The criminal trial of former prime minister Najib Abdul Razak involving the alleged abuse of power and money laundering of 1MDB funds enters its 15th day today at the High Court in Kuala Lumpur.

Malaysiakini brings you live reports of the proceedings.

KEY HIGHLIGHTS

- Najib gave approval for 1MDB-Aabar joint venture - witness

- Jho Low said proposed Aabar JV to majorly impact GE13 - Shahrol

- 'Boss will bulldoze' letter of support for US$3b bond

- TRX joint venture proposal similar to Petrosaudi's 2009 JV

- IPIC purportedly made proposal for Aabar-1MDB joint venture on TRX

- 1MDB's legal counsel Jasmine Loo worked closely with Jho Low

- Jho Low proposed Goldman Sachs to 1MDB as financial adviser

- Najib never contradicted instructions from Jho Low to me - Shahrol

- 1MDB Energy paid over US$1.48b to Genting, fake Aabar in Oct 2012

- 1MDB borrowed RM800m from Affin to buy over Mastika Lagenda

- Najib's actions 'tallied perfectly' with Jho Low's talking points - witness

- 'Jho Low arranged US$577m payment in order to misappropriate it'

- Witness identifies Tarek Obaid, Rosmah and her children in photo

- Ex-1MDB CEO identifies photo of Aabar's Husseiny hugging Najib

- 'Questions would've arisen on fake Aabar if matters not rushed'

- Fake Aabar used real Aabar's address in agreement with 1MDB - witness

- Ex-1MDB CEO didn't notice fake Aabar's address when signing agreement

- What happened to US$577m security deposit? I don't know, says Shahrol

- 'Tanjong Energy should've brought profit, public listing never happened'

- 1MDB took RM6.17b loan to acquire Tanjong Energy in 2012 - Shahrol

- Pressure from Jho Low to 'seal the deal' of Tanjong Energy acquisition

- Not informed why Falcon Bank was chosen to open account - witness

- 1MDB can't engage new loans without Najib's approval after May 2009

Thank you for following Malaysiakini's live report

Thank you for following our live report today.

Lead DPP Sri Ram jokingly asks if proceedings can extend to 8pm

4.45pm - The court bursts into laughter when lead DPP Gopal Sri Ram jokingly asks whether proceedings can continue up to 8pm.

Chuckles reverberate across the courtroom as former Federal Court judge Sri Ram makes the application jokingly as former 1MDB CEO Shahrol Azral Ibrahim Halmi ends his witness statement at page 242 for the day.

After the hilarity subsides, Kuala Lumpur High Court judge Collin Lawrence Sequerah adjourns the proceedings for the day and resume at 9.30am tomorrow.

Najib gave approval for 1MDB-Aabar joint venture - witness

4.30pm - The court hears that the then prime minister and finance minister Najib Abdul Razak approved in 2013 for a joint venture between Aabar Investments and 1MDB for global investment activities.

Former 1MDB CEO Shahrol Azral Ibrahim Halmi (photo) says that the approval was given by Najib through a "Special Rights Redeemable Preference Shareholder's Resolution in Writing" dated Feb 25, 2013.

According to Shahrol, Najib had given the approval in his capacity as the Minister of Finance Incorporated (MOF Inc) and as the special rights redeemable preference shareholder for 1MDB.

In his testimony, he says that the company's board of directors through a directors' circular resolution dated March 12, 2013, agreed to issue bonds worth US$3 billion through 1MDB Global Investments Ltd.

Jho Low said proposed Aabar JV to majorly impact GE13 - Shahrol

4.24pm - Wanted businessperson Jho Low told former 1MDB CEO Shahrol Azral Ibrahim Halmi that the Aabar joint venture would have a major impact on the 13th general election.

"Low also informed me at the time that the Aabar joint venture will have a major impact on the 13th general election.

"I did not ask further about it. I merely concluded that the fundraising definitely has something to do with GE13," he says.

