The Employees Provident Fund (EPF) has declared a dividend rate of 6.90 percent for conventional accounts for 2017, with a payout amounting to RM44.15 billion and 6.40 percent for Simpanan Shariah for 2017, with a payout amounting to RM3.98 billion.

In a statement today, EPF said, the payout for 2017 amounted to RM48.13 billion, an increase of 29.8 percent from 2016.

Chairperson Samsudin Osman said the overall performance in 2017 was also a landmark year for the EPF as it was now managing two savings schemes and declaring two dividend rates.

“Simpanan Shariah has shown a strong performance considering that this is its first dividend declaration.

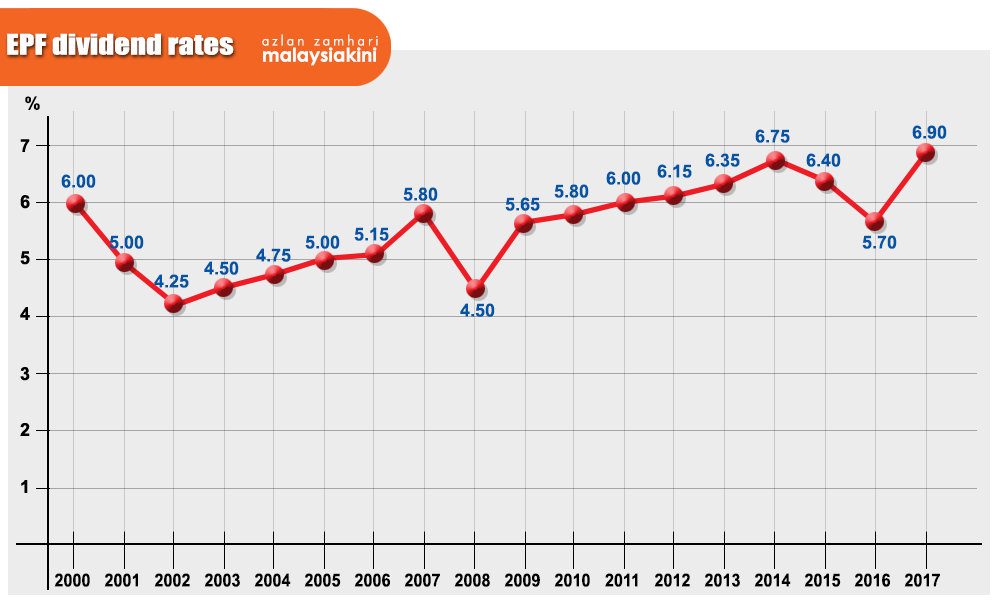

“This reaffirms the strength and health of EPF’s shariah assets and should come as good news to our members who have switched to Simpanan Shariah. As for conventional accounts, the 6.90 percent was the highest rate ever announced since 1997,” he said.

EPF said the dividend payout for each account was derived from total gross realised income for the year after deducting the net impairment on financial assets, unrealised losses due to foreign exchange rate and derivative prices, investment expenses, operating expenditures, statutory charges as well as dividend on withdrawals.

It said Simpanan Shariah derived its income solely from its portion of shariah assets while for conventional accounts, a total of 38 percent of the income was generated by its share of shariah assets and 62 percent from non-shariah assets.

Meanwhile, gross investment income for 2017 was RM53.14 billion, the highest since the EPF’s establishment in 1951.

It said of the amount, a total of RM4.60 billion was attributed to Simpanan Shariah, proportionate to its share of total shariah assets while RM48.54 billion was attributed to conventional accounts.

The returns for conventional accounts, it said, were enhanced by the income generated from non-shariah investments following the outperformance of global banking stocks, while Simpanan Shariah did not include conventional banking stocks due to their non-shariah-compliant status.

In addition, EPF said, equity impairments from shariah-compliant stocks, particularly the oil and gas, and telecommunications counters, lowered the income of the EPF’s shariah portfolio.

Samsudin (photo) said there would always be a deviation in Simpanan Shariah returns from conventional accounts in the short term.

“However, the returns are expected to be similar over the long-term as both share the same investment objectives and strategies.

“As a retirement fund, our objective is to preserve and enhance the value of our members’ retirement savings and this can be measured by looking at our declared dividend rates against Malaysia’s inflation rate.

“For 2017, the dividend rates declared for Simpanan Shariah and conventional accounts were 2.61 percent and 3.11 percent respectively over inflation rate of 3.79 percent,” he said.

Generating consistent returns

He said for the past three years, the EPF has declared a rolling three-year real dividend of 3.51 percent and 3.67 percent respectively, which exceeded the fund’s strategic target of two percent real dividend.

On the RM48.13 billion dividend 2017 payout, he said the amount needed to pay one percent dividend was RM7.02 billion, in tandem with the annualised growth of members’ savings of 10.98 percent since 1990.

As at Dec 31, 2017, total members savings amounted to RM768.51 billion, of which RM67.76 billion was under Simpanan Shariah and RM700.75 billion under conventional accounts.

“This is a challenge that goes into managing a large fund like the EPF as we need to generate consistent and sustainable returns for the long run.

“This is partly the reason why we need to diversify into overseas markets as the increase in global asset value helps us realise sizeable gains from different markets and asset classes, which contributed to the overall performance,” he said.

EPF said the RM53.14 billion in 2017 gross investment income increased 14.13 percent from RM46.56 billion in 2016 and the amount has been growing annually at 11.90 percent since 2007, and is equivalent to a gross return on investment (ROI) of 7.30 percent.

Samsudin said the EPF’s investments had been delivering a three-year annualised ROI of 7.30 percent, which was commendable given the EPF’s nature as a balanced fund with exposure in fixed income instruments of about 50 percent.

EPF added that the crediting of the 2017 dividend would be made on Sunday, Feb 11, 2018, and members can check online via the EPF website or through the i-Akaun mobile app.

Members who wish to switch to Simpanan Shariah 2019 may do so by registering before Dec 24, 2018.

- Bernama

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.