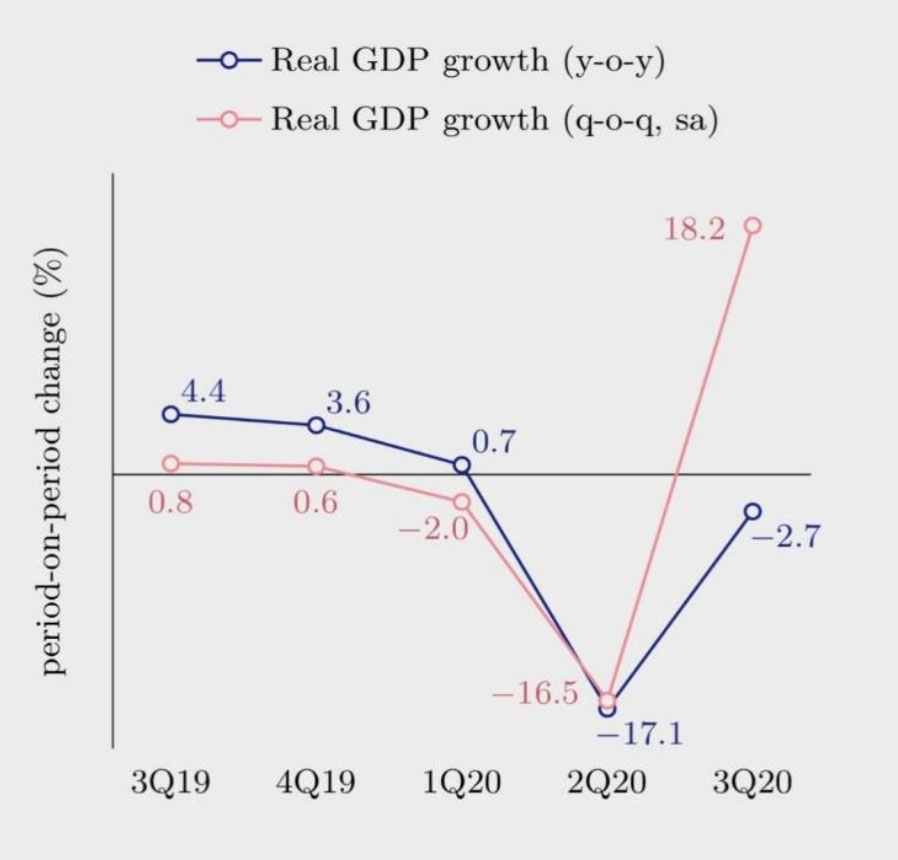

It feels good to be vindicated when the voices of gloom and doom as a result of a deep contraction of 17.1% in Malaysia’s Gross Domestic Product (GDP) for the second quarter were up on the air in September, we at Emir Research were among a few lone voices then that said it’s not the end of the world yet for Malaysia and stressed that the worst is over.

True enough, when the GDP for the third quarter of this year (3Q20) was announced yesterday (Nov 13), it declines less steeply at 2.7% year-on-year (yoy) compared to the previous quarter’s contraction of 17.1% – a whopping 14.4 percentage-point increase.

When viewed on a quarter-on-quarter (qoq) basis, the picture gets better – the economy in the third quarter grew by a spectacular 18.2% compared to a contraction of 16.5% in the previous quarter.

What’s more, the latest GDP number also beats analysts’ estimate of a contraction of a 3.2% yoy. Moreover, as the diagram from Bank Negara Malaysia (BNM) below shows, the recovery is clearly a V-shaped one.

Emir Research has been writing on a V-shaped recovery for quite some time and being data-driven in our approach, we could see that actual monthly and quarterly economic figures of the past few months and the past two quarters were moving towards a recovery trajectory.

But we are not dogmatic enough to insist it must be at all costs a V-shaped recovery.

Our view is always premised on a conditional situation and this conditional premise pertains to we will only see this V-shaped recovery as the end goal, once vaccines are found, and even this requires the absence of logistical hiccups once a decision to vaccinate the population is made.

