Come July, the Companies Commission of Malaysia (CCM) will come down hard on individuals hiding behind proxies to obscure their beneficial ownership in a company.

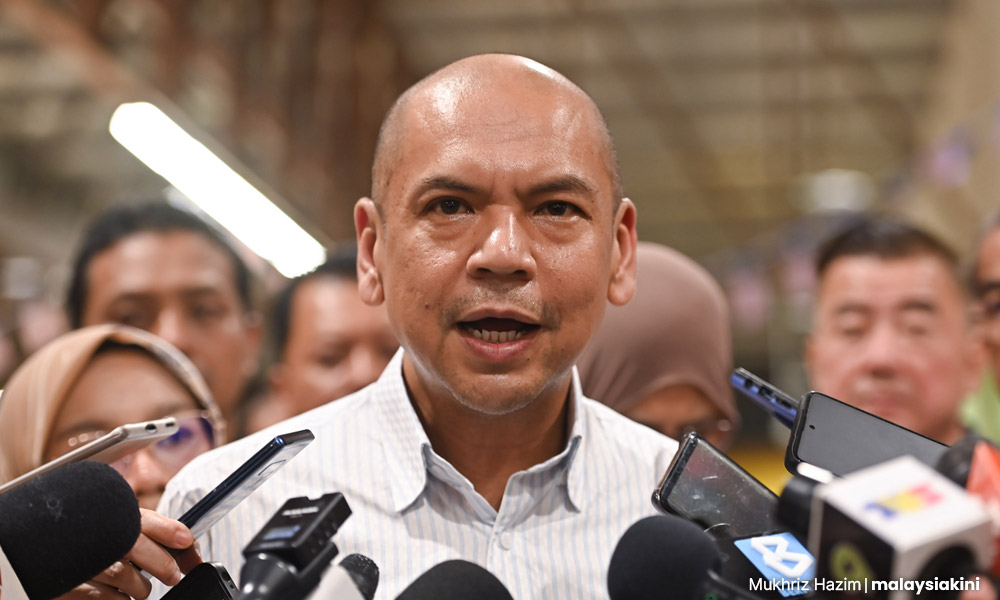

CCM corporate compliance division director Norhaiza Jemon said failing to comply is a criminal offence which carries a penalty of up to RM50,000 fine, three years imprisonment, or both.

This covers beneficial owners and their proxies, directors, as well as secretaries of companies.

“The first step will be to compound those who have not complied. Then we will give them a chance to correct their compliance,” she said.

However, Norhaiza said the list of beneficial owners will not be made public, and only the minister will decide who can view the list.

“Apart from reporting agencies and law enforcement, the list will remain confidential,” she said.

She added that the media and civil society will not have access to the information, including for purposes of news reporting.

“Only those who have a locus like reporting institutions, including foreign and local financial institutions based in Malaysia, and company secretaries.

“This is because they carry out investigations. They have statutory duties.

“Unlike in other countries where beneficial ownership information is freely available, in Malaysia the policy is very much controlled,” she said.

Keeping the identities of the real owners of companies confidential from the public is not to be mistaken as protecting them because law enforcement agencies still have access, said Norhaiza.

“We are not protecting any one of them,” she added.

Minister can exempt if already reporting elsewhere

Under the latest amendments to the Companies Act 2017 (Act 777) effective April 1, all 673,394 companies registered with CCM are expected to submit the names of their beneficial owners.

This includes companies limited by guarantee, such as charitable organisations and foundations.

However, the law allows the minister of domestic trade and living costs to exempt companies that already disclosed this information to other agencies in Malaysia.

Currently, no other law compels companies to reveal beneficial ownership to other agencies.

These changes to the law also address the earlier loose definition of a beneficial owner with the addition of the words “a natural person”, who ultimately owns and has effective control over a company.

“The new definition will cover companies by shares and companies by guarantee and the registrar of companies has issued a guideline for the public to better understand this,” said Norhaiza.

While company secretaries have been tasked with verifying the information provided, the guidelines also specify reasonable measures that must be taken by the company in reporting accurately.

“We will take action against false or misleading information and there are provisions to help us identify who will be held responsible,” she said.

She added that parties who own more than 20 percent of the company will also be considered beneficial owners, while other guidelines are available on the CCM website.

Beneficial owners’ new obligations

Although Act 777 previously made it mandatory for companies to reveal their beneficial owners, the latest changes now compel individuals to reveal themselves.

This means beneficial owners must inform the firms of their real role in the company.

Norhaiza said the new reporting framework addressed legal gaps that upgraded Malaysia to be in line with best practices and international standards endorsed by the Financial Action Task Force (FATF) and the Organisation for Economic Co-operation and Development (OECD).

“Compliance with FATF recommendations assures other countries that its (Malaysia’s) financial system is secure, removing suspicion of it being vulnerable to crimes like money laundering or terrorism financing.

“Being black or grey-listed can bring serious consequences, as such countries will face enhanced due diligence and will struggle to do business.

“For example, if a Malaysian company wants to remit money into another country abroad, our company will be under enhanced due diligence,” she explained.

Countries like North Korea and Myanmar are labelled high-risk by FATF, which are often referred to as “black-listed” by other countries.

For high-risk countries, the organisation calls for extra caution and even countermeasures to curb money laundering and terrorism financing.

Meanwhile, when FATF places a jurisdiction under increased monitoring, such as the Philippines, Vietnam, Türkiye, and Nigeria, it means the country has promised to fix identified problems quickly and under close watch. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.