As Putrajaya plans the upcoming budget around its Shared Prosperity vision, academics have pressed for a bigger focus on welfare and wages.

Presenting his thoughts at the Budget 2020: Making Shared Prosperity a Reality forum today, economist Jomo Kwame Sundaram said he foresaw a global recession and stressed that an expansionary budget was necessary to weather the risks.

The upcoming budget needs to allocate a bigger portion of public funds on healthcare, education and social protection so that more Malaysians benefit from these programmes, he said.

Jomo lauded Putrajaya’s focus on technical and vocational education and training (TVET) as well as on the recently announced free breakfast initiative for primary school students.

For the latter initiative, he proposed local smallholder farmers be prioritised to supply food to schools as this would stimulate the domestic agriculture sector and encourage more food crops.

“It needs to be an all-government approach where the education ministry works with the health ministry and with the agriculture ministry as well as other ministries, and very importantly, (they must) work with civil society,” he added.

Rather than highways and petroleum, Jomo proposed that the country’s fiscal policy stimulate the economy in a more sustainable way by supporting the renewable energy sector.

This was especially as global demand for such products was on the rise.

In particular, local entrepreneurs should be incentivised to research and develop products like photo-voltaic solar cells and palm oil-based biodiesel, he said.

Tax incentives for higher wages

Think tank Ideas, who organised the forum, proposed that Putrajaya incentivise corporations to pay employees a “living wage” and not just the minimum wage.

Presently, the national minimum wage is RM1,100.

Rather than impose a blanket policy, which research director Laurence Todd forecasted would hurt businesses, he said firms could be given tax incentives when they paid above the minimum wage.

Another suggestion was to implement employee equity schemes where workers, especially those who earned less, would be given shares of the company they worked at.

Todd said that this would distribute profits back to the people who worked for them, giving employees a bigger share of the economy.

Capital Gains tax

To deliver the Shared Prosperity goal, Todd analysed that Putrajaya would need to widen its tax base and proposed that a five percent capital gains tax be introduced.

Capital Gains tax is usually applied on profits garnered in the sale of assets.

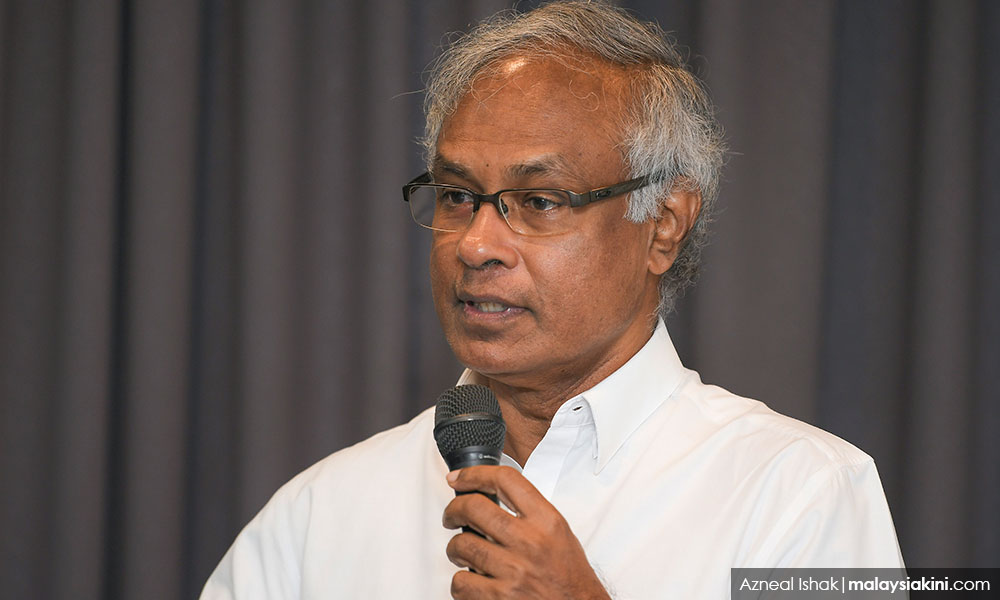

Panellist and former lawmaker Dr Michael Jeyukumar (photo) agreed with this new tax, adding that it was already implemented in countries like India.

The PSM chairperson was particularly concerned about countries in the ASEAN were competing in what he termed a “race to the bottom” when it came to corporate tax.

As Malaysia’s neighbouring countries lower their corporate taxes in a bid to attract foreign direct investment, he hoped Putrajaya would resist the urge to do the same.

“If we don’t stop this race to the bottom, the government will have no money to spend [...] if we can’t get the wealth, this will affect this shared prosperity vision,” he cautioned.

The budget is slated to be tabled in the upcoming Dewan Rakyat sitting which begins on Oct 7. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.