Finance Minister Tengku Zafrul Abdul Aziz has been urged to explain why the government would not have to "repay" banks for the B40 loan payment moratorium but was using compensation as an excuse to not expand the scheme.

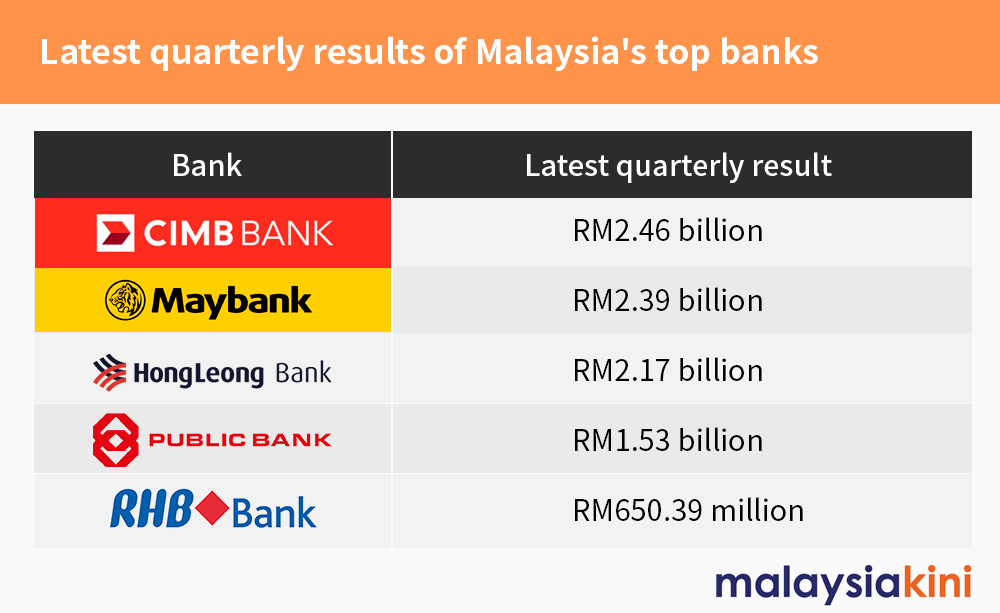

In a statement today, DAP secretary-general Lim Guan Eng said banks have been making a healthy profit despite the Covid-19 pandemic and should extend the programme to the M40 category.

"Why are banks able to cushion the cost of loan moratoriums for B40 borrowers, without any compensation from the government, but not the M40 borrowers?" asked Lim.

Lim was referring to Zafrul's long essay published in The Star today where he outlined reasons why a blanket loan repayment moratorium could not be implemented.

While conceding that Section 4 of the Emergency (Essential Powers) Ordinance 2021 allowed the government to acquire and mobilise any resources for the public good, Zafrul pointed to Section 5 which stipulated that there must be compensation involved.

"In short, (blanket moratorium) cannot be done at zero cost to the government," he said.

Zafrul argued that only 15 percent of borrowers needed the moratorium after the first movement control order (MCO) last year and therefore a blanket one was not necessary now.

Forcing the banks, he said, would affect investors' confidence in the long term. He added that most Malaysian banks are owned by government-controlled funds such as the Employees Provident Fund.

Although the country is currently under two weeks "total lockdown" (expiring June 14), Putrajaya only offered a three-month loan moratorium to those who lost their jobs or anyone who is qualified for the Bantuan Sara Hidup or Bantuan Prihatin Rakyat welfare payments.

Optionally, people who fall in this category can seek a 50 percent reduction in monthly loan repayments for six months.

Additionally, anyone else, including companies, which experienced a loss in income due to "total lockdown" can work out an arrangement with their banks to reduce their loan repayment temporarily.

Lim argued that banks could well afford the moratoriums as their earnings were not impaired, unlike businesses in stasis due to "total lockdown".

"It is imperative for banks to perform their social responsibility with such profits. In an economic downturn, it is necessary for them to share the burdens of borrowers, given that they have profited in 2019 and 2020.

"Don't allow the people to suffer while the banking industry sits comfortably. The government should also avoid the perception that they are only listening to the banks and not the people," he said. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.