The Sales Tax Bill 2018 and Service Tax Bill 2018 have been passedat the Dewan Rakyat but a PAS MP is still mooting the party's alternative form of taxation.

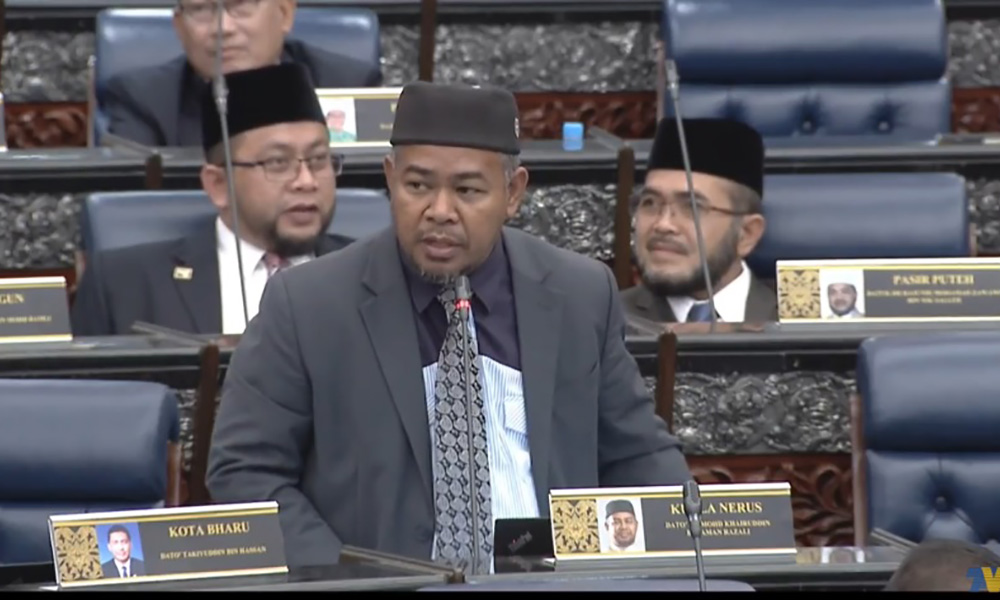

Kuala Nerus MP Khairuddin Aman Razali says that replacing the goods and services tax (GST) with the sales and services tax (SST) ultimately helps no one as both only burden the rakyat with increased costs.

He suggested that the government adopt PAS' idea of a taxation system modelled after the Islamic tithe system, which the party had put forth in the lead up to the 14th general election.

"I have repeatedly explained and stressed on the proposal for an alternation tax towards assets belonging to the rich, that adheres to syariah and is fair to all, based on the zakat (tithe) model, which is a tax on corporate savings and on stock trades," he said in a statement today.

Even so, Khairuddin, who is also PAS syura ulama council member, said that such taxation should not be implemented freely but must be tied with certain conditions.

For example, he said, besides income tax, other forms of taxation should be imposed on the rich only during certain periods such as in order to cater to the needs of the country should it become "desperate" including when the national income is not sufficient.

"Whether it is GST or SST, the implications of both are the same in that the end user must bear the rise in prices of goods and services purchased or used.

"Zakat is the best model for this; not only is it an act of piety for Muslims but it is a fair way to distribute wealth among people," his statement read.

At the same time, he said the government was obliged to find other sources of income and to spend wisely.

"The question is, who actually benefits from this GST and SST that they want to abolish and implement? The government, corporate (entities) or the rakyat?

"If it is truly for the rakyat, one tax should not be replaced by another because the rakyat would still be made to bear the burden," he said.

He urged the government to be more "creative" in supplementing income instead of taking "the easy route" by charging consumption tax.

Kharuddin added that the new government also had far more important matters to focus on such as the need to plug leakages in government spending, increasing efficiency in the existing tax system to address the issue of unpaid taxes and prevent losses from smuggling activities.

He added that if these issues were addressed, alongside the implementation of PAS' syariah tax system, there would not even be any need for GST or SST.

"PAS is not anti-tax, nor do we deny the importance of tax. It is just that it is clear that GST 'robs' upfront while SST 'steals' the rakyat's money silently.

"That is why PAS rejects both forms of consumption tax." -Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.