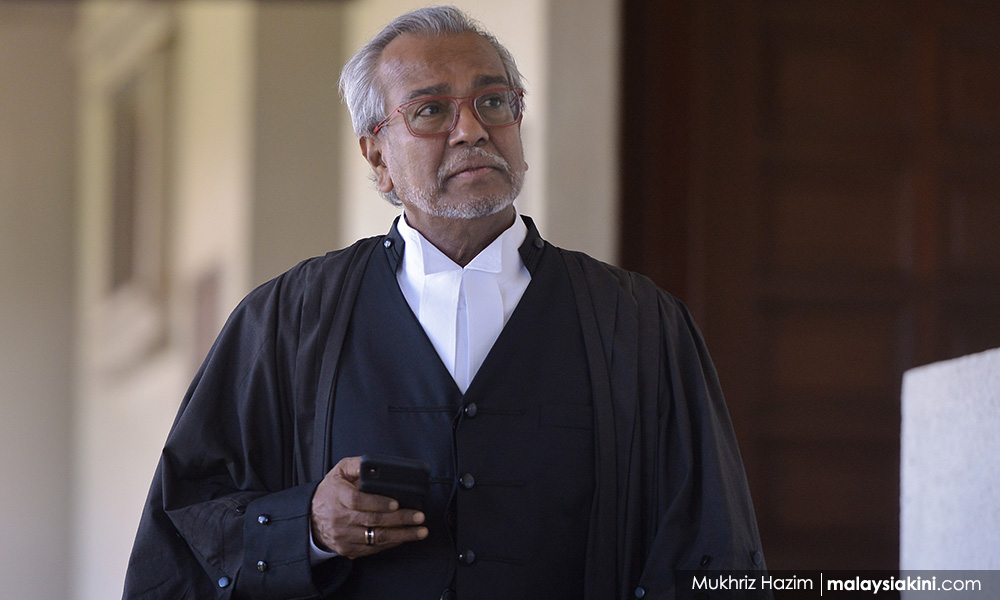

Justice Ahmad Bache informed Najib’s lead counsel Muhammad Shafee Abdullah and deputy revenue solicitor Abu Tariq Jamaluddin that the court would take at least a month to come to a decision, and that it would write to parties around a week before the date of the decision.

On May 8, it was reported that the court fixed today to hear the IRB’s summary judgment application.

Summary judgment is where a court decides a case without going for a full trial, thereby dispensing with the hearing of testimony of witnesses, among others.

During submissions this afternoon, Abu Tariq, acting for IRB, argued that the court should allow summary judgment in the current suit as Najib still can argue on the merits of the tax-reassessment with the Special Commissioner of Income Tax (SCIT).

It was previously reported that Najib had filed a tax-reassessment appeal with the SCIT.

In his submission, Abu Tariq also argued that the summary judgment application was in line with Section 106(3) of the Income Tax Act 1967.

Section 106(1) of the act states that tax due and payable may be recovered by the government via civil proceedings as a debt due to it.

Section 106(3) states that in any proceedings under the section, the court shall not entertain any plea that the amount of tax sought to be recovered is excessive, incorrectly assessed, under appeal or incorrectly increased, among others.

However, Shafee counter-submitted that the current suit is not a clear cut case suitable for summary judgment, as there are many issues of dispute that need to be ventilated in a full hearing by the court.

The veteran lawyer said among these issues are their contention that the monies assessed by IRB are allegedly donation funds and hence not taxable.

Shafee referred to the related issue of the alleged RM2.6 billion which went into Najib’s account, but that around US$620 million was allegedly returned to the donor, and these among other issues need to be heard in a full hearing of the suit.

He also questioned why the IRB was in a hurry to seek the summary judgment bid against Najib, claiming that it amounted to being oppressive against Najib, among others.

The government filed the suit against Najib on June 25, last year.

It sought over RM1.69 billion from the former premier, with an annual five percent interest rate beginning from the date of judgment, as well as costs and other relief deemed fit by the court.

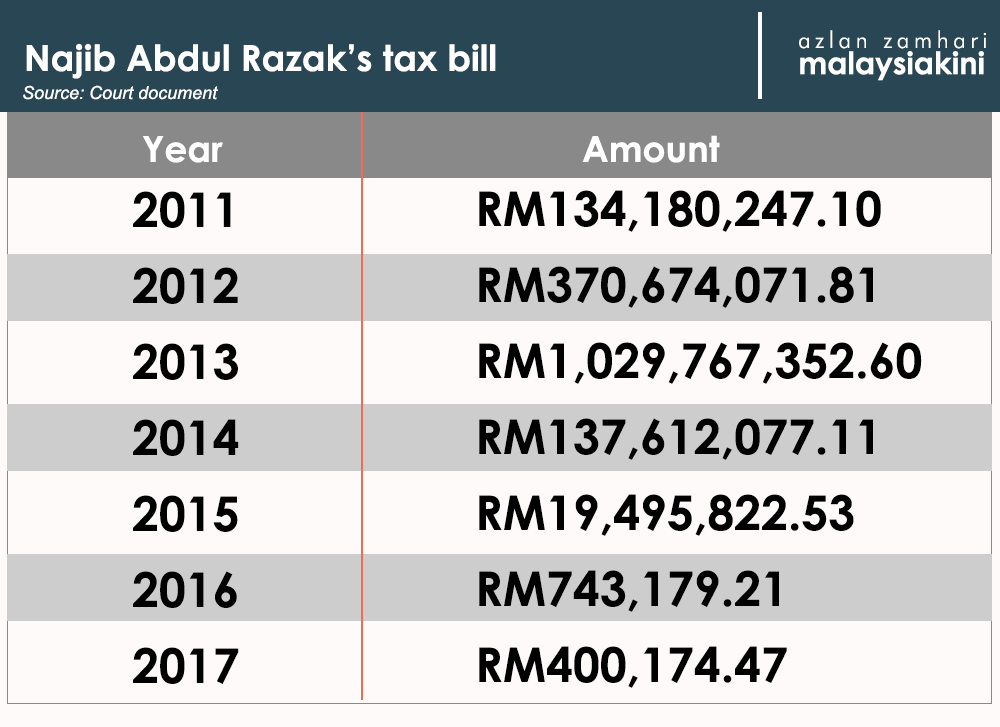

In its statement of claim, the government said Najib had failed to pay income tax from 2011 to 2017 within the stipulated 30-day period after assessment notices were issued.

As such, the amount owed each year increased by 10 percent.

It also said Najib was given 60 days to pay the taxes, together with the 10 percent increase, but he failed to do so.

Following this, Najib was slapped with another five percent increase in the 10 percent hike, bringing the total amount of income tax due to RM1,692,872,924.83.

The final amount owed each year are as follows:

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.