MP SPEAKS | One of the most significant economic impacts of the Covid-19 crisis is the loss of employment.

In the US, for example, unemployment jumped from 3.5 percent in February to 14.7 percent in April, a level not reached since the Great Depression, which lasted from 1929 to 1933.

In Malaysia, on the surface and in the official statistics (for now), we have not seen a significant increase in the unemployment rate. Even though the unemployment rate increased from 3.3 percent in February to 3.9 percent in March, or 525,000 to 611,000 in one month, Bank Negara Malaysia (BNM) is projecting the overall unemployment rate to increase to 4 percent this year.

Are we underestimating the number of jobs already lost during the movement control order (MCO) and conditional MCO, and also the potential job loss in the next six months?

At the end of April, Malaysian Employers Federation (MEF) executive director Shamsuddin Bardan said as many as 2 million Malaysians may lose their jobs this year. In addition, according to the Malaysian Institute of Economic Research (MIER), between 1.5 million to 2.4 million jobs may be lost in 2020.

Previously, in Part 1 of this series, I argued for a need to have a targeted sectoral approach in response to the Covid-19 economy. Similarly, in trying to understand the potential job losses, we also need to dig deeper into the economic impact at the sectoral level.

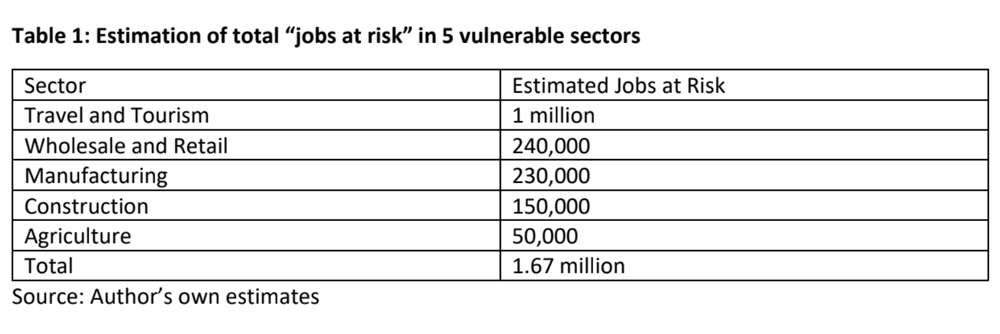

The five sectors of the economy with the largest employment and are also the most susceptible to the Covid-19 crisis are:-

- Travel and tourism

- Wholesale and retail

- Construction

- Manufacturing

- Agriculture

For each of these sectors, I estimate the number of "jobs at risk". These are jobs which may be lost but could potentially be reduced if well-design policies are put in place.

Without a doubt, the travel and tourism sector has been the hardest hit among all sectors. The World Tourism Organisation (UNWTO) projects international tourism to fall between 60 percent to 80 percent in 2020. International tourists, which comprise almost half of the entire tourism industry in Malaysia, have decreased to almost zero during this lockdown.

A spate of hotel closures has been announced including the Ramada Plaza Hotel in Malacca, the G City Hotel in Kuala Lumpur, the Kinta Riverfront Hotel in Ipoh and the Jazz Hotel in Penang, just to name a few. Domestic tourism cannot replace international tourists especially with continued economic uncertainty and government regulations stopping domestic travel.

Up to 30 percent of hotels may have to close down, according to the Malaysian Association of Hotels (MAH). It is not just the hotels which are suffering but also other business activities related to the tourism sector.

According to the Tourism Satellite Accounts for 2018, an estimated 3.4 million jobs are related to the tourism sector in services ranging from accommodation, F&B, passenger transport, travel agencies, recreational activities, retail sale of automotive fuel and retail trade. A conservative estimate of 30 percent of jobs at risk in this sector would translate into approximately 1 million jobs.

