Thinking big in business appears to be the trend for South-East Asian nations during the prolonged Covid-19 pandemic, and see the futuristic possibilities of unicorn companies.

The inspiring news about South-East Asia’s first decacorn, Grab Holdings Inc, to be listed in the United States in a massive near-US$40 billion (RM165.16 billion) deal may well be a big loss for Malaysia.

”Super-app” Grab, known for its diversified services from ride-hailing and food delivery to online banking, is an ultra-smart case of how a startup incubated in Malaysia was eventually lost to a neighbouring country.

For the record, its valuation is more than double the market capitalisation of Malayan Banking Berhad, which is the country’s largest listed company. The exit of companies with high potential such as Grab is indirectly a sign of lack of confidence in the domestic market and there is a pressing need to seriously address the issue.

Above all else, let the financial warnings be clear: Malaysia stands to lose huge economic opportunities and the chance to strengthen the domestic talent pool, if more homegrown companies seek to leave the shores if there is a lack of willingness to fund such ventures.

Change in headquarters

Previously known as MyTeksi, Grab was launched in 2012 and one of its earliest funding came from Cradle Fund Sdn Bhd, an agency under the Finance Ministry. But as the company grew into a regional player, it shifted its headquarters to Singapore, although Malaysia remained an important market for Grab.

The truth be told: One of the key reasons for Grab to change its headquarters to Singapore was the lack of funding from Malaysian sources to upscale its business further.

Mind you, Grab is not the only ”gem” that Malaysia has lost in the past. Many other homegrown companies have preferred listings in other stock exchanges, including Hong Kong and Australia, compared to Bursa Malaysia.

Experts are saying that Malaysian companies are leaving the shores in search of greater market accessibility; more diversified capital options and a high-quality talent pool. They added that Malaysia needs to undertake important structural changes if it is serious about retaining such companies in the country.

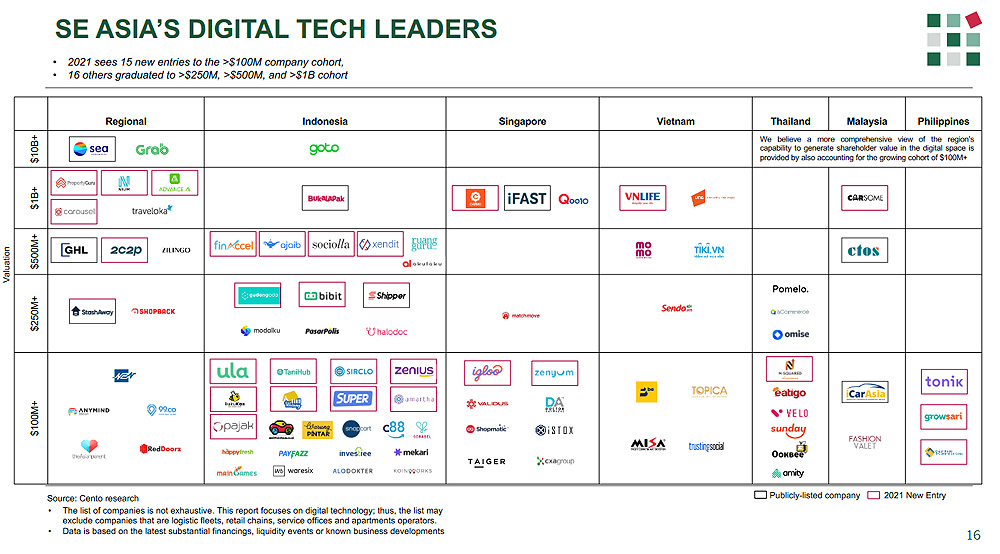

Recently, I was intrigued by the rankings of regionally potential unicorn companies, which delved to do a bit of digging to ascertain how these companies fared and their origins.

