Wanted for questioning? Taib’s brother and long time business associate Onn Mahmud

Chief Minister, Taib Mahmud’s business-partner brother Onn has left some very awkward questions to be answered in Sydney, where his family lives in one of the city’s smartest houses, over-looking the harbour bridge.

Documents obtained by Sarawak Report plainly show that Onn Mahmud has offered conflicting information to the Australian authorities, in order first to obtain a Business Visa and then to export the profits from a series of multi-million dollar property transactions.

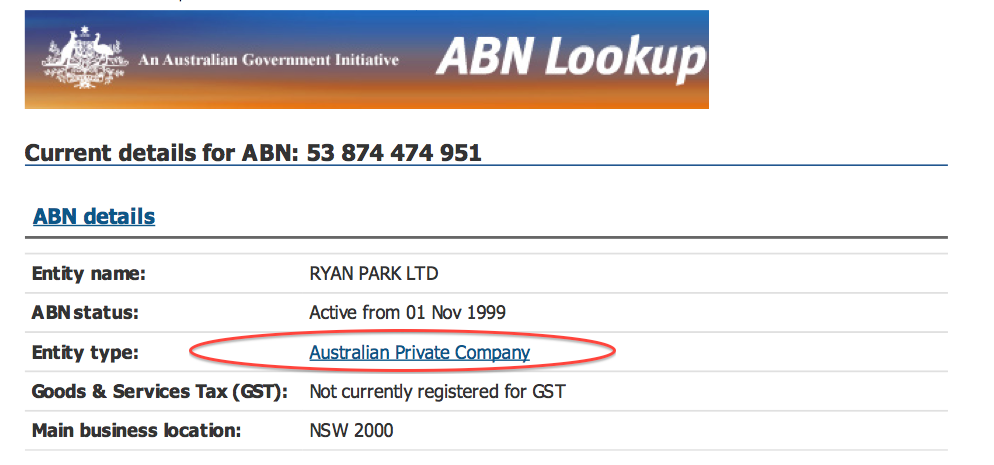

Incorrect information given to the authorities includes claiming that a foreign based company, Ryan Park Limited, which was used to sponsor his visa application, was an “Australian Private Company” registered in Australia.

We can further reveal that Onn Mahmud has bought and sold tens of millions of dollars worth of investments in Sydney real estate, through an elaborate network of off-shore companies, based in the Cayman Islands and managed by a top American bank, Merrill Lynch, from offices located in the Isle of Man.

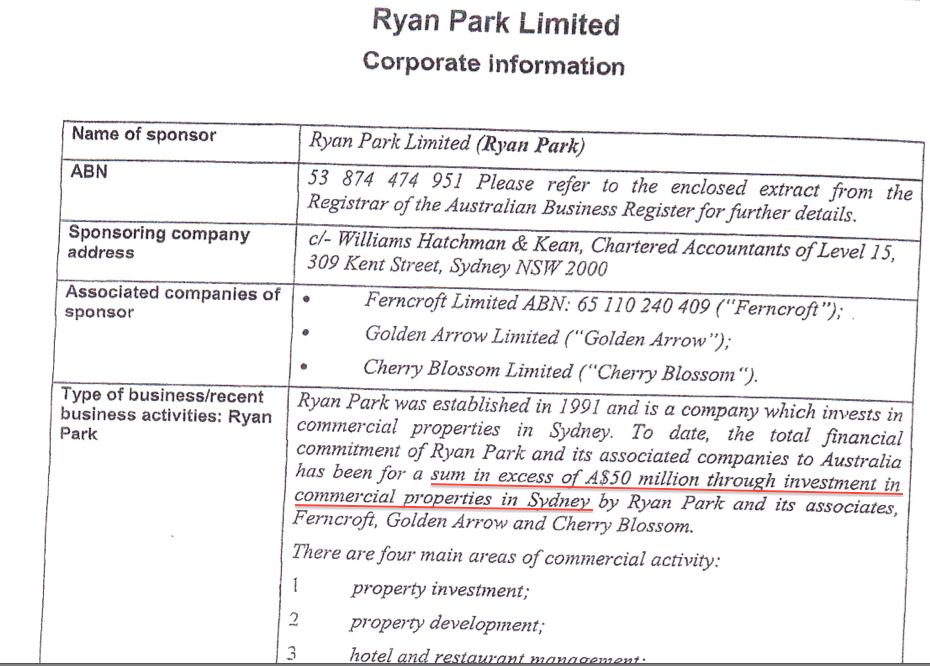

The visa application, submitted by the Chief Minister’s brother to the Australian authorities, clearly states that Ryan Park and its associated companies (which all appear to have been ultimately controlled by Onn himself) owned commercial properties in Australia worth in excess of A$50 million:

“To date, the total financial commitment of Ryan Park and its associated companies to Australia has been for a sum in excess of A$50 million through investment in commercial properties in Sydney by Ryan Park and its associates, Ferncroft, Golden Arrow and Cherry Blossom” [Business Visa Application submitted by Onn Mahmud, 2002]

Visa application – in excess of AUS$ 50 million invested by Onn Mahmud’s companies in Sydney.

