HISTORY: TOLD AS IT IS | Malaysia’s economic history is easily constrained to the notion that it owed principally to Chinese entrepreneurship and financial networks, capital inflows by Europeans, colonial economic policies, and South Indian labour, particularly Tamil labour. These elements are undeniable, but they do not, and are far from capable of, representing the entire story.

Many historically marginalised economic players have yet to be properly recognised. The Chettiar business class is one such actor. They were a principal money-lending business community, which was a major financial source for practically the entire social hierarchy of colonial Malaya in the 19th and pre-World War II 20th century.

The Chettiars who established themselves in Malaya were the Tamil-speaking merchant caste from the Ramnad and Pudukkottai regions of former Tamil Nadu (formerly Madras Presidency under the British), collectively known as the Chettinad region.

Historically, the Chettiars arose as a mercantile elite in their own right during the reigns of the first century south Indian kingdoms of India, especially the Cholas (100 to 1200 A.D.), Pandhya (200 to 1200 A.D.), and Vijayanagar (200 to 1200 A.D/1300 to 1500 A.D.). Their money-lending activities, in particular, most likely began in the 16th or 17th centuries, during the Portuguese era or the East India Company’s reign in India.

Under constraining conditions of the subsequent British colonial rule, the Chettiars were pushed to revive, expand, and even combine their money lending, trading and banking businesses in Madras Presidency. Due to their struggle to compete with Western corporate entities and other Indian rivals, as well as the introduction of rigorous colonial rules to regulate their activities in Madras, the Chettiars had no choice but to expand their base to the new British colonies in Southeast Asia, including Malaya, Burma and Indo-China.

In Malaya, the laissez-faire policy of the British colonial administration permitted the Chettiars to act as money lenders while also venturing into other areas. They initially set foot in the Straits Settlements and engaged in money lending and commercial activities, and they played an essential role in the economic development of Straits-born Chinese. Until the 1840s, they served as a substitute for banks in providing credit to Chinese traders, as well as ‘hundi’ exchange, a type of remittance exchange.

The Chettiars’ financial knowledge was so apparent that the Chartered Bank of India, Australia and China, founded in Singapore in 1859, hired several Chettiars to manage banknotes transactions involving the bank and Chinese merchants, such as in opium trade. As bank agents, they had to deposit a sum of money at the bank in order to purchase banknotes and then address the merchants.

Later, the Chettiars began trading opium on their own. They also provided credit to lease revenue farmers. In one case, Ng Boo Bee mortgaged his possessions to Chettiar lenders in order to settle outstanding debts for lease revenue business with the British. They were also a source of funding for a significant number of Chinese retailers who ran small-scale rice businesses in the Malay States and the Straits Settlements. For example, in 1872, a retailer named Kang Oon Lock, borrowed money from Coomarapah Chetty to invest in rice trade in China Street, George Town.

Seen as notorious

The Chettiars were so assertive and their business behaviours so rigid that they were sometimes labelled as notorious. Despite this reputation, the Chinese had to rely on the Chettiars because banks were sometimes unwilling to finance their enterprises due to the risky nature of starting businesses.

During the tin price fluctuations, for example, some Chinese businessmen were forced to borrow large sums of money in order to open and manage new mine sites, recruit and manage labour, pay wages, provide workers with amenities, and settle debts. They did, however, write to the British Resident of Selangor, claiming that the Chettiars had no conscience when they asked that the loan be paid before the borrowers could even make any profit.

Even mining giants had to turn to the Chettiars for assistance. In 1892, the famous Yap Ah Loy had to use KVAL Alagappa Chitty’s service to use the former's lease letters for deposits worth $15,000 in order to obtain a $2,000 loan from the state government. Loke Yew, the “Tin Magnate”, borrowed large sums from SAS Chellapa Chetty as well.

Furthermore, Chinese investors interested in the rubber business were also drawn to Chettiars. Tan Chay Yan, Malaya's first commercial rubber producer, planted rubber in Malacca in 1872 with credit assistance from the Chettiars. Customers of the Chettiars also included well-known figures such as Tan Kah Kee and Tan Cheng Lock. Cheng Lock borrowed $10 million from several Chettiars in Malacca alone by 1921.

Tan Kah Kee, popularly known as the “Rubber King,” took out debts from Chettiar lenders. In fact, before he could borrow, he had to pay off his father's debt to the Chettiars. With ties to the Chettiars, he eventually came to own 7,000 acres of rubber estates in Johor, Perak, Selangor, and Singapore. Despite the fact that the Chettiars were not successful in mining, a large number of them did own rubber plantations.

The Chettiars also served as a channel for Tamil estate workers to send money as well as a sort of bank for the labourers to deposit money that would earn them interest when they withdrew money to be sent to Madras. As early as 1907, several influential Chettiars were involved in negotiations with British officials in the Indian Immigration Committee for the mass recruitment of Tamil labourers. They themselves were among the pioneer recruiters of Tamil labourers alongside the Europeans since the mid-19th century.

The Chettiars were also engaged in ‘toddy’ (palm wine) contracting activities. They gained a fortune from the selling of the product in their own plantations. Planters such as MRMN Nagappa Chetty in Klang, Selangor; Supramaniam Chetty in Rantau, Negeri Sembilan; Veerappa Chetty in Alor Setar, Kedah; and Ratnam Chetty in Tanah Merah, Kelantan, were among the Chettiar toddy contractors.

