Despite multiple requests from the media, I refrained from commenting on the merits of the settlement that the government of Malaysia reached with Goldman Sachs which was announced on July 24, 2020.

As the person leading the negotiations in 2019 on behalf of the previous government, I felt that it was not proper for me to publicly comment. After all, it is the prerogative of the present government to reach a deal on whatever terms it wishes.

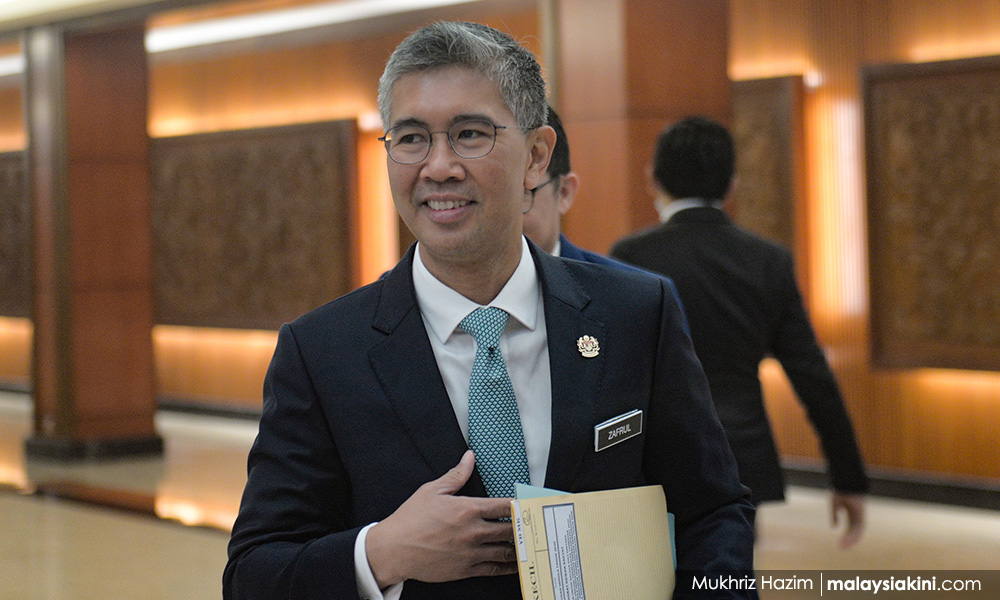

Regrettably, I have to set the record straight and correct the misleading statements made by Finance Minister Tengku Zafrul Abdul Aziz in an interview with The Edge.

Excerpt of interview question and answer

“Why didn’t you just make the same demand as the Pakatan Harapan government by proceeding with the charges and force them to pay?

Did the previous demands result in a concluded settlement? The criminal charges initiated by the former attorney-general against Goldman Sachs are for making untrue statements under Section 179 (c) of the Capital Markets and Services Act 2007 (CMSA). There is no imprisonment provision against a corporation. The penalty would have been only a fine. The fine would not have been sufficient to cover the 1MDB losses suffered.

On the other hand, the current Attorney-General Idrus Harun secured a settlement after intimating to Goldman Sachs of amended and new charges for fraud under Section 179(a) and civil disgorgement claims under Section 199 CMSA. These entitled Malaysia to disgorge three times the fees (US$606 million x 3 = US$1.818 billion) earned by Goldman Sachs. These statutory claims are more robust and irrebuttable and resulted in the settlement. The USD$2.5 billion cash payment is 42 percent more than the offer received before.”

My response

I charged the Goldman Sachs companies in December 2018. They were followed by charges against 17 of their directors in August 2019. They would been tried jointly. We have a very strong case against all the accused, which we would have established at trial. We were confident that upon conviction, the trial court would in addition to sending the individual directors to jail, order the Goldman Sachs companies and the individuals to pay compensation.

The compensation that a criminal court would order would be on the same basis that a civil court would order under the CMSA, as occurred in two bond default cases in Malaysia, namely Pesaka and Aldwich.

Hence, there are two practical advantages of charging the companies and their directors in the criminal court. First, criminal charges ensure greater bargaining power for Malaysia. Secondly, the same court can order compensation or damages to reflect Malaysia’s losses arising from the three bonds that Goldman Sachs had designed and structured.

Any litigation lawyer would advise that the leverage that his client would have, whether as plaintiff in civil proceedings or as prosecutor in criminal proceedings, is to start a trial with the maximum negative publicity against the adverse party. This advantage was lost by the present administration because the settlement was rushed and premature. There are no objective reasons to have reached a settlement at this point in time.

What ought to have happened was to start the criminal trial against Goldman Sachs and its directors. From Malaysia’s perspective, any settlement should have only taken place in the middle of the trial or after the verdict is announced.

Separately, I would like to comment on two general matters raised by the disingenuous statements of the finance minister.

First, that the settlement he reached was higher than the US$1.75 billion offered to the Harapan government. That is correct only because we rejected such a low offer, bearing in mind that Malaysia’s total exposure in principal and interest on the three bonds is US$9.6 billion.

Secondly, the misleading statement about the US$1.4 billion (RM5.97 billion) as part of the Goldman Sachs settlement. Malaysia would have received this sum from the US Department of Justice, in any event, independent of this settlement with Goldman. This was because of the good relationship that Malaysia has established with the DOJ after the Harapan government took office in May 2018.

In other words, Malaysia’s right to receive the US$1.4 billion was not in any way dependent on the Goldman Sachs settlement.

TOMMY THOMAS is the former attorney-general. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.