The application explains that Onn holds the position of ‘General Manager – Australia” for these companies, acting as their “sole employee”, who “reports directly to the Directors”. However, Onn’s ultimate ownership of the companies is also implied:

“In addition to the investment in excess of A$50 million in the Australian economy, Mr Mahmud and his investment companies are also creating employment opportunities.. ” [page 4, visa application form]

Yet, we can demonstrate that Onn Mahmud appears to have supplied incorrect details to obtain Australian Business Numbers (ABN) for one of the companies Ryan Park Limited, which is described as an “Australian Private Company”, although it does not in fact exist on the Australian Company register (ASIC).

The company Ryan Park Ltd was used to sponsor a visa application for Onn Mahmud. However, it is not an Australian Private Company as claimed. There is no trace of its incorporation on the Australian Company Register (ASIC).

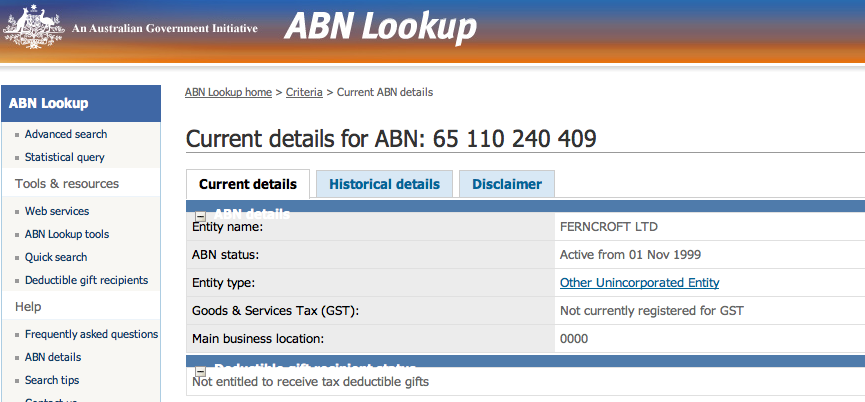

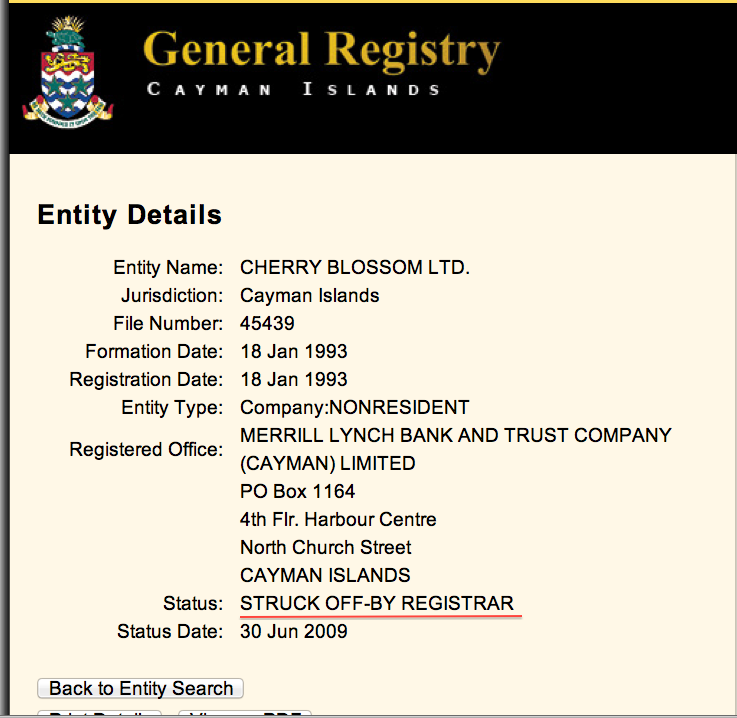

Another of the companies, Ferncroft Limited, is registered as an “other unincorporated entity“. Under Australian business rules this definition is supposed to apply to an association involving “a number of people grouped together by a common purpose with club-like characteristics, for example, a sporting club, social club or trade union”.

