As of today the movement control order (MCO) is still in place and will only be reviewed tomorrow as to whether a further extension is necessary to break the chain of infection. Given the number of cases it is very likely that a further two weeks extension will be ordered. Many, of course, are waiting with bated breath for the news, including a large section of the small and medium enterprises.

Trade around the world is at a major standstill. Containment of Covid-19 outbreak is one issue; the deteriorating of the economy is another. It is therefore imperative for every government to provide some form of financial assistance to weather through the Covid-19 storm.

Prime Minister Muhyiddin Yassin has unveiled two stimulus packages so far. The intention behind them is, of course, to somewhat ease Malaysians from the burden of Covid-19 outbreak. The first economic stimulus package (ESP) is stated to be valued at RM250 billion. The additional ESP touted as "Prihatin SME" of RM10 billion is stated as additional reliefs provided under the first ESP with the intention to assure two-thirds of the workforce will remain employed. In summary, the additions are as follows:

Wages Subsidy

What is it?

It is a subsidy introduced by the government to allow SMEs to retain its local staff force by subsidising the staff’s wages for a period three months.

How does it work?

Applications can only be submitted by the employer via online Perkeso with this link starting April 9, 2020, until Sept 15, September 2020.

What are the criteria?

The employer and employee must be registered or have contributed under Perkeso;

Employers must be registered under Companies Commission of Malaysia (SSM);

The subsidy is only applicable for employees with RM4,000 monthly salary and below;

The employer must ensure that these staffs are not dismissed, forced to take unpaid leave or a pay cut during the three month period whereby the subsidy is provided. Furthermore, employers are not allowed to dismiss these employees following three months after the end of the wage subsidy period.

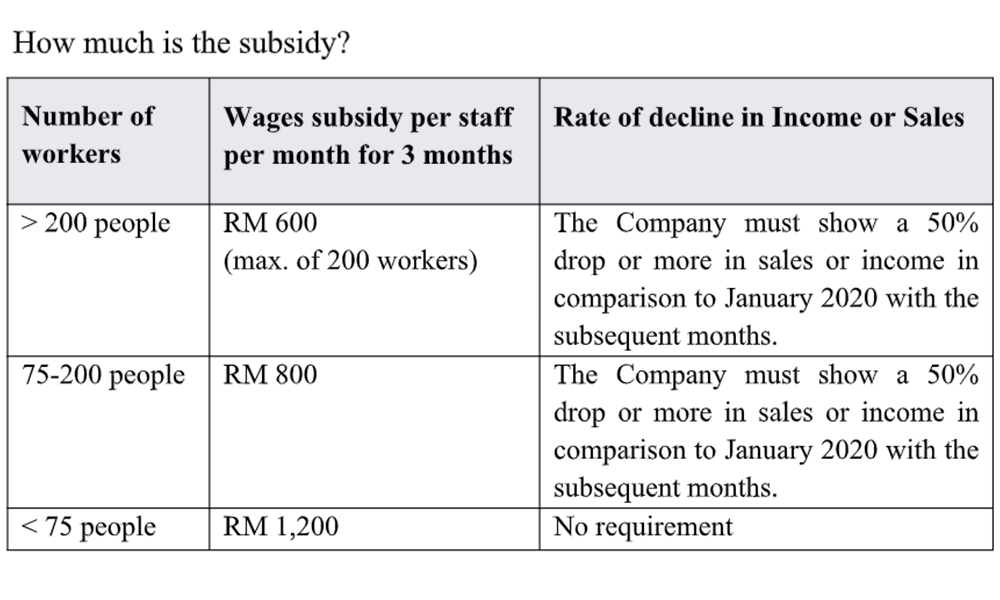

Refer to the table below for reduction in the rate of sale as another criteria.

Who is not eligible?

Employers who registered or commenced business on or after Jan1, 2020;

Employers and employees which has yet to be registered or contributed under Socso;

The employees who have received financial assistance from the Employee Retention Programme (ERP) in the same month;

Employees who have a monthly salary of RM4,001 and above;

Employees who have been dismissed from work; and

Workers from public sectors, federal and state statutory bodies, all statutory bodies which are exempted from remuneration, local authorities, self-employed individuals (do not have an employer) including freelancers, foreign workers and expatriates.

How much is the subsidy?

Documents required for application of Wage Subsidy:

List of staffs name (letter can be obtained by the same Perkeso) link above;

Banking details of the employer (front page to bank statement);

Copy of the Business Registration Number (BRN) which was registered by the employer during the opening of the bank account (please refer to the bank);

Copy of SSM/ROS/ROB/Professional, Scientific or Technical Services authorities registration or business license;

Declaration of PSU50 (letter can be obtained by the same Perkeso link above); and

**Proof of documents (e.g. financial statements or sales report which has been verified by management or similar declaration document).

** Notes: To include proof of documents for companies with 76 staff and above.

Payment method:

Successful applications will result in subsidy being credited into employer's account within 7-14 days upon approval.

Special Grant of RM 3,000

What is it?