The next sector to consider is wholesale and retail. There are an estimated 1.5 million full time and another 100,000 part-time paid staff in this sector. Initial projections by the Retail Group of Malaysia (RGM) is for a contraction of 5.5 percent in retail sales, the first time that this sector has experienced a contraction since the 1998 Asian financial crisis.

An estimated 51,000 retail stores (out of 325,000) are expected to close permanently. This represents about 15 percent of all retail stores.

The Malaysian Automotive Association (MAA) has revised its passenger vehicle sales in 2020 downwards by one-third from 600,000 to 400,000. Even if “only” 15 percent of employment in the retail sector is “at risk”, this represents 240,000 jobs.

The manufacturing sector is an important engine for trade and economic activity and provides approximately 2.3 million jobs. Manufacturing held firm in the first quarter (Q1) of the year, registering a 1.5 percent growth rate (compared to Q1 2019). But for the year's second quarter (Q2), figures for manufacturing will be in deep negative territory as even factories operating in essential sectors were mostly allowed to operate at a maximum of 50 percent capacity.

The IHS Markit Purchasing Managers’ Index (PMI) for Malaysia in April fell from 48.6 to 31.3, a massive decline. Although the May IHS Markit PMI bounced back to 45.6, depressed global conditions are likely to dampen this sector for the remainder of the year. Small and medium enterprises (SMEs) are likely to be underrepresented in this PMI survey and these are the companies most negatively impacted by the shutdown. Even if 10 percent of jobs in this sector are at risk, this translates into 230,000 jobs.

The construction sector provides an estimated 1.5 million jobs to the economy. In Q1 2020, this sector contracted by 7.9 percent in real terms (compared to Q1 2019). Most construction activity grounded to a standstill during the MCO and still have yet to be fully restored during the conditional MCO while awaiting Covid-19 testing for the large foreign workforce which comprise a significant number of manual workers in this sector.

It would not be surprising to have 10 percent of jobs in this sector at risk if construction activity remains lethargic for the rest of the year. This puts another 150,000 jobs at risk.

The agriculture sector provides an estimated 483,000 jobs to the economy. This sector contracted by 8.7 percent in Q1 2020 (compared to Q1 2019), led by palm oil production which contracted by 22 percent during this time period.

Approximately 90 percent of agriculture establishments are SMEs employing about 190,000 workers. According to a report by the Khazanah Research Institute (KRI), these SMEs are the most at risk of failing and their workers being asked to take unpaid leave or be retrenched.

The agriculture sector also has a high proportion of workers who do not contribute to the Employment Insurance Scheme (EIS) and as such are more financially vulnerable when out of work. Even if 10 percent of jobs are at risk in this sector, this represents another 50,000 jobs.

When the total jobs at risk are summed up, we arrive at an estimation of 1.67 million jobs (Table 1 below). When we add this to the 600,000 unemployed as of March this year, we will exceed the 2 million unemployed mark.

The total labour force was 15.8 million as of March. With an estimated 2.3 million unemployed, we may reach a 14 percent unemployment rate at the height of this economic crisis.

Some of these jobs at risk may have been saved by the Wage Subsidy Programme (WSP) and the Employee Retention Programme (ERP) that was launched by the government earlier this year.

According to the seventh Laksana report, as of May 31, approximately 286,000 companies had applied for the WSP involving 2.2 million workers at a total cost of RM3.22 billion. At the same time, 184,000 workers had been approved for the ERP. While these programmes have been helpful to companies, especially the SMEs, it would be wrong to claim that they have "saved" 2.4 million jobs.

Some of these companies would have continued to operate even without the WSP. At the same time, there would have been other companies which did not sign up for the WSP because they couldn’t afford to continue to keep the same number of staff on payroll for the next six months, which is a condition to apply for it.

One important indicator of the loss of employment (other than the official unemployment figures reported by the Department of Statistics or DOSM) is the reports to the Employment Insurance System (EIS) made by individuals who were retrenched. The EIS centre has made available these retrenchment figures for 2019 and also for the months of January to April of this year.