Shahrol was referring to the 1MDB director circular resolution (DCR) passed on Feb 25, 2013, to form a joint venture with Aabar for global investments.

He says the planned US$6 billion joint venture involved 50:50 split between 1MDB and Aabar.

'Boss will bulldoze' letter of support for US$3b bond

4pm - Former 1MDB CEO Shahrol Azral Ibrahim Halmi claims that Jho Low once told him the then prime minister and finance minister Najib Abdul Razak will ensure the Finance Ministry will issue a letter of support (LoS) in relation to the issuance of US$3 billion bonds from 1MDB Global Investment Ltd.

He says Low told him that "boss will bulldoze, don't worry" - meaning that the LoS for the 1MDB-GIL bonds will be expedited - when questioned if there was sufficient time to obtain the letter.

The bond issuance followed the signing of a 50:50 joint venture agreement on March 12, 2013, between Aabar Investments PJS and 1MDB to form a US$6 billion strategic acquisition fund.

The US$3 billion raised from the bonds would represent 1MDB's 50 percent share.

TRX joint venture proposal similar to Petrosaudi's 2009 JV

3.50pm - Under examination by DPP Gopal Sri Ram (photo), former 1MDB CEO Shahrol Azral Ibrahim Halmi tells the court that he saw that there were several similar characteristics between this TRX joint-venture proposed by IPIC with the one that 1MDB had entered with Petrosaudi in 2009.

Gopal: Did it anyway resemble the joint venture with PSI?

Shahrol: Yes. The 2009 JV proposal from PSI also included a joint venture company in which the joint venture partners were to inject assets and cash.

Gopal: Similar to this proposal?

Shahrol: Correct

Gopal: And the time committed to putting these transactions through, was it short, long, or medium?

Shahrol: It was very short. And one of the similarities, the letter IPIC Group (sent) to Najib, the one Lodin brought to the board, was sufficiently detailed up to the costs and book values, similar to the earlier one to be injected to PSI (in 2009).

However, Shahrol adds that the joint venture proposed by IPIC for Aabar and TRX did not materialise.

IPIC purportedly made proposal for Aabar-1MDB joint venture on TRX

3.40pm - Shahrol Azral Ibrahim Halmi tells the court that in 2012, IPIC had purportedly made a proposal for a joint venture between Aabar and 1MDB to work on Tun Razak Exchange (TRX).

According to the former 1MDB CEO, IPIC had suggested for larger cooperation between Aabar and 1MDB which would involve consolidation of real estate assets between Aabar and TRX.

This would purportedly help 1MDB to finance the development of TRX infrastructures.

Shahrol testifies that a letter by IPIC on this, dated Nov 6, 2012, was sent to 1MDB and later discussed in a 1MDB board meeting in Dec that year.

He says the then chairperson of 1MDB board of directors, Lodin Wok Kamaruddin, had tabled the letter in the board meeting.

Shahrol says everyone at the meeting believed that Najib Abdul Razak was aware of the content of the letter from IPIC and the then prime minister had given the go-ahead for the joint venture.

1MDB's legal counsel Jasmine Loo worked closely with Jho Low

3.10pm - 1MDB's legal counsel Jasmine Loo was working closely with Jho Low in carrying out the mandate in accordance to the wishes of then premier Najib Abdul Razak, the court hears.

Shahrol Azral Ibrahim Halmi testifies that Loo had been working at 1MDB for at least a year, and the direction to issue a mandate to deal with various transactions came from Jho Low.

"In my mind, at the time, this just confirmed my trust that Jasmine (Loo) would execute according to the wishes that would be Najib's (and conveyed by Jho Low)," Shahrol tells lead DPP Gopal Sri Ram during examination-in-chief.

Jho Low proposed Goldman Sachs to 1MDB as financial adviser

3pm - The court hears that controversial businessperson Jho Low had proposed Goldman Sachs to be the financial adviser for 1MDB and its group of companies in 2012.

