Two interrelated factors will result in the private healthcare system failing in its role to provide affordable services to most Malaysians except the very rich.

They are the prohibitively high medical insurance premiums caused in turn by the unbridled rise in the cost of private hospital services.

I was shocked to see that the premiums for my medical insurance coverage this year have increased by not 10, not 20, not 30, not 40 but a mind-boggling 50 percent from my last annual payment. And I have not even crossed an age group.

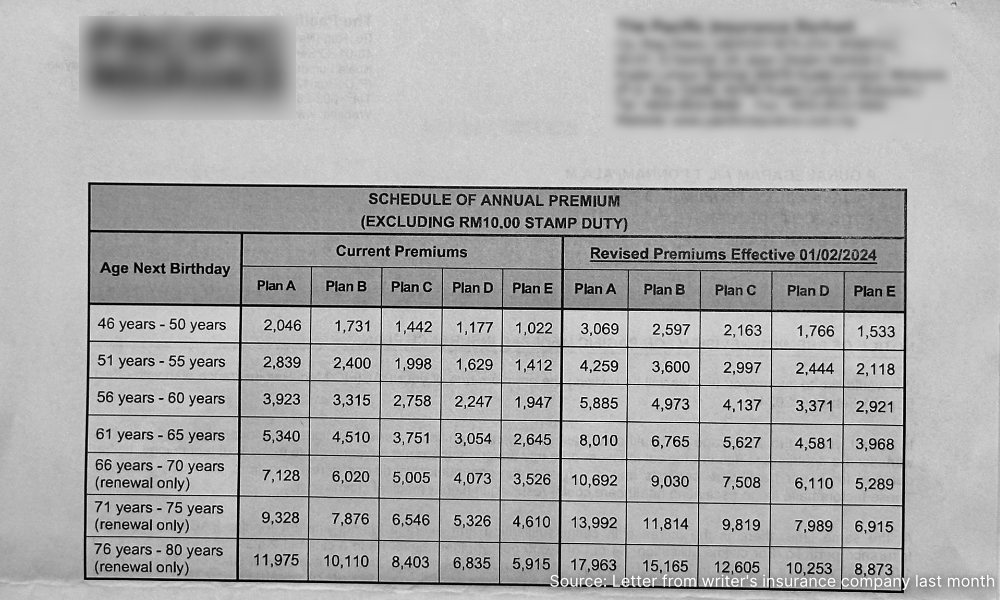

For illustration, I show the rates for my own insurance policy, which I have used for perhaps the last 25 years. I am on Plan C, a moderate plan, and I am 71-75 years of age.

My premium increased for my next year of coverage to RM9,819 from RM6,835 - a surge of 50 percent in just one year. How this was allowed by the regulatory authorities, in this case, Bank Negara Malaysia, is puzzling. What justification is there for such a jump?

In 2018, I paid just RM5,316 in premium and before that RM3,751. In 2006, I paid only RM1,225, showing a sharp increase in premiums.

Yes, costs have gone up and coverage has increased but even then a 50 percent increase in a space of a year is simply too much. I am paying RM818 a month just on medical insurance premiums!

In old age, incomes decrease because most people are in retirement. This is when people need increased insurance coverage. In my case, I claimed no insurance until just three years ago, paying premiums for over 20 years with no return at all.

During that time, the insurance company was receiving free money. However, suddenly they have been allowed to increase yearly premiums by 50 percent across the board. What justifies such an outlandish increase?

With the cost of insurance coverage escalating so rapidly, most salaried workers in the private sector are not going to be able to afford to be covered post-retirement and will be forced to rely on an overburdened government sector, putting a tremendous strain on an already stretched public medical service.

For most workers in Malaysia, if they are employed in the private sector, medical coverage ends with employment - that is if they are lucky enough to get proper medical coverage in the first place. The private sector employs almost 90 percent of the workforce of nearly 16 million.

To avoid being burdened with heavy medical expenses in old age, when they will be most needed, medical insurance premiums need to be at affordable levels so that more people can get services from the private sector.

Private hospitals may be inadvertently killing the golden goose - the middle class - if they keep on to high rates, which seem to be hardly regulated.

The public is now highly suspicious of private hospitals - with insurance coverage there is a greater incentive to overtreat and overcharge.

I don’t deny that many practitioners in private hospitals are highly ethical and do the right thing but one can be sure, as with all professions, that if there are insufficient controls, checks and balances there is room for much abuse and overcharging.

The Health Ministry has to look seriously into the problem of overcharging in private hospitals, otherwise, private hospitals will only make matters far worse, diverting precious resources to serve the whims and fancies, rather than the needs, of a few.

Affordable medical premiums are necessary for proper health care but they must concomitantly be followed by a control in prices charged for all kinds of basic medical services by private hospitals so that insurance companies don’t lose money.

Data from 2022 indicate that private hospitals have some 18,000 beds in Malaysia compared with government hospitals which have 45,000 accounting for two-thirds of beds. Five years ago, government hospitals accounted for nearly three-quarters of beds.

If the trend of decreasing proportion of government beds is to continue, then the cost of private hospital care must start falling, reducing the pressure on premiums.

A 50 percent increase in medical insurance premiums will not increase admissions into private hospitals - in fact, the reverse would happen.

Restricting medical tourism

If private hospitals are dependent on medical tourism, there are already cheaper places. Also, the government can restrict medical tourism on the grounds that limited domestic resources are being used for the benefit of rich foreigners.

If medical costs continue to escalate, government hospitals will end up treating far more than two-thirds of patients (who else can afford to pay at least RM800 in premiums for decent treatment in private hospitals?), an intolerable burden which will break the back of the public health system.

The solution is to regulate rates for medical procedures, keep costs down (10 times the cost outside for a simple mask is just too much as are huge margins for medication), limit over-treatment and subsidise private hospitals.

All of this means that premiums will also have to come down, leading to the start of a virtuous cycle which will utilise private and public resources to make medical care available to all. - Mkini

P GUNASEGARAM says the government must make the provision of good health services to all a major priority. Allowing a 50 percent increase in medical insurance premiums in a single year does the exact opposite.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.