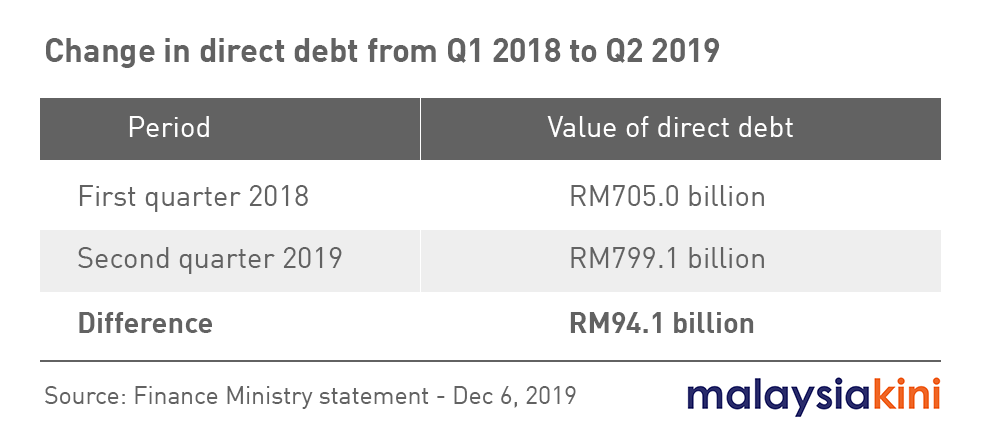

The federal government's direct debt had increased at most by RM94.1 billion between the end of Q1 2018 and Q2 2019, Finance Minister Lim Guan Eng said.

"(This figure) is in stark contrast to the oft-repeated mistaken claim that direct debt had increased by RM245 billion, as made by irresponsible parties," he said in a statement today.

Direct debt was RM705 billion by end-Q1 2018. It was RM799.1 billion as of end-Q2 2019. Pakatan Harapan took over the federal government in May 2018.

Lim said the funds were needed to finance development expenditure, the fiscal deficit and debt repayments, including for 1MDB related matters.

"Finally, total 1MDB debt, including its interest, is RM50.5 billion, which will only be fully paid off by 2039.

"The government will have paid RM13.9 billion to finance debt and interest relating to 1MDB and SRC International Sdn Bhd (SRC) from 2017 until 2020.

"The RM13.9 billion payments for 1MDB and SRC by the government is a direct loss to the people that could have been used for the country's welfare instead," he said.

Lim also said that there was a public misconception on external debt, as opposed to direct debt.

"As published by Bank Negara Malaysia, Malaysia's total external debt stood at RM931.1 billion as of end-June 2019. However, only RM190.0 billion of the external debt belonged to the government through its direct debt," he said.

As a whole, the federal government's debts - which include direct debt, government-guaranteed payments, 1MDB payments and other liabilities - stood at 77.1 percent of the gross domestic product (GDP) as of Q2 2019.

This marked a 2.1 percent reduction since Q4 2017.

Lim said the Cabinet's Debt Management Committee had met on Dec 2 and endorsed the federal government's borrowing programme for 2020, which included the option of issuing another tranche of Samurai bonds.

"Furthermore, the committee evaluated existing and additional government guarantee facilities, and new best practices in assessing and monitoring contingent liabilities using the latest fintech," he said.

He reiterated that the government was committed to lowering debt and liability levels to 65 percent of the GDP by the end of 2025. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.