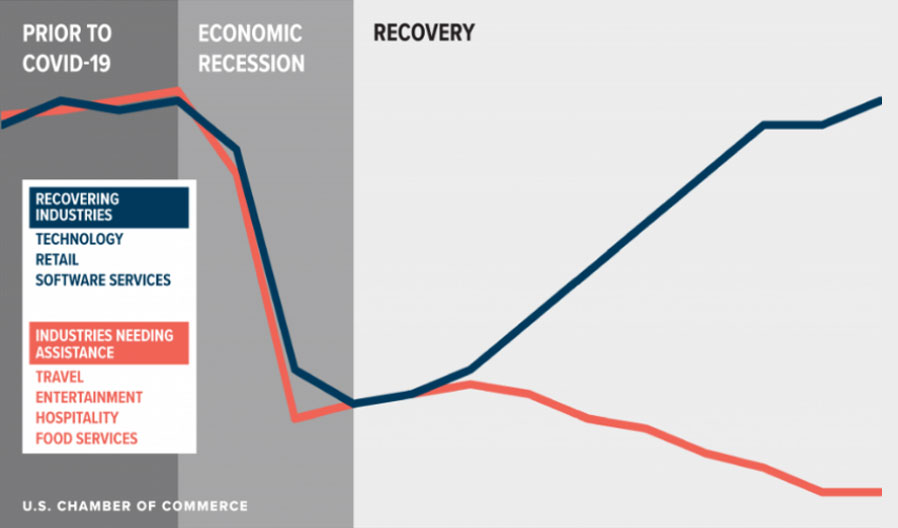

Some experts have recently settled on the alphabet "K" as their recovery of choice. The diagram from the US Chamber of Commerce below shows the divergent lines more accurately represent some portions of the economy are recovering quickly, just like the technology and e-commerce sectors, while others lag behind, like travel, tourism and hospitality. The upward line within the "K" represents those sectors that do well, while the downward line represents those still floundering.

In the Malaysian context, glove companies are doing pretty well, but tourism and aviation are going down the drain – so a K-shaped recovery is also possible here.

Of course, we are realistic enough to know that whether it is a V or K-shaped recovery, it does not mean we are out of the woods or there is an absence of massive sufferings among the rakyat. In the case of the V-shaped recovery, it all depends on which territory the V-shaped recovery is taking place.

From the figure above, it is taking place at the negative territory of the GDP curve which means people are still suffering, and hence an empathetic rakyat-centric budget is still required and is a must.

But at least with a V-shaped recovery taking place, it means the trajectory is towards a full recovery, ceteris paribus, that is, everything else remains constant, full recovery is assured.

However, we know that in real life, ceteris is not necessarily paribus, and in this regard, a failure to pass Budget 2021 by the politicians in Parliament will throw a spanner in the works of attaining a V-shaped recovery.

As mentioned by the discussants of Emir Research’s focus group discussion (FGD), which is confirmed by our latest survey’s findings for the third quarter (3Q20), the pandemic is not the only factor that has exacerbated the worries of the rakyat. Rather, it is more of the politicking of the politicians that concerns them, as time and again it occurs, and when it does, this will definitely have a detrimental effect on the economy.

Pity finance minister

What I am getting at is the V-shaped recovery that has been attained at this point will be shred into pieces once the vote for Budget 2021 doesn’t pass muster.

Even experts have weighed in on this issue such as the prediction of international ratings agency, Fitch Solutions, which expects politics in Malaysia to blunt economic growth for the next decade.

Combined with slower population growth and reduced fiscal space to cushion against negative future economic shocks, Fitch predicts real GDP growth to be at just 3.4 percent over the next 10 years compared to 6.4 percent over the past decade.

At the same time, pity is in order for Finance Minister, Tengku Zafrul Tengku Abdul Aziz (above) for being whacked by some parliamentarians during the budget debate for making an optimistic forecast on the economy in presenting Budget 2021, especially when there is a reason now to be optimistic because of the optimistic GDP third-quarter figures that have now been released.

Nevertheless, the parliamentarians should and must debate as much as they want on the budget, but at the end of the day, please put aside all partisan sentiments and let the budget be passed for the sake of the rakyat, economy and the country.

Coming back to the third-quarter GDP growth, chief statistician Mohd Uzir Mahidin said the economic performance in 3Q20 was uplifted on the supply side by a rebound in the manufacturing sector, while other sectors showed an improved negative growth compared to the previous quarter.

On the demand side, private final consumption expenditure and gross fixed capital formation also registered a smaller decline as compared to the contraction in the second quarter of 2020.

“Overall, the performance in the third quarter was mainly driven by the manufacturing sector which grew 3.3% compared to the decline of 18.3% in the previous quarter, supported by electrical, electronics and optical, as well as vegetable and animal oils and fats, and food processing products.

“The favourable performance was attributed by exports-oriented industries which turnaround to 5% from -13.5% in the second quarter of 2020 and this was reflected in the performance of total exports in the month of September 2020 which recorded a positive double-digit growth,” said Uzir.

Meanwhile, Bank Negara Malaysia Governor Nor Shamsiah Mohd Yunus said the recovery in export performance was driven by E&E exports given the strong demand of work-from-home equipment and medical equipment, resulting in the current account on the balance of payment registering a higher surplus of RM56.1 billion or 7.1% of GDP during 3Q20.

"However, the outlook is still subject to downside risk, whereby the resurgence of Covid-19 cases could impact the global growth, although the risk to economic growth due to the resurgence in cases is not expected to be as severe as observed in the second quarter," she said during a virtual media conference.

BNM keeps this year’s GDP contraction forecast at between 3.5% to 5.5%. It expects GDP is to recover in 2021 in the range of 6.5%-7.5%.

JAMARI MOHTAR is director of media & communications at Emir Research, a think-tank focused on strategic policy recommendations. - Mkini

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.