Ferncroft Limited is registered as an “Other Unincorporated Entity”.

Such an association should have “club-like characteristics” such as “there are members of the association” and ”there is a constitutional arrangement for meetings of members and for appointing officers”. Therefore, Sarawak Report questions whether this is the correct registration for a property company, which developed and then sold a major office block in Elizabeth Street, Central Sydney at a considerable profit.

The other two companies controlled by Onn (Golden Arrow and Cherry Blossom) are not even registered with Australian Business numbers for basic tax purposes, although the visa application plainly states they were in possession of millions of dollars worth of Sydney commercial real estate in the form of two hotels.

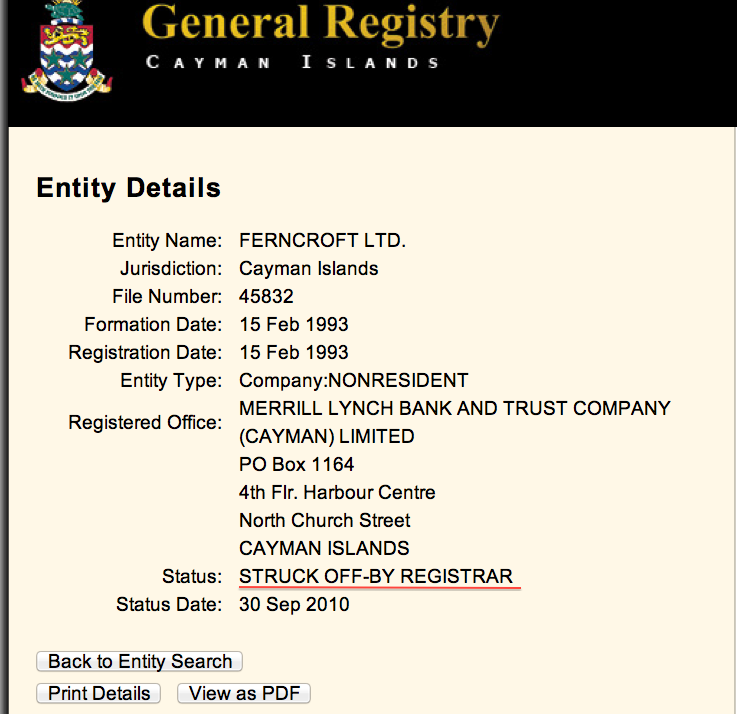

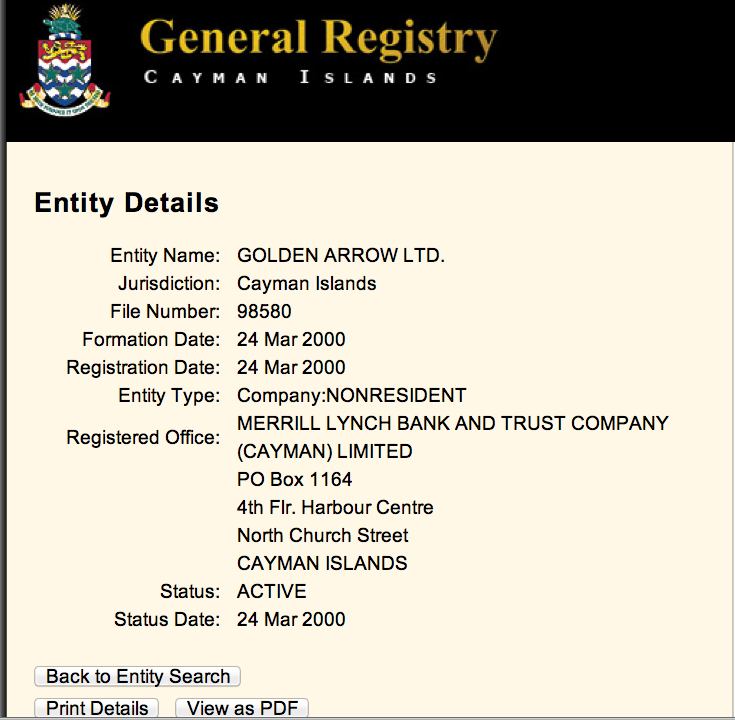

Cayman connection

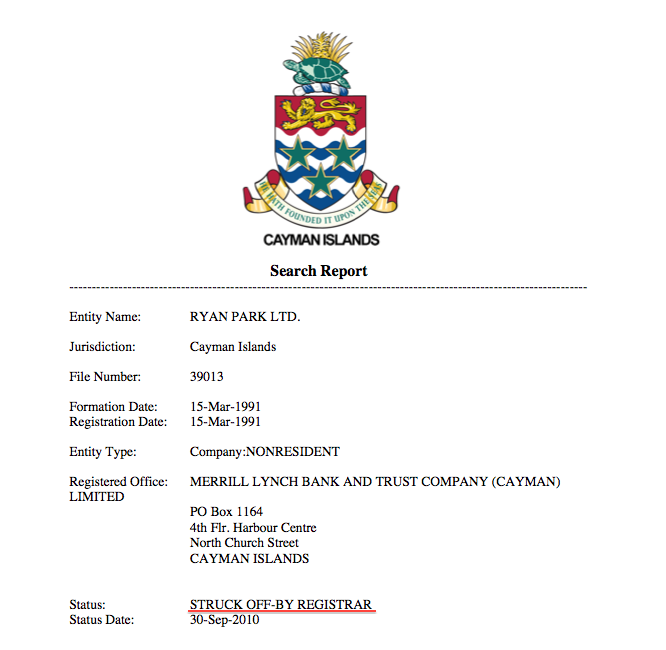

Instead we tracked down all four companies to the Caymen Islands, where they were all incorporated as “non-resident” companies at the time of the visa application (although 3, including Ryan Park Ltd, have now been struck off the register).

Ryan Park was established in 1991, but in the Cayman Islands not in Australia.

Profit on a block left derelict

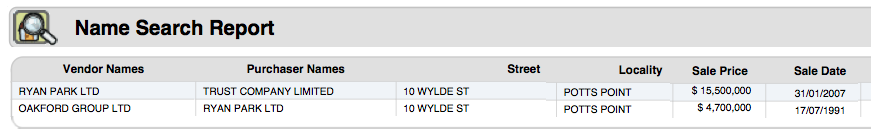

