The majority of parliamentarians in the Dewan Rakyat will only serve one or two terms in office and would not be able to accumulate significant retirement savings in lieu of a lifetime pension, according to several former MPs.

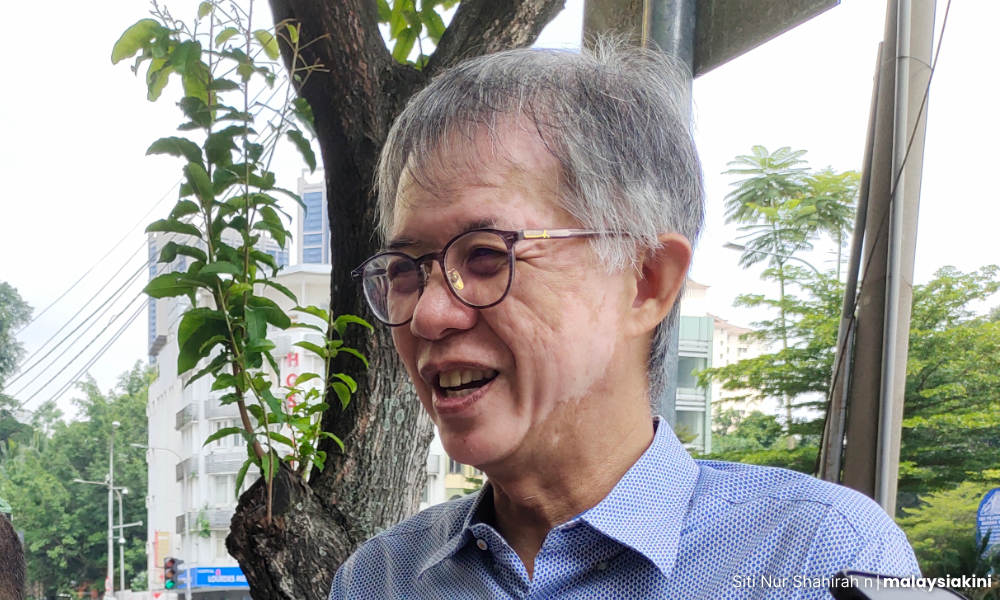

Former Serdang MP Ong Kian Ming said while a proposal to remove multiple lifetime pensions can be considered, it should not be confused with a separate proposal to shift civil servants from lifetime pensions to EPF contributions.

“The truth of the matter is, if an MP only serves for one or two terms, their EPF contributions will not be very significant. It would not be sufficient for MPs to ‘retire’ on,” he told Malaysiakini.

Ong was responding to an interactive article by Kini News Lab which looked into the various types of pensions awaiting MPs who were elected in the last two general elections when they turn 50 and are no longer in office.

Ong was elected as Serdang MP during the 13th general election in 2013, and as Bangi MP in GE14, after which he was named deputy international trade and industry minister during the Dr Mahathir Mohamad administration.

Critics had argued that MPs are “undeserving” of their pension when compared to civil servants, but Ong said a point to consider was the higher risks involved.

The discussion follows the government’s ongoing austerity measures, raising questions on whether MPs should play their part by limiting their pension to just one of the many positions that they are eligible for.

“Civil servants, yes, they have to work longer to be eligible for lifetime pension as currently structured, but they do not have to face elections and risk losing their jobs.

“Whereas an MP, he or she is elected to serve for one term. There’s no guarantee that the person will be selected to continue to stand in that particular seat,” he said.

“And even if let’s say he or she does stand again, there is no guarantee they will win.

“So, the risk we are talking about being faced by MPs or representatives is quite different than that of civil servants,” he said.

Impractical idea

Former Batu MP Tian Chua said the conversion of pension into retirement fund contributions was “impractical” for the amount of time an MP would be in office, mostly up to two terms since 2018.

“How will they accumulate savings (in EPF)?

“If we want to look at austerity measures, we must come up with institutional changes on how to curb leakages and corruption. These structural changes will help us save more money,” said the former PKR vice-president.

Chua claimed the savings from the revision would be minimal in comparison to the cost of implementing a new system.

Further, he pointed out that for elected lawmakers holding positions in both Parliament and state assemblies, two “different employers” are involved.

“So, who shouldn’t be paying here (in the proposed austerity measure)?” he questioned.

The multiple pensions refer to separate amounts calculated from salaries received in different elected positions, either simultaneously or otherwise.

They could receive multiple pensions if they held positions at the state level as assemblypersons or state executive councillors, and at the federal level as MPs, ministers or deputy ministers, speakers or deputy speakers.

Taking into consideration the different positions held by MPs throughout their career, including at the state level, Kini News Lab found that some MPs could get more than RM30,000 in monthly pensions once they retire.

Big savings

Economist Muhammed Abdul Khalid estimated that the government could save RM2.4 million per MP if the pension scheme is changed to EPF contributions.

This works out to over half a billion ringgit for a single cohort of 222 Dewan Rakyat members.

United for Rights of Malaysian Party (Urimai) president P Ramasamy - a former Penang deputy chief minister, state assemblyperson and Batu Kawan MP - said the current multiple pensions cannot be “arbitrarily reduced to one pension just because the government is in debt”.

“We cannot fault the pensioners for the government’s debt.

“There must be a proper study before a new pension scheme could be devised,” he told Malaysiakini.

At the same time, he conceded that EPF contributions can be a proposed alternative to a pension scheme. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.