Former 1MDB CEO Shahrol Azral Ibrahim Halmi testifies that the suggestion was made by Low in early 2012.

In his testimony, the witness says he had informed 1MDB board of directors during its special meeting on June 21, 2012, that Goldman Sachs had been selected to be the group's adviser due to its in-depth understanding of 1MDB's capital structure.

Najib never contradicted instructions from Jho Low to me - Shahrol

2.52pm - There was not a single instance where Jho Low's instructions to former 1MDB CEO Shahrol Azral Ibrahim Halmi was countermanded or contradicted by then prime minister Najib Abdul Razak, the court hears.

Shahrol says this during the examination-in-chief by lead DPP Gopal Sri Ram.

Sri Ram: You said that Low told you the accused knew about this?

Shahrol: Yes.

Sri Ram: Did you verify with the accused?

Shahrol: No. I felt that it would be improper as, since 2009, all directions and instructions with respect to 1MDB matters that were conveyed to me by Low from Najib have proven to be consistent with the subsequent action and approval from Najib. Moreover, there was not a single instance in which these directions from Low (to Shahrol) were countermanded or contradicted by Najib.

A bit later when reading out his Witness Statement, Shahrol says he believed that all directions by Low were from Najib himself and that the then prime minister knew everything that was done by Low.

1MDB Energy paid over US$1.48b to Genting, fake Aabar in Oct 2012

2.45pm - The court hears that 1MDB Energy Ltd's account with Falcon Bank in Hong Kong received US$1.64 billion on Oct 19, 2012 as part of its US$1.75b bonds issued for the purpose of taking over Genting's power assets.

Former 1MDB CEO Shahrol Azral Ibrahim Halmi testifies that on the same day, 1MDB Energy had withdrawn transactions of US$692 million to pay to Genting Power Holdings, and US$790 million as payment to Aabar Investments PJS Limited.

Proceedings resume

2.37pm - The hearing resumes with former 1MDB CEO Shahrol Azral Ibrahim Halmi continuing his testimony as prosecution witness number 9.

Court breaks for lunch

12.50pm - Proceedings break for lunch and will resume at 2.30pm.

1MDB borrowed RM800m from Affin to buy over Mastika Lagenda

12.30pm - The court hears that 1MDB board of directors had in Oct 2012 approved the company to borrow RM800 million from Affin Investment Bank for the purpose of taking over Mastika Lagenda.

Then 1MDB CEO Shahrol Azral Ibrahim Halmi testifies that the approval was made by the board through a director's circular dated Oct 9, 2012.

He says the board had also given him the power to manage the agreement matters and to sign the agreement on behalf of the company as its CEO and managing director.

Najib's actions 'tallied perfectly' with Jho Low's talking points - witness

12.05pm - According to former 1MDB CEO Shahrol Azral Ibrahim Halmi, he believes that Jho Low was mandated by Najib Abdul Razak to orchestrate all of the company's bonds issuance and IPIC guarantee.

Shahrol testifies under examination by DPP Gopal Sri Ram that his belief originated from his observation of Najib's actions, which Shahrol claims had tallied with talking points that had been prepared by Low.

Gopal: You said you believed that Low was mandated by Najib. What are the reasons you had that belief?

Shahrol: Because at this point in time, I had observed the actions and talking points that originated from Low were fulfilled by the actions of Najib.

Gopal: So in other words, the action taken by the accused corresponds with talking points sent to you by Low.

Shahrol: Actions tallied perfectly.

'Jho Low arranged US$577m payment in order to misappropriate it'

11.55am - Wanted businessperson Jho Low arranged 1MDB's payment of US$577 million security deposit to alleged Aabar Investment PJS Limited in order to misappropriate it, a former 1MDB CEO testifies.

Shahrol Azral Ibrahim Halmi tells the court that investigation showed that the security deposit was arranged by Jho Low to be funnelled into an account controlled by him.