Of course, it is no brainer to say, the most populous country will have the number advantage and the potential of upscaling the start-ups from unicorns to decacorns. (Unicorn is the term used in the venture capital industry to describe a startup company with a value of over US$1 billion. Decacorns are startups that have a valuation of more than US$10 billion)

Let’s set the cards financially straight: It may be a fair statement to make but any country with a strong trajectory to continuously invest in such ventures will stand out even when the odds are against it.

In South-East Asia, Singapore was ranked fourth, in the same standing of the USA and Australia as the fastest from start-ups to unicorns. Tech start-ups in Singapore raised US$5.3 billion in the first half of this year.

This is commendable because during the virus-pandemic, where countries tighten the belts and reallocate resources accordingly, investing in start-ups may well be the last in one’s mind.

Take on global giants

But not for Singapore as three unicorns – software firm PatSnap, car marketplace Carro and payments company Nium - are taking on the global giants without fear or favour.

And to support and to ensure that the momentum continues, 13 news venture capital (VC) firms will likely be appointed as co-investment partners under the Startup SG equity scheme. This literally translates investments into more than US$150 million worth of investments into deep tech sectors.

According to industry observers, Singapore continues to hone local talents as well as becoming an attraction for other tech start-ups to be based in the city-state.

One reason for the overseas venture is the lack of confidence in the local market, which inevitably forces start-ups to look for greater market accessibility. In essence, the mixed flavour of funding injection, talent growth, business incubation centres spearheaded by venture capitalists (VC) and tax incentives will give a good recipe; a much-needed mantra to retaining talents.

It must be noted that some of these once neglected start-ups, today has a valuation that’s more than double the market capitalisation of a country’s largest listed company. This clearly translates to economic loss and opportunities.

Indonesia, too, has a big share to play in transforming unicorns into decacorns. One of the many tech start-ups was Gojek, which comes from the term “Ojek” or motorbike taxis, launched in 2015. It proved to be a game-changer with the concept of motorbike ride-sharing (GoRide).

A brilliant way of addressing the pain points of people moving around with ease without being caught in long hours in the jam. Speaking from experience, it was the least costly and ease of movement especially in cities such as Jakarta.

Of note, Gojek is the first Indonesian unicorn company, as well as the country's first "decacorn" company. Today, it spread its wings overseas gaining a foothold in different markets.

Much to the rejoice of many Malaysians, the used car marketplace Carsome Group has become Malaysia's first technology unicorn. Carsome will acquire 19.9 percent of Australia-listed automotive portal iCar from Catcha Group, the largest shareholder of ICar with a 30 per cent stake.

Started the journey in 2015, awarded the "Startup of the Year" by the Malaysian Rice Bowl Startup Awards, there was no looking back for Carsome, securing multiple funding over the years having a strong presence in Malaysia, Indonesia, Thailand and Singapore.

It grew by leaps and bounds. Today, it is ranked in the top 50 of the Nikkei-FT Statista High-Growth companies in the Asia-Pacific 2021 list.

Lack of confidence?

Let’s not forget there are several home-grown tech companies that became successful overseas but not locally. Why is that so? Experts opined the lack of confidence in the local market, which inevitably forces start-ups to look for greater market accessibility.

The pain point of a lower standard of living compared to countries with unicorns and the major setback of financial muscle to hire top talents derails some of these enthused tech start-ups. So they move elsewhere to seek funding from international venture (VC) capitalists.

The trick of the trade perhaps must be to focus largely on having a flexible regulatory framework for local start-ups, ease of setting up foreign talent hub, access to funds and a much promising tax regime.

Such a robust framework will chart the way forward for the young start-ups to become the next decacorns.

Mark my words: If the South-East Asian nations buck up, and see above the prolonged Covid-19 pandemic, the futuristic possibilities of unicorn companies may well be overwhelming.

Bottom line: Pandemic or otherwise, now it’s the right time to take the financial risks to take on other leading Asian or continental players in the same industry. - Mkini

SURESH SOMU is a Singapore-based journalist.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.