The Chettiars were not, unsurprisingly, lenient to members of their own ethnic group. Thambimuttu, a Public Works Department (PWD) contractor in Seremban, for example, borrowed $647 from Arunasalam Chettiar in 1908. The latter eventually went on to claim the land mortgaged by the former in order to obtain the loan.

In 1909, Muthucalley Servai failed to pay a loan owed to a Chettiar, prompting the Seremban court to order the State Engineer to settle Muthucalley’s debts of $477.88, including court expenses. A similar case occurred in 1905, when Vellayan Chetty petitioned the employer of one Thampiah, a PWD labourer, to ensure that he paid his obligation in accordance with a court decree.

PWD labourers also often borrowed money from the Chettiars. Sinniah, a Seremban Sanitary Board labourer, borrowed from Meyappa Chetty in 1922. SPKN Vellayan Chetty and NH Vyravan Chetty provided money to Thampiah and Muthukarpen (PWD labourers) in 1906. Ramasamy, a fireman in the Taiping Railway Department, borrowed money from Sithambaram Chetty in 1928.

Malay aristocrats

The Chettiars were also one of the key financial sources for the Malay aristocrats. For example, in 1903, Raman Chetty loaned $11,350 to the Raja Muda of Perak. Tunku Laksamana of Perak borrowed $251 from RMP Supramaniar Chetty in 1912. Negeri Sembilan’s Tengku Nila binti Tengku Ja’afar borrowed $860 from a Chettiar in Seremban.

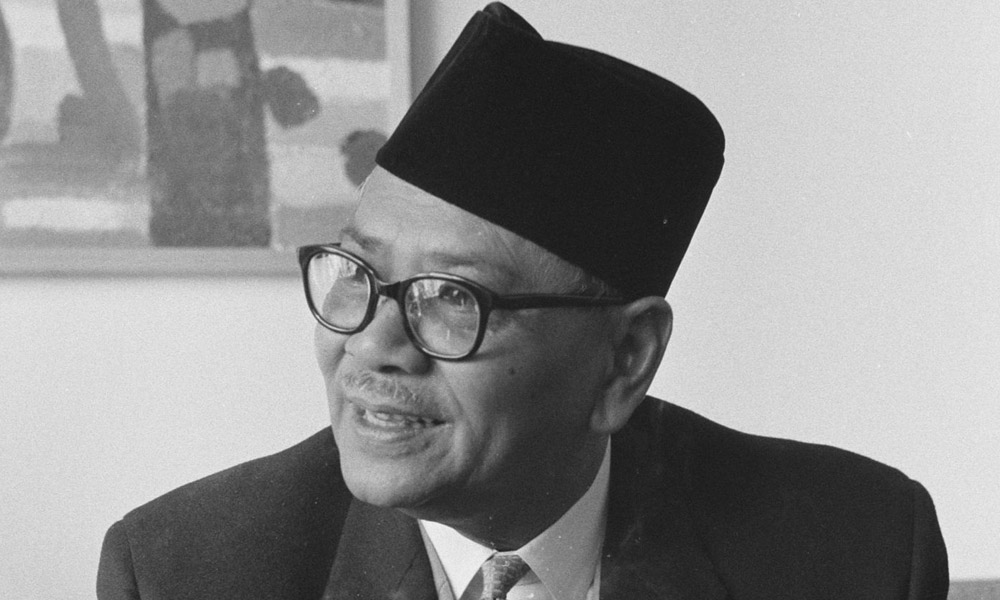

Even as late as the mid-1930s, when Malaya was recovering from the Great Depression, the Chettiars were still able to fund the commercial activities of the Malay aristocrats. Tunku Abdul Rahman of the Kedah nobility, who was the District Officer of Kulim at the time, borrowed $4,636.58 from a Chettiar in 1935. As collateral, he had pledged a piece of land.

In the 1930s, his mother, Che Manjalara, and sisters, Tunku Kalsom and Tunku Rokiah, also borrowed money from Chettiars for their businesses. Tunku’s mother was financially supported for by Karuppiah Chettiar and Muthukarpen Chettiar, while Kailasam Chettiar and SLN Palaniappa Chettiar lent money to her sisters.

During the economic recession, some low-income civil officials also became Chettiars’ customers. Clerks in the Straits Civil Service who earned less than $150 per month borrowed from Chettiar for festive purposes. As early as 1882, Malay constables in Penang borrowed money from Chettiar creditors.

Summing up, Chettiar moneylenders may be judged for their harsh and uncompassionate character in dealings with borrowers, as well as for being directly involved in the emergence of social maladies related to excessive toddy consumption among Tamil estate labourers. Evidently, their uncompromising attitude bolstered their status as a financial capitalist class in British Malaya.

Of course, their historical role in the economic development of British Malaya is frequently forgotten, but it was fairly enormous. The economic landscape of British Malaya would not have taken the shape it did without their financial assistance to venture capitalists in the rubber and mining sectors, as well as the groundwork they laid for Tamil immigration policies. - Mkini

SIVACHANDRALINGAM SUNDARA RAJA is an associate professor at the Universiti Malaya’s History Department. He is a well-known scholar in the field of Malaysian economic history, with numerous local and international research publications to his credit.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.