The 9th witness stressed that he did not know the money was meant to be misappropriated by going to Aabar, and that the payment by 1MDB was made in good faith based on documentation prepared by 1MDB's Jasmine Loo and Terence Geh as well as Goldman Sachs' Tim Leissner (photo).

"I would not have approved the remittance if I had known that it would be misappropriated.

"After an investigation was done then I found out that the security deposit was arranged by Jho Low to enable 1MDB money to go into an account controlled by him for the purpose of misappropriation," Shahrol says.

Witness identifies Tarek Obaid, Rosmah and her children in photo

11.45am - The hearing resumes after a short break with DPP Gopal Sri Ram showing a photograph to former 1MDB CEO Shahrol Azral Ibrahim Halmi.

The witness then identifies that those in the photo as Najib Abdul Razak, Tarek Obaid, Najib's wife Rosmah Mansor, and their children Norashman and Nooryana Najwa.

Ex-1MDB CEO identifies photo of Aabar's Husseiny hugging Najib

11.05am - The court is shown a series of photographs by DPP Gopal Sri Ram, who then asks ninth prosecution witness Shahrol Azral Ibrahim Halmi if he knows the people in them.

Shahrol, who is a former CEO of 1MDB, then identifies those in the photographs as the accused Najib Abdul Razak, Jho Low, and one Husseiny (Mohammed Badawy al-Husseiny) whom the witness identified earlier as related to Aabar.

It includes a photograph where Husseiny was hugging Najib.

Gopal then asks Shahrol to circle the men he identified with a red pen, and mark them as A, B and C, respectively.

'Questions would've arisen on fake Aabar if matters not rushed'

10.50am - If matters were not rushed, questions would have arisen on the suspicious aspects of Aabar Investment PJS Limited, the court hears.

Former 1MDB CEO Shahrol Azral Ibrahim Halmi says this about the whole expedited process of the collaboration agreement for credit enhancement between 1MDB Energy Limited and Aabar Investment PJS Limited dated May 21, 2012.

"The element of speed had always been there when we move at speed. We have entrusted each of the working parties to do their bit and to do so in the best interest of the country and company.

"Had they been given more time, there would probably have been questions raised on the peculiar aspect of the company (Aabar Investment PJS Limited (BVI))," Shahrol says.

Fake Aabar used real Aabar's address in agreement with 1MDB - witness

10.49am - The fake Aabar company had used the real Abu Dhabi-based Aabar's address when it entered into a "Collaboration Agreement for Credit Enhancement" with 1MDB in 2012, a witness testifies in court.

Then 1MDB CEO Shahrol Azral Ibrahim Halmi says that he was confident of signing the agreement on May 12, 2012 as there was not much difference in the company's name, and it had used the real Aabar's address at 187 Floor, Ministry of Energy Building, Corniche Road, PO Bx 107888, Abu Dhabi, United Arab Emirates.

"I had been to this address to deal with IPIC and the real Aabar. So it was using the legitimate address of IPIC and real Aabar, while the short-form used in this agreement was 'Aabar Investments'.

"Thus, I did not notice at all that it was a different company which was Aabar Investments PJS Ltd (British Virgin Islands)."

Shahrol testifies that he only realised that there was a difference between the real Aabar and fake Aabar, where the latter had the word "Limited", when news broke out about the 1MDB scandal.

Ex-1MDB CEO didn't notice fake Aabar's address when signing agreement

10.45am - The court hears from a former CEO of 1MDB that the company through its subsidiary 1MDB Energy Ltd had entered an "Option Agreement" with Aabar Investments PJS Ltd on May 18, 2012.

Shahrol Azral Ibrahim Halmi testifies that he did not have any experience in such financial structure before, and had to rely fully on Goldman Sachs and other board members to give their take on the matter.

He says that the other factor why they signed the agreement was because, with the call option, 1MDB would lock-in Aabar as an investor from Abu Dhabi.