Top apartment block in fashionable Potts Point Sydney – bought by Onn Mahmud in 1991 through Ryan Park Limited.

The irregularities surrounding the registration of Onn’s companies may well be of interest to the Australian tax authorities, which expects all companies to be correctly registered for tax purposes.

This is particularly since it appears that Onn Mahmud came up with a different story about Ryan Park Limited, after the company made a large profit selling a major apartment block, Oakford Apartments, in one of Sydney’s smartest areas, Wylde Street, on Potts Point.

At the time of his visa application Onn had recorded Ryan Park Ltd as an Australian Private Company and detailed business plans to “extensively redevelop and upgrade” Oakford, creating numerous jobs in the process.

The block was part of a portfolio of hotels, offices, apartments and restaurants listed as part of the company’s wider business in Sydney.

Just shy of A$11 million profit

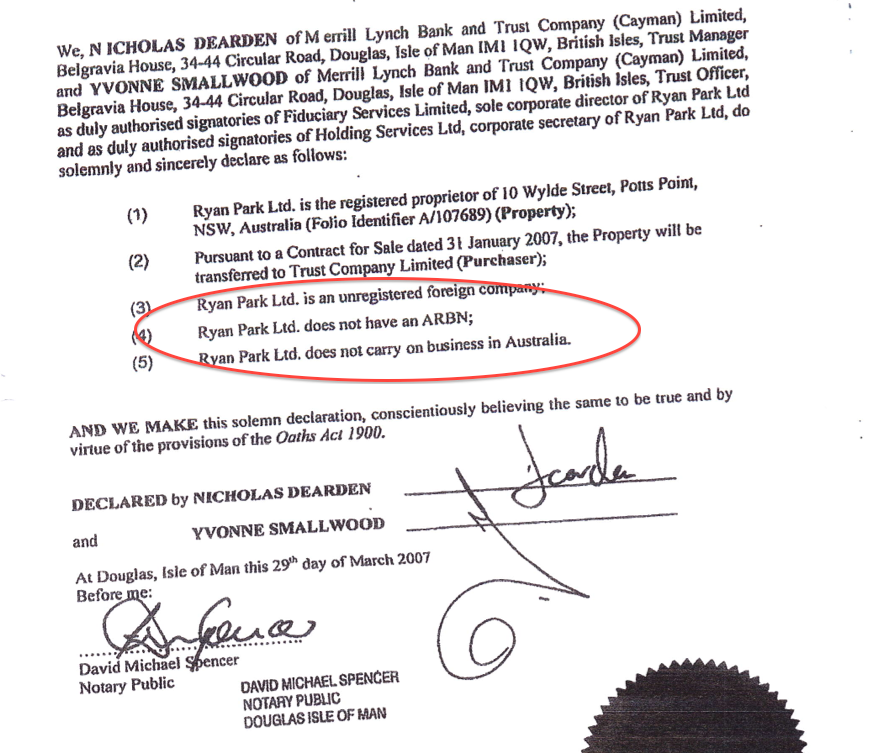

However, 5 years later Onn merely re-sold the property in a derelict state for A$15.5 million, representing an A$11 million profit on his original purchase price of A$4.5 million. At this point his Cayman Island bankers (Merrill Lynch) signed a statutory declaration in the Isle of Man, swearing that Ryan Park Limited was “an unregistered foreign company”, ”which does not carry on business in Australia” and “does not have an ARBN”.