This is a special Prihatin grant amounting to RM3,000 which will be given to eligible micro SMEs which is registered with LHDN. The government will be receiving a list of eligible micro-enterprises from the local authorities and SSM.

Registered Money Lenders urged to provide moratoriums to SMEs on loan repayment

What is it?

The prime minister has urged moneylenders registered under the Money Lenders Act 1951 to provide moratoriums on the monthly loan repayments for a period of six months starting April 2020 as per what Malaysian banks are offering.

Other initiatives

- Abolishment of 2% interest rate to 0% for RM500 million loans for Micro Credit Scheme granted by Bank Simpanan Nasional (BSN). The soft loan scheme for micro-enterprises is also extended to Tekun Nasional with an increase limit to a maximum of RM10,000 at 0% interest for each enterprise.

- Exemption on rental payment or discounts on rental expense to SMEs for renting the premises owned by government-linked companies (GLCs) such as Mara, Petronas, PNB, PLUS, UDA and others (duration not mentioned).

- The prime minister has also urged private premise owners to follow suit which is by reducing the monthly rental imposed to their SME tenants during the MCO period and three months after. These owners that provide rental reduction or waiver to SMEs tenants will be given further tax deduction which is equivalent to the amount of rental deduction for the months of April to June 2020. Further tax deduction will be given to the owner provided that the reduction of rental is at least 30% from the usual rent rate.

Other initiatives (cont’d)

- A 25% reduction of foreign workers levy fee for all companies whereby these foreign workers permits will expire within the period of April 1 to Dec 31, 2020. However, this is not applicable to the domestic help sector.

- An automatic moratorium of 30 days from the date the MCO is lifted for companies to lodge the required statutory documents to CCM/SSM.

- For companies with year ended Sept 30 to Dec 31, 2019, there is an option to submit an application to CCM/SSM to extend three months from the date the MCO is lifted for the lodgement of financial statements. No fees will be imposed for the extension application.

Tax – adjusted timelines

With MCO Phase 2 in operation, all government-linked organisations are coming up with an extension to address the pressing datelines with no exception to matters relating to income tax requirement. The frequently asked questions on tax matters during the MCO period has also been updated on April 3, 2020.

Firstly, the dateline to submit the initial tax estimate and revision of tax estimate which due from March 18, 2020, to April 14, 2020, has been extended to April 30, 2020. Similarly, instalment payment for the tax estimate which is due on or before April 15, 2020, is also given an extension to April 30, 2020. Furthermore, the unprecedented third-month revision of tax estimate for companies with year ended Dec 31, 2020, has also been extended April 30, 2020, which allows companies to have more time to evaluate and forecast its net profit.

Companies with small-medium enterprises (SME) status are also eligible to defer its CP204 tax instalment payments for three months starting April 2020 till June 2020. The basis to determine the companies’ SME status is:

Paid-up share capital of less than or equals to RM2.5 million ordinary shares at the beginning of basis period for a year of assessment; and

Have a gross business income of RM50 million and below;

Other conditions such as its related companies which do not fulfil any of the SME requirements will automatically disqualify the company with the SME status.

The tourism sector has been severely affected and hence a longer deferment of CP204 tax instalment payment is granted of up to six months starting from April 2020 till September 2020. The deferment of tax installments do not require application as it is automatically granted to all companies under tourism industries based on IRB’s record.

Any balance of tax shortfall (if any) has to be settled upon the submission of the income tax return since taxpayers are not required to pay the deferred CP204 tax instalments.

For individuals with business income which is required to comply with the CP 500 tax instalments may defer his/her tax instalments starting April 2020 till June 2020. This means the first and second instalment which is due on March 30, 2020 and May 30, 2020, respectively can be deferred. Moreover, the deferment is automatically granted and they do not need pay these deferred CP 500 tax installments until the income tax return has been submitted and thereon, any tax shortfall has to be paid at that point of time.

Another important question is on the late payment penalty. There will not be any late payment penalty if the tax payment is made on or before April 30, 2020, on all types of income tax payment which is due during the period from March 18, 2020, to April 14, 2020.

Withholding tax payment which falls between March 18, 2020 to April 14, 2020 can be made from April 15 until April 30, 2020, via telegraphic transfer (TT) by furnishing complete payment details to IRB via fax at 03-6201 9637 or email to HelpTTpayment@hasil.gov.my

Lastly, submission and payment of monthly tax deduction (CP38 – MTD /PCB) data due April 15, 2020, for March 2020 remuneration is also given an extension of time till April 30, 2020. Although the extension of tax payment is granted, however, the refund of tax credit is still being processed at the usual speed which is the cherry on the top.

Conclusion

It remains to be seen whether the additional stimulus package will have a cushioning impact on the economy. The focus appears to be centered on a trilogy of factors, employer-employee, tax and rents. Will this be sufficient? In our view, this will depend on the numbers of days of "no productivity". If the days continue perhaps another stimulus with different target factors will be needed.

ABDUL SHUKOR AHMAD is an advocate, mediator and strategist at law firm Shukor, Baljit & Partners while HARJIT SINGH SIDHU is CEO of tax advisory firm, HSS Advisory Sdn Bhd. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.