This, Shahrol adds, would fulfil 1MDB's goal of bringing in foreign investments in the energy sector.

However, according to the witness, he did not realise that the address of Aabar referred to in the agreement was in the British Virgin Islands.

For the record, the real Aabar is a company based in Abu Dhabi.

What happened to US$577m security deposit? I don't know, says Shahrol

10.40am - A former 1MDB CEO has no idea what happened to the US$577 million that 1MDB paid to Aabar Investments PJS Limited (BVI) as a security deposit for Aabar's holding company International Petroleum Investment Company (IPIC) to issue a guarantee for bonds to be issued.

This is what Shahrol Azral Ibrahim Halmi testifies during examination-in-chief by lead DPP Gopal Sri Ram.

Shahrol: There was a security deposit that 1MDB needed to pay amounting to US$577 million.

Sri Ram: Was that amount paid?

Shahrol: Yes.

Sri Ram: To which account?

Shahrol: It was an account belonging to Aabar BVI.

Sri Ram: Did you know what happened to the money?

Shahrol: I do not know.

'Tanjong Energy should've brought profit, public listing never happened'

10.35am - Shahrol Azral Ibrahim Halmi tells the court that 1MDB should have gained profit from its acquisition of Tanjong Energy Sdn Bhd (TEHSB) in 2012 when the latter gets publicly listed.

However, according to the then CEO of 1MDB, the public listing of Tanjong Energy never happened.

Shahrol, who is the ninth prosecution witness, testifies this under examination-in-chief by DPP Gopal Sri Ram.

Gopal: Now, the purchase of TEHSB, did it produce any income for 1MDB?

Shahrol: I can't remember if there were any cash that flowed upwards after the acquisition. But the bulk, the profits that should have come, should have come when (we) publicly list the entity, which never happened.

Gopal: So public listing of Tanjong never took place.

Shahrol: Never took place.

1MDB took RM6.17b loan to acquire Tanjong Energy in 2012 - Shahrol

10.25am - The court hears from a former 1MDB CEO that the company entered into a loan facility agreement worth RM6.17 billion with two banks in May 2012 to acquire Tanjong Energy Holdings Sdn Bhd.

Shahrol Azral Ibrahim Halmi testifies that the agreement was signed by 1MDB subsidiary 1MDB Energy Sdn Bhd with Maybank Investment Bhd and RHB Investment Bank Bhd on May 17, 2012.

According to him, the loan was for the 100 percent acquisition of Tanjong Energy's equities.

Pressure from Jho Low to 'seal the deal' of Tanjong Energy acquisition

10.08am - Jho Low (photo) pressured for 1MDB's speedy acquisition of Tanjong Energy Holdings Sdn Bhd in order to quickly "seal the deal" in the high-level negotiation between the Prime Minister's Office (PMO) and Abu Dhabi's crown prince, the court hears.

During examination-in-chief by lead DPP Gopal Sri Ram, former 1MDB CEO Shahrol Azral Ibrahim Halmi says that the matter involved "G to G" (government to government) implication, so the timetable and deadline were driven by external factors which included pressure from Jho Low.

"In this particular case, because of high-level negotiation between the Prime Minister's Office and the crown prince of Abu Dhabi, to obtain the guarantee (linked to the acquisition), we needed to move fast to seal the deal.

"'Seal the deal' was a quote from Jho (Low)," Shahrol says.

Not informed why Falcon Bank was chosen to open account - witness

10.06am - Former 1MDB CEO Shahrol Azral Ibrahim Halmi testifies that he was not informed why Falcon Bank was chosen by 1MDB's Jasmine Loo and Terence Geh to open an account for the sovereign wealth fund's related company, 1MDB Energy Limited.

"I was not informed by Jasmine Loo as well as Terence Geh why Falcon Bank was chosen as the bank for 1MDB Energy Limited.

"As far as I remember, at that time I had no knowledge at all that Falcon Bank had something to do with Aabar and Abu Dhabi.