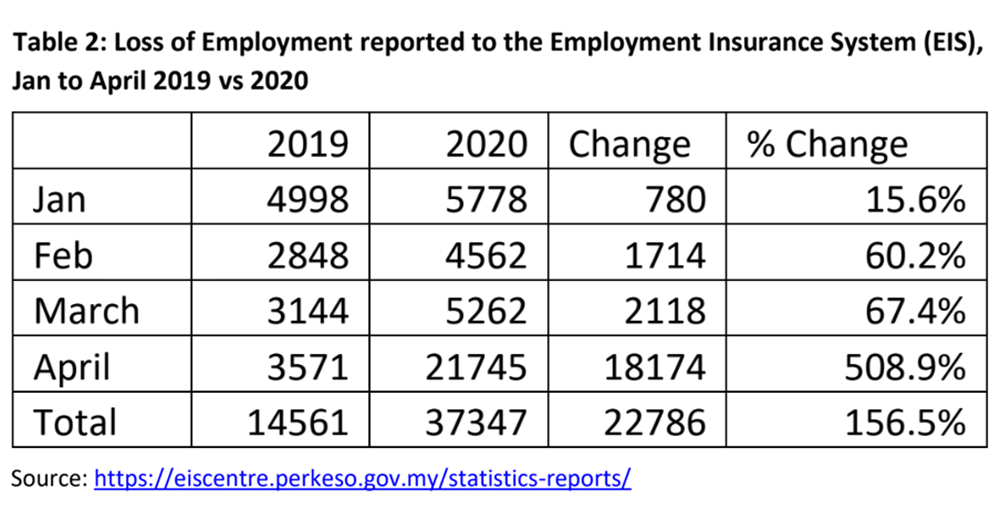

The loss of employment (LOE) increased from 5,262 in March to 21,745 in April, a four-fold increase! For the months from January to April, LOE was reported at 37,347 jobs compared to 14,561 jobs during the same time period in 2019, an increase of 156.5 percent. Reported retrenchments increased by 500 percent from 3,571 in April 2019 to 21,745 in April 2020! (See Table 2 below)

