After being ranked as the number one investor in firms identified as being drivers of deforestation, Permodalan Nasional Berhad (PNB) has responded saying it only invests in sustainable palm oil companies.

“In relation to PNB’s exposure in the plantation sector, it is important to highlight that its investee companies follow the principles of sustainability standards including Roundtable on Sustainable Palm Oil (RSPO), the Malaysian Sustainable Palm Oil (MSPO) and the Indonesian Sustainable Palm Oil (Ispo).

“Together, these guide the companies’ actions and determine how they manage their performances in relation to economic, environmental, social and governance factors,” it said in a comment to Malaysiakini.

PNB added it placed “great emphasis” on its investees to meet the standards.

It specifically mentioned how investee Sime Darby aimed to reduce its carbon footprint by 40 percent by 2030.

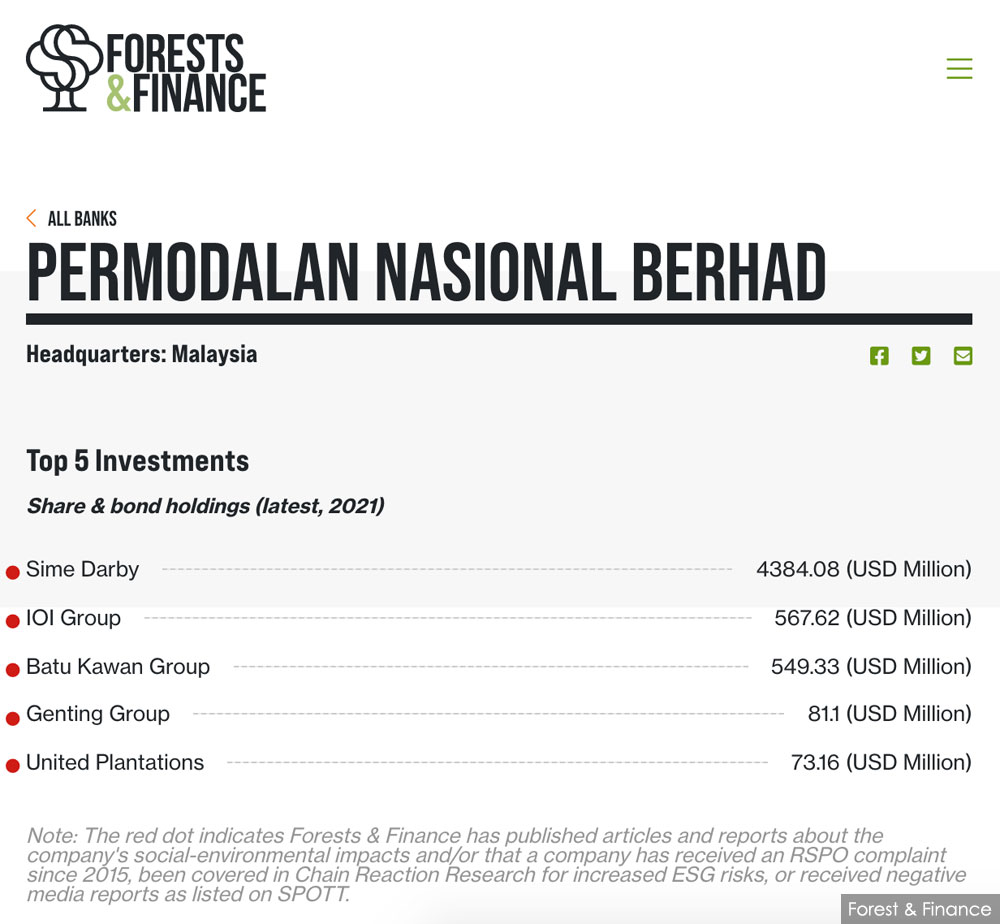

Yesterday, online initiative Forests and Finance calculated that PNB had invested US$5.710 billion (RM23.460 billion) into “forest-risk companies” as of April 2021.

This was by far the most investment by a single entity into such companies in its list.

All of PNB’s top five beneficiaries in this category were palm oil plantation conglomerates - Sime Darby, IOI Group, Batu Kawan Group, Genting Group and United Plantations.

Batu Kawan Group is the parent company of Kuala Lumpur Kepong Bhd.

The ranking system is based on a list of 300 forest-risk companies, identified as such for their impact on forests due to operations in palm oil, rubber, timber, soy, beef and/or palm and paper.

The latest publicly available data was used to trace the financing received by these companies.

PNB was not the only Malaysian government-linked company (GLC) that topped the Forests and Finance list.

The Employees Provident Fund (EPF) was ranked the second-largest investor in forest-risk companies while the Retirement Fund Incorporated (Kwap) and the Federal Land Development Authority (Felda) placed sixth and seventh respectively.

Malaysian listed group Genting placed tenth.

Malayan Banking Berhad (Maybank), meanwhile, was ranked as among the top 10 financial institutions worldwide that provided loans to forest-risk firms.

Forests and Finance is a collaboration between a coalition of environmental groups around the world including Sahabat Alam Malaysia, the Rainforest Action Network, TuK Indonesia, Profundo and Amazon Watch. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.