Not an Australian Private Company after all. The ultimate profit from this property investment in Sydney was retained by the offshore company managed from the Isle of Man.

Squatters paradise. The Oakford block in this smart area is now derelict. The pool dangerously boarded over, the gate un-guarded and windows ajar on the ground floor (photo July 2012).

We therefore suggest it is time Onn Mahmud corrected the recorded details about his companies and rectified any discrepancies with the authorities. For the record we also note that Onn Mahmud ceased to be a Director of the Hotel Valentine on George Street in 2004, handing over to his wife, Halimantan Abdul Ghani, who runs the enterprise through the company Donmastry.

Politically exposed person

287 Elizabeth Street – a major office block in Central Sydney that was bought and redeveloped by Onn’s company, Ferncroft Limited, then sold.

Meanwhile, Sarawak Report is concerned that the scale of Onn’s investments in Australia, raises serious questions as to how the brother of Sarawak’s Chief Minister had so many millions to invest?

Given Onn’s status as a Politically Exposed Person in Malaysia, these are questions that ought to have been carefully investigated by the banks and other professionals involved in assisting his operations, because of concerns about money laundering.

Any such enquiry would have revealed Onn to be a businessman operating in close association with a corrupt state government dominated by his own brother?

Taib’s business partner

In fact, as Sarawak Report has already documented, for years Onn Mahmud acted as Taib’s most obvious business partner, working at the heart of his brother’s family businesses.

For example, Onn was an original Director of the Taib family company Sakto in Canada, which the Chief Minister has finally admitted he set up with his own money in 1983. He was also an original Director of the sister property company Sakti in the US. The other Directors were Taib’s children, another brother Arip and, in the case of Sakti, Taib himself!

Valentine on George Street – another hotel owned by Onn’s hidden trust in the Isle of Man

Even more significantly, Onn performed as the Managing Director and major shareholder of the Taib family’s Sarawak firm CMS, from the time that the family took over the company in 1989 until it was handed over to Taib’s sons to manage in 2004.

Meanwhile, of course, Onn was also (with his wife) the sole shareholder and key Director of Achi Jaya Sdn Bhd, which controls Achipeligo, the company to which Taib handed a monopoly over shipping licences for timber exports.

Industry insiders have told Sarawak Report that this monopoly has been worth US$2billion a year over the past three decades in terms of kickbacks. Indeed, in 2007 the Japanese tax authorities identified several million which had been paid by certain shipping companies to an Onn related company in Hong Kong called Regent Star.

Hong Kong connection

Sarawak Report has obtained further evidence that the money used to buy properties in Sydney for Onn Mahmud’s companies was transferred by his bankers Merrill Lynch from Hong Kong via their Singapore branch.

We have also learnt that the entire portfolio is managed by this major US Bank (now taken over by the Bank of America) under a trust set up in the Isle of Man, which controls the Cayman Island company network. With the striking off of the other companies, this trust is now believed to be managed through the remaining company Golden Arrow Limited.

Malaysian cuisine, managed by Onn’s wife in her ’boutique hotel’ in Sydney – Valentine on George Street.

This is just one of a series of Taib foreign trusts, which we have now identified as being protected from disclosure by “nominee” services performed by reputable international banks.

It is an arrangement that was clearly designed to provide maximum secrecy over Onn’s identity as the ultimate controller of the money which was flowing through Australia after this series of lucrative property transactions.

Failure by Malaysia to curb its own corruption does not release banks like Merryl Lynch from their own rules and America’s laws on assisting money laundering, as UBS is likewise discovering with the criminal investigation underway over its handling of millions of dollars associated with Musa Aman.

We challenge Bank of America to provide us with information about what steps Merrill Lynch under-took to ensure that the millions hidden by Onn in their managed trust account in the Isle of Man did not represent the laundered profits from Sarawak’s illegal logging practices?

You want to ship it all out? Apply to my brother Onn for a licence first.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.