As banks gear up to begin receiving applications for loan moratoriums tomorrow, the central bank has reminded borrowers that opting-in for this facility will raise the overall cost of borrowing.

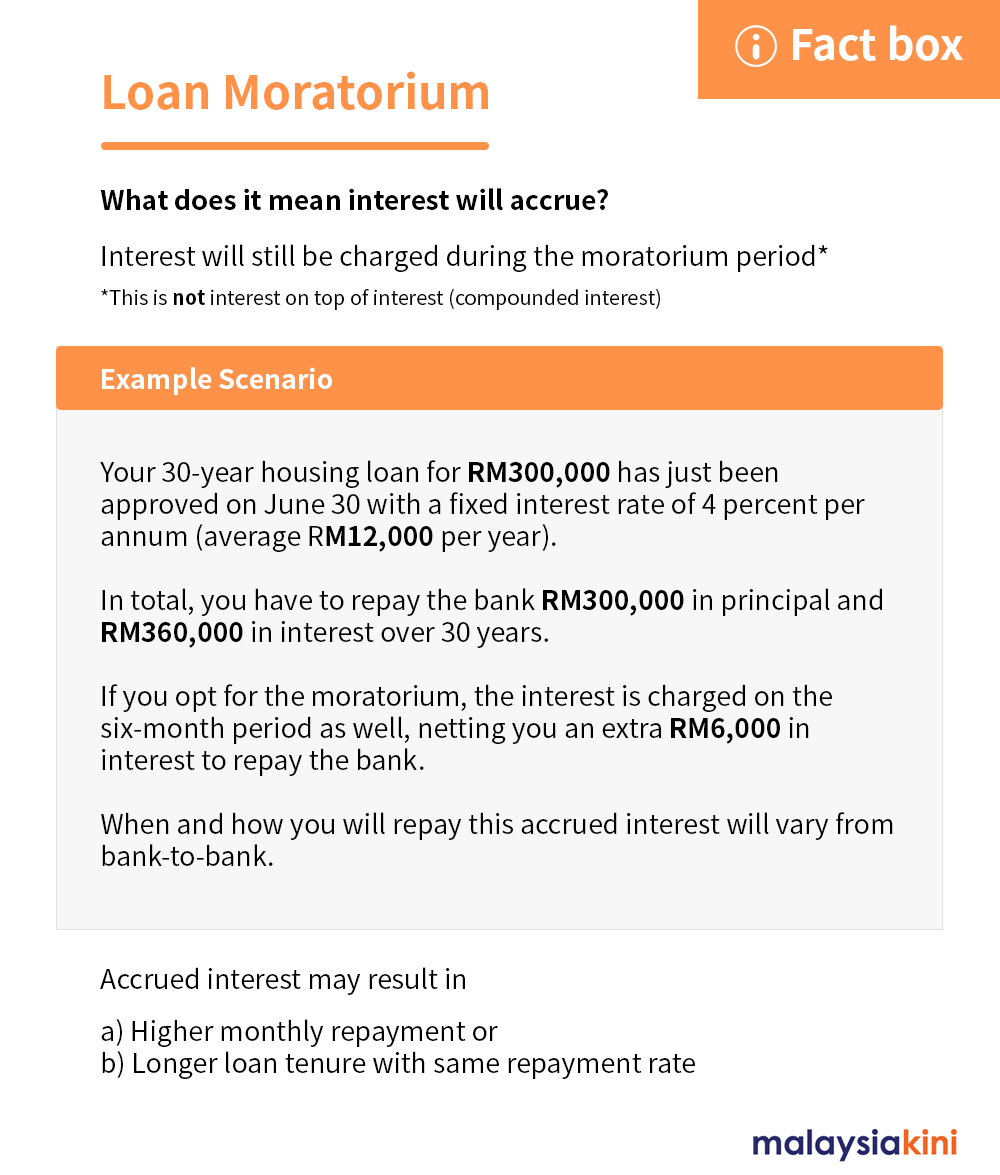

It said that banks will not charge any compounding interest or profit - or any penalty interest/profit - while payment is being deferred.

However, profit/interest will still be accrued on the deferred payments.

“Banks are required to provide borrowers with information on how instalment amounts and the financing tenure will be impacted.

“Where a borrower requests to maintain lower instalments (instead of original instalments) after the moratorium, this would result in the loan tenure being extended for a longer period,” it said in a statement today.

For clarity, this means an interest would be charged on the loan principal during the six-month deferment.

How this will affect monthly repayments varies from bank-to-bank, though the end result is still a higher cost of borrowing.

Meanwhile, Bank Negara said that, starting tomorrow, those eligible for the six-month loan moratorium under the National People's Wellbeing and Economic Recovery Package (Pemulih) scheme can apply to opt into the scheme.

In addition, banks are offering a reduction in instalments and other packages, including to reschedule and restructure financing to suit the specific financial circumstances of borrowers.

Approval for the moratorium or any other repayment package is automatic, and there is no need to provide supporting documentation. Any assistance received in 2021 will not affect borrowers’ Central Credit Reference Information System (CCRIS) records.

Bank Negara said borrowers can opt-in through online forms or an auto-generated email from their banks, or by calling their banks.

“If borrowers are unable to use these digital channels, they may also visit their bank branches to submit their request for the moratorium.

“However, they are advised to check with respective banks on any changes in operating hours or arrangements for over-the-counter services due to movement restrictions,” it said.

The assistance is available for loans approved before July 1, and borrowers must not have missed instalments by more than 90 days or be subject to bankruptcy/winding up proceedings at the time of their application for assistance.

Those already under a repayment assistance programme and have been financing their loans in accordance with the terms of the programme are also eligible to apply.

Those who have missed payments for more than 90 days are urged to contact Credit Counselling and Debt Management Agency (AKPK) instead, which would provide repayment assistance and free financial advice.

Affected small and medium enterprises and microenterprises can also reach out to AKPK through its dedicated SME helpdesk.

Bank Negara also urged borrowers who face difficulties with their banks, or if instalments increase unreasonably, to contact the central bank. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.