Umno Youth has outlined seven economic rationalisations to ensure banking institutions are able to offer a second loan moratorium without any additional charges or interest in order to maintain economic sustainability.

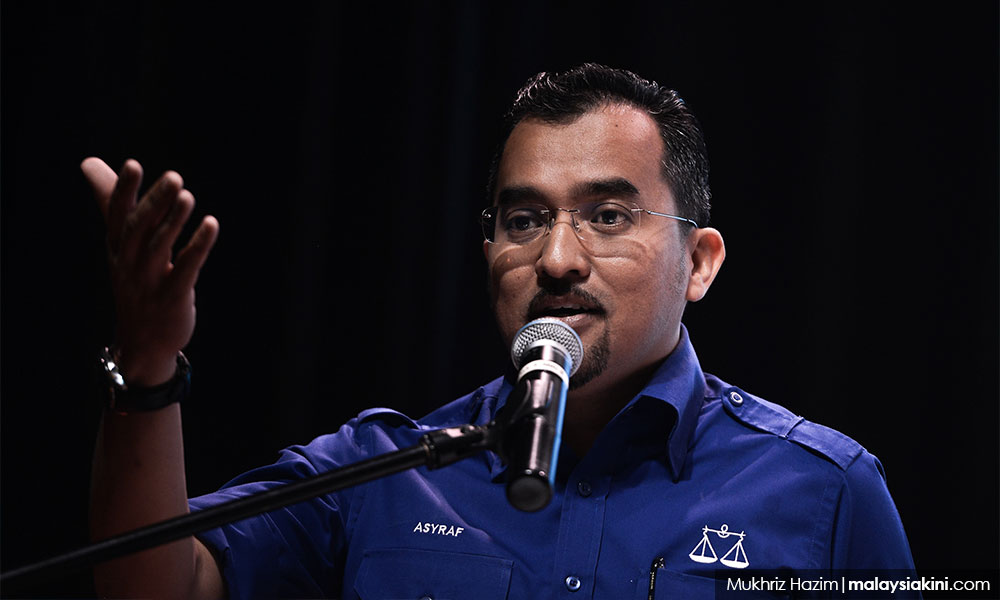

Its chief, Asyraf Wajdi Dusuki, said this is to ensure the people’s cash flow is not affected during the total lockdown while also preventing more citizens from suffering bankruptcy.

He said this is why the government must fully utilise its power under the Emergency Ordinance (Essential Powers) 2021.

“(The government must) ensure that the people’s cash flow is not affected by the implementation of the total lockdown which will lead to the country’s economy being badly affected as well as a drastic decrease in household spending especially for basic necessities such as food, shelter, and utilities.

“Many are facing cash problems due to dwindling savings compared to the first movement control order (MCO 1.0) as a result of (having experienced the) prolonged MCO before this.

“Delaying payments for bank loan instalments can also help prevent bankruptcy from happening due to worsening incomes for small and medium enterprises (SME), the self-employed and households without stable income including those in the M40, due to the prolonged Covid-19 pandemic,” he said in a statement on Facebook today.

Asyraf said increased bankruptcy among the people due to a drop in income and an inability to service loan instalments or bank financing could cause tremendous damage to the country’s economy and have a direct effect on the operations and stability of local banking and financial institutions.

Umno Youth also urged the government to extend the i-Sinar and i-Lestari programmes to provide relief for the people during the implementation of the full MCO.

During MCO 1.0 which started in March last year, the government not only offered special assistance but also provided a loan moratorium for six months.

Asyraf said offering a moratorium could ensure the financial system’s stability and would also help banks to avoid a phenomenon where customers are unable to service their loans which could lead to an increased default rate.

“Local banking institutions' ability to absorb any potential market shock is still at a solid level according to international standards and Bank Negara Malaysia (BNM).

“Local banking institutions have a healthy capital level and can support the country's economic credit flow based on the total capital ratio level currently at 18.1 percent, exceeding BNM’s minimum requirement of 8 percent with capital excess buffer hitting RM126.3 billion in February,” he added.

Asyraf reasoned the successful implementation of the first loan moratorium proved that it did not affect the ability of banking institutions to generate profit.

In addition to the seven reasons, Umno Youth urged the government to direct government-owned financing and credit agencies that target the B40 group such as Mara, Tekun, Amanah Ikhtiar Malaysia, SME Bank and others to implement a moratorium for their programmes' participants. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.