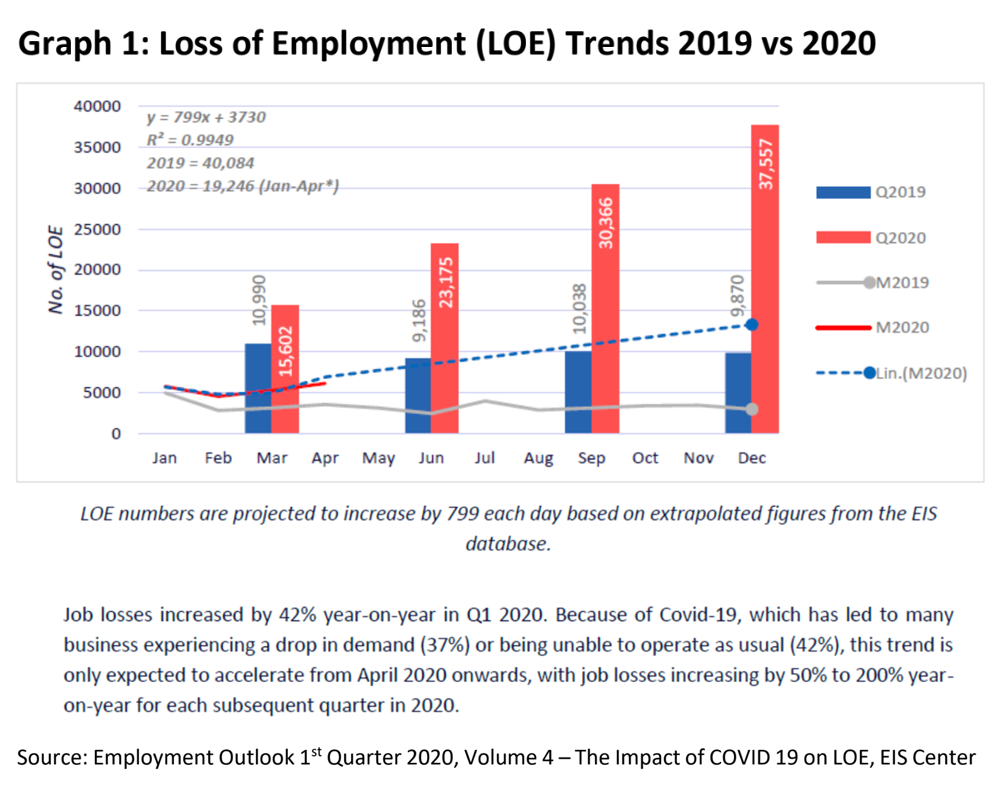

What is more worrying is the projections made by the EIS centre, that total LOE will increase from 40,084 in 2019 to 106,700 in 2020, or an increase of 266% (Graph 1 below).

We have to keep in mind that not all workers are registered with the EIS and that LOE claims represent only part of the actual unemployment reality. We must also keep in mind that those who may have lost their jobs in the past would not find it as easy to find another job soon in the Covid-19 economy.

The unemployment rate in 2019 was 3.4 percent. If we project this to increase by 2.5 times, as a reflection of the projected LOE by the EIS centre, we would reach an unemployment rate of 8.4 percent in 2020, far higher than the estimated 4 percent by BNM and other government agencies.

Some of this increase in unemployment would be borne by the foreign worker population which makes up 15 percent of the total workforce (using official foreign worker figures). But it would be a mistake to think that all of the foreign workers will lose their jobs first before Malaysian workers. This is very dependent on the industry in question.

What does this mean from a policy perspective?

Firstly, some of the jobs losses and shops and businesses closures could have been prevented if Malaysia had been more proactive and passed a Covid-19 Relief Bill before the beginning of the MCO.

Singapore passed its Covid-19 (Temporary Measures) Act 2020 in early April which provided temporary relief measures for certain contractual obligations that companies could not meet because of the Covid-19 crisis.

In Malaysia, the legal affairs division in the Prime Minister’s Office is only now asking for feedback for a similar bill. Some lawyers have already argued that such a bill, which can only be debated and passed in both houses of Parliament by August and gazetted in September, will be too little too late.

Secondly, with local transmissions of Covid-19 having come down significantly, the government should focus its efforts on having specific plans to revive those sectors most affected by the Covid-19 crisis.

In the travel and tourism sector, for example, the lifting of interstate travel after June 9 would help domestic tourism. Re-emphasising the government’s commitment to the economic stimulus package which was announced by then prime minister Dr Mahathir Mohamad, at the end of February, which includes measures to stimulate the domestic tourism sector such as digital vouchers for local travel, would also be somewhat helpful.

Starting negotiations with some countries in the Asia Pacific with similarly low community transmission rates to establish special travel channels would bring back some international travellers.

Singapore, for example, is establishing a fast track travel lane for business travellers and officials from China and are looking to extend this to New Zealand soon. Japan is weighing the lifting of travel restrictions for visitors from Australia, New Zealand, Thailand and Vietnam (but not Malaysia).

Thirdly, the government should increase its assistance to businesses and individuals beyond the already announced plans. BNM's allocation for the Special Relief Fund (SRF) should be increased beyond the RM10 billion already allocated.

The Bantuan Prihatin Nasional (BPN) assistance should be extended beyond June and be given to those who have lost their jobs and livelihood and are not registered under the EIS. Other financial assistance should also be considered.

If the loss of employment figures are not taken seriously, any further action by the government may come too late and the increase in unemployment to between 8 percent and 14 percent will have serious societal as well as economic implications.

ONG KIAN MING is Bangi MP. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.