YOURSAY | ‘We might just end up like Sri Lanka, when they cannot repay the communists.’

Kingfisher: CIMB Group Holdings Bhd chairperson Nazir Razak's view that we need to be cautious while engaging China in investment merits consideration.

Malaysia has had a good run in international trade and foreign direct investment (FDI) for some 25 years under the "globalisation of economies and liberalisation of global trade" regime.

This globalisation phenomenon has lately come under severe scrutiny and the outlook for the future is rather bleak.

The distribution of development amongst a community of nations (especially emerging economies) that "globalisation" facilitated will slow down drastically as advanced economies continue to experience adverse effects to their manufacturing capacities and declining employment/incomes for their middle and lower classes of citizens.

Emerging economies that had failed to translate the benefits of globalisation for overall development, and in particular their human development, will be hard pressed in the future, perhaps even facing social strife.

Malaysia, it appears, has been neither frugal nor astute in many regards during the good times.

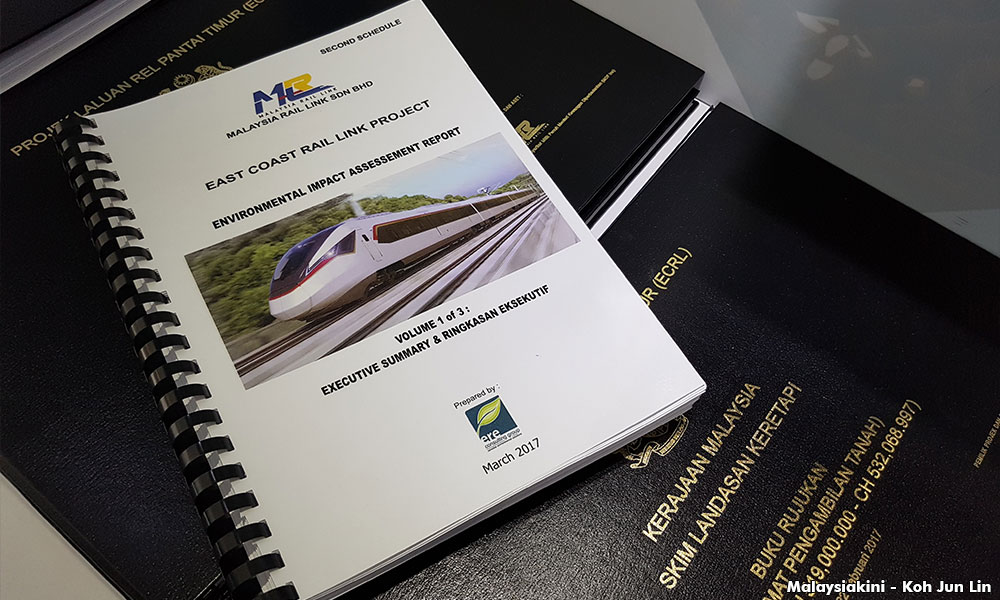

Anakraja: The East Coast Rail Link (ECRL) project has an inflated price so that the person who gave the project will be rewarded to a tune of, perhaps, RM15 billion.

Will the ECRL project bring economic boom? There is not enough passenger volume to sustain the rail link and its balance sheets will be in the red. Any comments from economic experts?

Voice: The first few years is when the project is under construction and there is no income generated. So, where to get the fund to pay the interest on such a humongous loan?

When you start generating revenue from passengers and advertisement, etc, it is also time you have to repay the principal sum.

The issue is not just whether the revenue generated will be enough to repay the loan, but how it needs to repay the loan, bearing in mind there will likely additional higher interest when there is a loan payment default.

How are we going to handle such humongous loan repayment when our country is already in a scary mountain of debt?

681 Porky Pies: At a cost of RM55 billion, let's say the communists are very generous and charge us an interest rate of 3 percent per annum - that's RM1.65 billion per year or about RM130 million per month, not including the principle sum.

Can the railway generate enough revenue to repay the interest? An express bus from Kuala Lumpur to Kota Bharu costs about RM40, how much can ECRL charge for its tickets to attract riders?

We might just end up like Sri Lanka, when they cannot repay the communists.

China Economic Colonisation: Imagine if RM55 billion for ECRL is used to build affordable housing instead.

At RM150,000 per unit with RM55 billion, Malaysia could build 360,000 units, or 28,000 units for each state. Which one does Malaysia need more - ECRL or affordable housing?

ECRL looks likely to serve the purpose of China military strategies in South China Sea.

Prudent: Nazir is using Financial Management 101, sub-topic - Costs and Benefits Analysis.

Detach costs to be incurred from the benefits to be derived from the costs so incurred, and one may have a financial disaster in the making.

But in this case, there are likely to be loads of 'benefits' but the beneficiaries are very likely limited to MO1 and cronies.

Apa Ini?: They will give with one hand and take twice as much, if not more, with the other. And one day we will wonder what we have learnt as a nation with a colonial past. Possibly nothing!

GE14 Voter: This is not a problem really for the current decision-makers; they won't be around to bear the consequences, only poor future Malaysians.

FellowMalaysian: Johari Abdul Ghani said China is the only major economy that is in investment mood. As the second finance minister, he should be sacked for making this claim.

Johari has conveniently ignored to mention that the US is the largest investor (investing country in a foreign land) in the world and China, although occupying the world's second spot, accounts for only 11% of the world's total foreign investments.

Major investors from the US has some time ago shunned our country, especially after the 1MDB kleptocracy malaise scourged the country and this has driven away FDI in the droves.

Oscar Kilo: Loans are not investments. Loan means we borrow money that we have to pay back. Investment means others pump in their money.

Spinnot: Loans are not foreign investments? Investopedia is certainly more authoritative on this than internet trolls:

"There are two additional types of foreign investments to be considered: commercial loans and official flows. Commercial loans are typically in the form of bank loans that are issued by a domestic bank to businesses in foreign countries or the governments of those countries.

“Official flows is a general term that refers to different forms of developmental assistance that developed or developing nations are given by a domestic country.

“Commercial loans, up until the 1980s, were the largest source of foreign investment throughout developing countries and emerging markets. Following this period, commercial loan investments plateaued, and direct investments and portfolio investments increased significantly around the globe."

Worldly Wise: After independence, the country encouraged foreign investments. But we were wary of control by foreigners. That is why we had different incentives for different projects. There was tight control. We have to be wary of China.

Anonymous 568201438363345: If I can borrow hundreds of billions of free money to finance multi-million mega projects, why not?

They’ve many "contractors" and "sub-contractors" to take up those projects. But does our country need those projects? Do we have enough funds to repay these loans? -Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.