"It was only in 2015 that I knew that Aabar, through Mohamed Badawy Al-Husseiny, was among the directors of Falcon Bank," he testifies.

Shahrol says he signed as the account holder for 1MDB Energy Limited on May 16, 2012.

1MDB can't engage new loans without Najib's approval after May 2009

9.55am - The court hears from former 1MDB CEO Shahrol Azral Ibrahim Halmi that after the company received government guarantee in May 2009, it could no longer engage any more loan agreements without the approval from the finance minister.

He says this when testifying that then finance minister Najib Abdul Razak had in 2012 issued a letter approving RM6.17 billion bridging loan and US$1.75 billion 10-year notes connected to 1MDB's take over of Tanjong Energy Holdings Sdn Bhd.

Shahrol testifies that without the letter, 1MDB could not have gone forward with the notes.

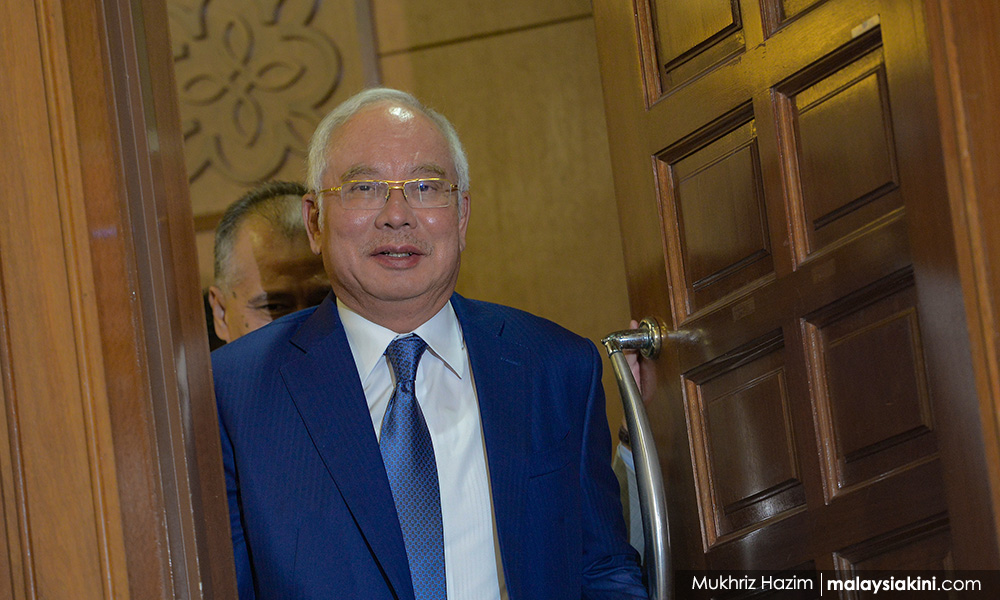

9.45am - Accused Najib Abdul Razak enters the dock as proceedings begin.

Former 1MDB CEO Shahrol Azral Ibrahim Halmi takes the witness stand to resume examination-in-chief by lead DPP Gopal Sri Ram.

9.30am - Accused Najib Abdul Razak enters the court and takes a seat at the front row of the public gallery to wait for proceedings to begin.

Today marks the fifth day of former 1MDB CEO Shahrol Azral Ibrahim Halmi’s testimony in Najib Abdul Razak’s RM2.28 billion 1MDB trial.

As the 15th day of hearing before Kuala Lumpur High Court judge Collin Lawrence Sequerah resumes after 9am this morning, ninth prosecution witness Shahrol will continue to read from page 175 of his 270-page witness statement.

Previously on Thursday, Shahrol, among others, testified that wanted businessperson Jho Low and Goldman Sachs (Asia) CEO Tim Leissner played matchmakers for the meeting of then prime minister Najib and Goldman Sachs CEO Llyod Craig Blankfein at a gathering of potential investors in New York in 2009. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.