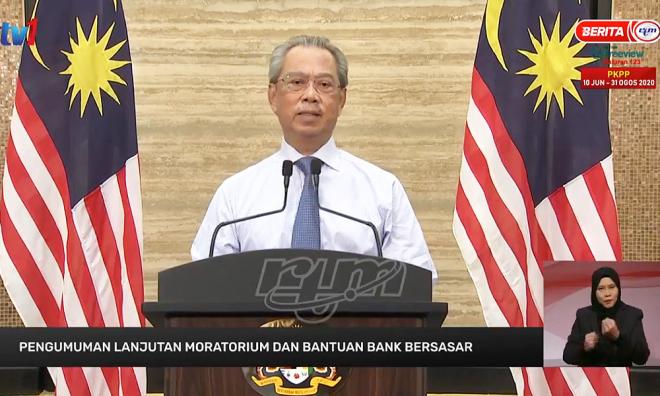

Prime Minister Muhyiddin Yassin today announced that loan reliefs the government had negotiated with banks will shift to a targeted approach when the blanket loan moratorium expires on September 30.

Muhyiddin, in introducing the targeted measures after the end of the blanket loan moratorium, said the government was taking into account feedback from the people, some of whom are not yet financially ready to resume repayment on their loans.

"I hear your concerns about the loan moratorium that will end on Sept 30. I also know that many people hope that the moratorium will be extended.

"Therefore, I have discussed with the Finance Ministry and Bank Negara governor to seek a solution to the problem faced by some of you who may still need help when the moratorium ends.

"Today, I am pleased to announce that the Perikatan Nasional government has agreed to implement an extension and targeted relief that is more focussed on groups that truly need them," he said in a television address.

"With this announcement, I hope that Makcik Kiah, Pak Salleh, Encik Lee, Puan Rani, Encik Douglas and all Malaysians can get some relief while the government and industries work on reviving the country's economy," he added.

The moratorium, which began on April 1 and will end on Sept 30, allows borrowers to defer their loan repayments during the period.

After Sept 30, the general public is required to resume repayment on their loans but the following targeted reliefs will be available for certain segments of society:

1) Three-month extension for those who lost their job this year

To qualify for the three-month extension, a borrower must have lost their job this year and have yet to secure a new job.

If their situation persists after the three-month extension, which expires at the end of the year, the banks may still provide a further extension for such individuals, depending on their respective situation.

2) Reduced monthly repayment amount for those whose salary was reduced

Borrowers whose salary has been cut due to the economic downturn brought about by the Covid-19 pandemic may seek a reduction in the monthly repayment.

The reduction in monthly repayment will be based on the proportion of the salary reduction.

The ratio of monthly repayment reduction to salary reduction may differ depending on loan type.

For housing and personal loans, the monthly repayment can be reduced at the same rate as the salary reduction. The ratio of reduction was not provided for other forms of loans.

This reduction will be allowed for at least six months.

An extension can be considered, depending on the status of an individual's salary.

3) Others may negotiate with banks for certain reliefs if facing difficulties

The government said banks have given a commitment to help individuals, small and medium enterprises (SME), small traders and self-employed individuals who face difficulties in meeting their commitments due to the Covid-19 pandemic.

Among the possible reliefs that can be negotiated by such individuals are:

- Only paying the interest portion of loan repayment for a certain period of time

- Extending the overall loan length in order to reduce the quantum of monthly repayment

- Other reliefs until a borrower is financially stable again

All individuals and businesses who qualify or are still facing financial difficulties may reach out to their banks to negotiate the above reliefs from Aug 7 onwards.

Some already started repayment

Muhyiddin said the targeted measures are expected to benefit three million individuals and SMEs.

"If more people need help, the banking institution has given a commitment to consider the necessary assistance," he said.

Muhyiddin said as of July 20, the loan moratorium had benefitted 7.7 million individuals or 93 percent of borrowers amounting to RM38.3 billion since it began on April 1.

Likewise, he said Bank Negara Malaysia's data showed 243,000 SMEs or 95 percent of borrowers have also benefited from the loan moratorium amounting to RM20.7 billion during the same period.

He said the moratorium was intended to help Malaysians cope when a substantial part of the economy was shut down under the movement control order (MCO) to deal with the Covid-19 pandemic. However, he said the economy is now getting back on track.

"Since the reopening of the economy in stages since May, followed by the recovery MCO, economic activity can be seen to be picking up pace.

"Now, there are individuals and businesses who can repay their loans. The number of individuals who chose not to take up the moratorium relief and continued to repay their loans increased from 331,000 borrowers in April to 601,000 in July.

"In the same period, the number of SMEs who opted out of the moratorium increased from 5,000 to 13,000 borrowers," he said.

However, Muhyiddin said he acknowledged that there are still uncertainties in certain sectors of the economy.

"I understand that there are businesses that are not yet fully operational and there are among you who have lost your job and source of income.

"I hope the moratorium extension and target bank relief can ease your burden due to economic problems brought about by the Covid-19 pandemic.

"It is hoped that the government's decision, in cooperation with the banking institution in the country, can help support business sustainability, revive and jump-start the country's economy and assure your well-being," he said.

He also advised Malaysians to continue taking precautions against the spread of Covid-19 by practising social distancing, wearing a face mask in public places and avoiding crowded places. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.